You can save Rs 1 lakh in income tax with health insurance - here's how

Health Insurance: As the financial year 2022-23 nears its completion, taxpayers would be doing the math to save their taxes. Here, we will tell you how to save tax up to Rs 1 lakh by getting yourself and your family insured!

Health Insurance: Salaried persons are asked by their employers to reveal their investment declaration at the beginning of a financial year. Investment declaration is important because it helps an employer to calculate the tax accordingly from monthly salary. It can lead to a higher in-hand salary. The taxpayers have to submit proof of their investment to their employer before the end of the financial year.

As the financial year 2022-23 nears its completion, taxpayers would be doing the math to save their taxes. Here, we will tell you how to save tax up to Rs 1 lakh by getting yourself and your family insured!

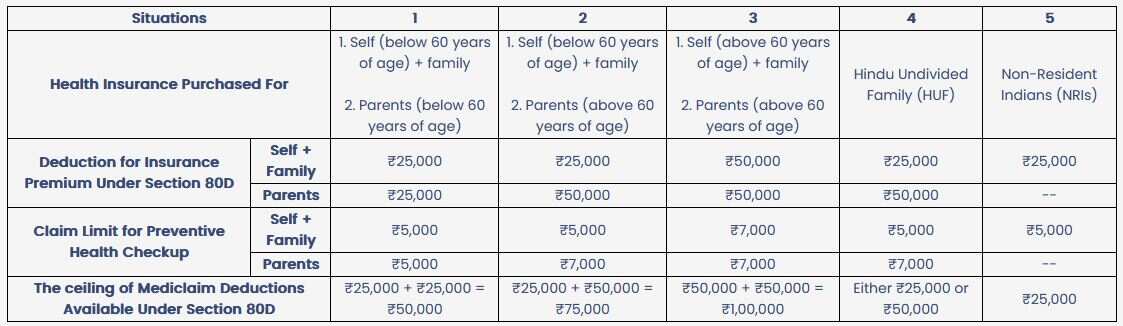

Under section 80D of the Income Tax Act, the government provides taxpayers with a tax exemption of Rs 25,000 on health cover of an individual taxpayer, spouse and children. If the taxpayer is also paying the premium of dependent parents who are senior citizens, he/she can get a deduction of Rs 50,000 up to Rs 1 lakh.

Also read:THESE 4 tips can help you repay dues faster

Health Insurance tax benefit: How to avail Rs 25,000 tax deduction

Under Section 80D of the Income Tax Act, taxpayers get tax exemption on the premium paid for health insurance. The exemption is from Rs 25,000 up to Rs 1 lakh in a financial year. Tax deduction can be claimed by the taxpayer who has paid a health insurance premium of Rs 25,000 in a year and is less than 60 years of age.

On the other hand, if the taxpayer is paying the premium for the health insurance of his parents and is below the age of 60 years, then he gets an additional exemption of Rs 25,000.

Health Insurance tax benefit: How to avail Rs 50,000 to Rs 1 lakh deduction

If taxpayers' parents are senior citizens and the taxpayer is paying the premium for their health insurance, then they can get a deduction in income tax of Rs 50,000. However, the taxpayer and their parents should have to buy separate health insurance.

On the other hand, if the taxpayer is a senior citizen, then the exemption of Rs 25,000 can reach up to Rs 1 lakh.

Health Insurance tax benefit: Mode of Payment important for tax deduction

Click here to get more stock market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Large and Mid Cap Mutual Funds With Highest SIP Returns in 1 Year: Rs 27,27,2 monthly SIP investment in No. 1 fund has zoomed to Rs 4,05,296

PPF vs SIP: With Rs 12,000 monthly investment for 30 years; which can create highest retirement corpus

Power of Compounding: How can you create Rs 5 crore, 6 crore, 7 crore corpuses if your monthly salary is Rs 20,000?

Stocks to buy for 2025: Anil Singhvi bets on 2 largecaps and 1 midcap stock for up to 48% potential gains

SBI Guaranteed Return Schemes: Here's what PSU bank is giving on Amrit Vrishti and other fixed deposit schemes to senior citizens and others

Top 7 Mutual Funds With Highest Returns in 1 Year: Rs 6,54,321 in No 1 scheme has jumped to 10,38,996; what about others?

Top 7 Mutual Funds With Best SIP Returns in 1 Year: Rs 33,333 monthly SIP investment in No. 1 fund has generated Rs 5,12,069; know more details

10:57 AM IST

ITR e-Verification: Received an e-verification notice? Here's what you can do next

ITR e-Verification: Received an e-verification notice? Here's what you can do next  ITR filing: Must take THESE basic precautions to avoid ERRORS

ITR filing: Must take THESE basic precautions to avoid ERRORS