Women's Day Special: 'Stronger women build stronger nations' - Women in Indian Mutual Fund Industry

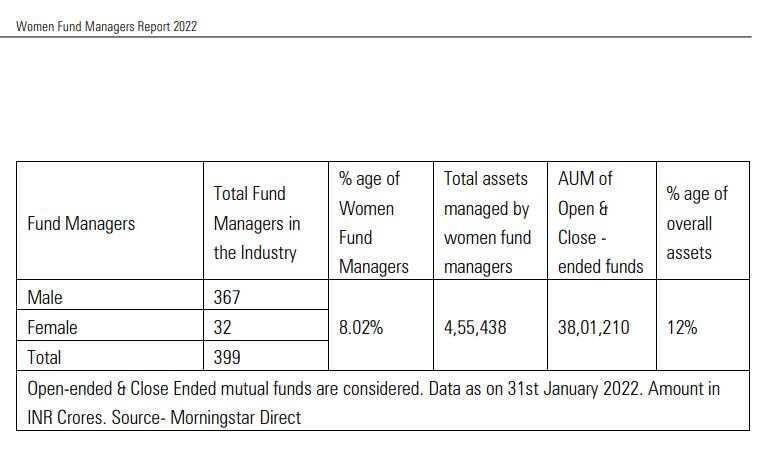

Women Fund Managers Report 2022 by Morningstar Research reveals, "When it comes to gender diversity, the latest findings of our report show that of the 399 fund managers, 32 are women, who are managing funds either as primary / secondary managers or have oversight as heads of equity / debt."

Modi government recently appointed former Sebi member Madhabi Puri Buch as chairperson of the Securities and Exchange Board of India (Sebi). Madhabi Puri Buch is the 1st woman to lead market regulator. Amid the development, Morningstar Research team has released a report titled - Women Fund Managers Report 2022.

According to the Women Fund Managers Report 2022 authored and released by Morningstar Research team ahead of Women's Day, "With the appointment of SEBI’s first female chief, the quote by activist Zainab Salbi- ‘Stronger women build stronger nations’ rings out loud. Women continue to make inroads in various fields be it financial services, pharma, FMCG and many others. The recent hit TV series Shark Tank India also highlighted the entrepreneurial side of women as three among the seven judges were women, hugely successful in their own respective fields."

The report cites that the mutual fund industry’s assets during the last year have increased by a sharp 24,6%, with the total assets being managed now standing at approx. INR 38.01 Lakh crore as on 31st Jan 2022, up from INR 30.50 Lakhs crore a year earlier. These assets are managed by 399 fund managers across all fund houses.

Women Fund Managers

Women Fund Managers Report 2022 by Morningstar Research reveals, "When it comes to gender diversity, the latest findings of our report show that of the 399 fund managers, 32 are women, who are managing funds either as primary / secondary managers or have oversight as heads of equity / debt."

"Currently, the total count of women fund managers has increased from 30 last year to 32 now. Interestingly, the total number of fund managers saw a healthy increase this year up from 376 managers seen last year. With a meagre 8% representation, women still remain drastically under-represented among the ranks of mutual fund managers. That said, the representation in percentage terms has been on the rise over the last two years albeit marginally," adds the report by Morningstar Research.

Assets Managed by Women Fund Managers

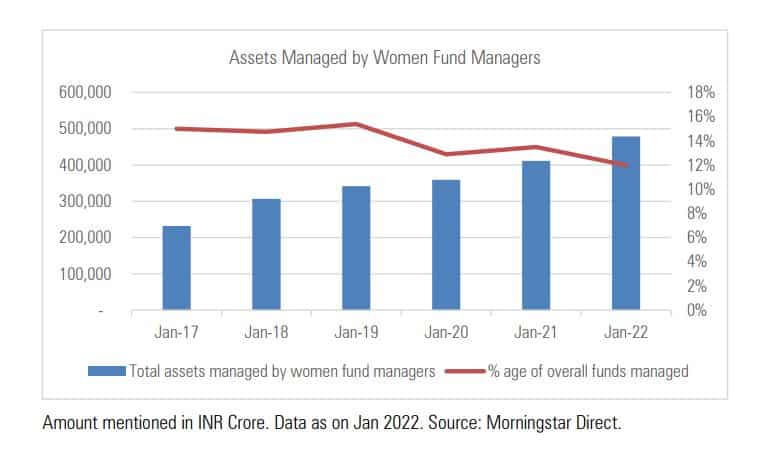

Further, Women Fund Managers Report 2022 by Morningstar Research shows, "The total open and close end assets managed by women fund managers is approximately INR 4.55 Lakh crore, which is 12% of the total mutual fund assets. Over the last few years, while the assets managed

by women are on the rise, in percentage terms of the overall industry assets, this number has not been something to boast about."

