Your debit card can also be your credit card - Here’s how this combo card helps you

Debit card as credit card: Not many banks have introduced this new facility - it was first was done by IndusInd Bank with state-owned Union Bank offering this feature too now.

By holding multiple cards in your pocket, chances are you might forget PIN number of at least one of them. This is very common, and must have happened with almost every debit card or credit card holder. But, technology has changed things drastically, and now carrying out a financial transaction is quite easy. Both debit cards and credit cards are different from each other, even though they have similar appearances. The former allows you to remove money, while the latter helps in borrowing. Interestingly, there is a new card in town, where your debit card can also be your credit card. This one is called Debit-cum-Credit Card or combo card. Not many banks have introduced this new facility, but first it was done by IndusInd Bank and now even state-owned Union Bank offers this feature.

Pros of this dual card:

The most common benefit would be it gives flexibility. It eliminates the need for carrying two different cards, and narrows it down to one single duo card where both debit and credit benefits are available. Also, they eliminate the need of remembering multiple PIN number, also lessens the weight of your wallet.

Secondly, you can review your debit and credit credit card statement in one format. Because they are combo card, banks give customers with single account statement every month which helps track down every transaction carried in debit and credit card in one page. This also is less time-consuming.

Surprisingly further, this combo cards also have the benefit of no additional processing fees, however, some banks may choose to levy extra charges depending upon their policies and conditions. Also, the interest you pay on this dual card is generally lower than compared to that offered on normal credit cards. Apart from this, there is also no hefty ATM withdrawal charges as the card acts as debit as well.

Let’s understand what Union Bank and IndusInd Bank are offering!

IndusInd Bank’s Debit-cum-credit-card:

This two-in-one Duo Card with two Magnetic Stripes & 2 EMV Chips brings the functionalities of both debit and credit cards to the Indian consumer, on just one piece of plastic. The card design uses the anagram technique to enhance and highlight the singularity of the Duo Card.

When used as debit card, following benefits are given:

1. A special loyalty programme, which rewards customers for all types of spending. You may accrue reward points under the programme and redeem them for cashback and exciting gifts.

2. Get a free movie ticket per month, with every movie ticket you purchase through BookMyShow.

3. Losing sleep over rising petrol costs? Here’s some good news. No surcharge is levied on your IndusInd Duo Debit Card. This is applicable at all petrol stations in India.

4. Get an air accident cover of Rs. 25 lakhs, and personal accidental death insurance cover of Rs. two lakhs.

But when used as credit card, the benefits are:

1. An attractive rewards programme under which you get one reward point for every Rs. 150 spent on your IndusInd Bank Duo Credit Card

2. Overcome by wanderlust? Enjoy the incredible Travel Plus programme under which you are entitled to special waivers on lounge usage charges outside India.

3. Get insurance on lost or delayed baggage, on loss of ticket or passport, as well as total protection all the way up to your credit limit.

4. Buy one movie ticket and get one free. Avail yourself of this offer up to 12 times a year. This offer, however, is only applicable to bookings made on BookMyShow.

5. With ’Total Protect’, you may banish those worries about fraudulent usage of your card. This is a unique programme which covers you for a sum up to the credit limit on your credit card. ‘Total Protect’ gives you insurance cover for unauthorized transactions — in case of loss or theft of the card — as well as for incidents of counterfeit fraud.

Union Bank Debit-cum-credit Card:

Union Bank’s Rupay Combo Debit Cum Credit Card allows cardholders to enjoy the convenience, flexibility and freedom to choose in a single physical card for the debit /credit transaction facility and they need not carry two cards. To enable cardholders to choose between credit and debit card facility, there are two different card numbers, separate chips, separate magnetic stripes and two different CVV numbers.

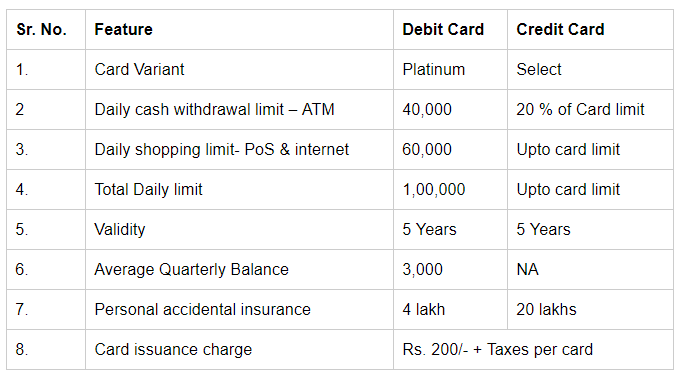

The features of Union Bank Combo Debit Cum Credit card are as under:

Additional benefits are:

Cardholders can use combo card as debit card linked to his/her bank account by inserting/swiping ‘debit card’ side of the card in ATM/POS card reader and enter the debit card PIN for financial and non financial transactions at ATM and purchases at POS machine. Transaction initiated with the card will appear on the statement of cardholder’s bank account.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SIP Calculation at 12% Annualised Return: Rs 10,000 monthly SIP for 20 years, Rs 15,000 for 15 or Rs 20,000 for 10, which do you think works best?

FD Rates for Rs 10 lakh investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 5-year fixed deposit returns

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

SBI Senior Citizen FD Rates: Know your maturity amount for investments ranging from Rs 5 lakh to Rs 15 lakh in 1 year, 3-year and 5-year, calculations inside

05:55 PM IST

Credit Card: Always in a credit card debt trap? Follow these effective ways to come out of it

Credit Card: Always in a credit card debt trap? Follow these effective ways to come out of it Credit Card Portability: What are its benefits, and how will it impact current Indian credit card users?

Credit Card Portability: What are its benefits, and how will it impact current Indian credit card users? HURRY! Enjoy DELICIOUS DISCOUNTS on Zomato by using Bank of Baroda debit cards, offer valid till July 31 - check all details of the offers here

HURRY! Enjoy DELICIOUS DISCOUNTS on Zomato by using Bank of Baroda debit cards, offer valid till July 31 - check all details of the offers here This is how you can withdraw cash from ATM without using CARD

This is how you can withdraw cash from ATM without using CARD Data of 1.3 million Credit and Debit cards on Dark net, necessary remedial actions taken: MoS Fin

Data of 1.3 million Credit and Debit cards on Dark net, necessary remedial actions taken: MoS Fin