"Last year, this number was 13.5%. Having said that, over the years there is certainly a rise in the number of women fund managers in the mutual fund industry. When we first came out with a report on women fund managers back in 2017, there were only 18 women fund managers. This increased to 24 in 2018, 29 in 2019, then reduced to 28 in 2020 and again increased to 30 in 2021 followed by 32 in 2022," adds the report.

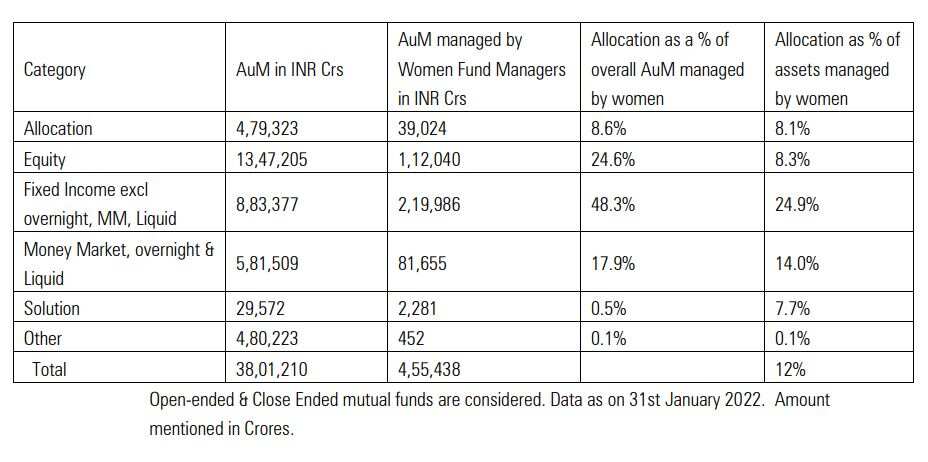

Assets managed across various asset classes

As per the Morningstar Research report, "From the perspective of assets managed across various asset classes, out of the total open and close end fund assets managed by women (4.55 lakh crore), approximately INR 2.19 lakh crore (48%) were fixed income funds (excluding Money market, Liquid and Overnight Funds), INR 0.81 lakh crore (18%) were money market funds, liquid and overnight funds, INR 1.12 lakh crore (25%) were equity funds, INR 0.39 lakh crore (9%) were allocation funds and the solution and other category cumulated to 0.02 lakh crore (0.6%).

"This accounts for 24.9% of all fixed income assets (excluding money market, liquid and overnight funds), 14% of all money market, liquid and overnight assets, 8.3% of equity assets, 8.1% of allocation assets and 7.7% and 0.1% of solution and other assets respectively," the report added.

Fund performance: Interesting bright spots

"Scrutinizing the data further throws up some interesting bright spots especially related to fund performance. Our reports show that of the total open-ended assets managed by women fund managers, 69% of the AUM outperformed the peer group average on a one-year basis, 96% of the AUM outperformed on a three-year basis and 69% of the AUM outperformed on a five-year basis - a feat truly worth commending," the report says.

"The 32 women fund managers were spread across 19 fund houses, with 4 fund houses having 3 or more women fund managers. 4 fund houses had 2 women fund managers while 11 fund houses had at least 1 woman fund manager," the report added.

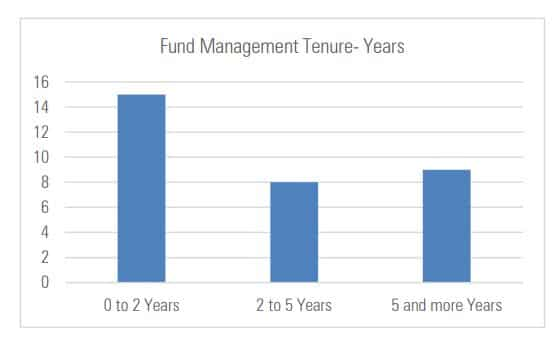

Tenure

"When it comes to tenure, 9 fund managers have managed funds consistently for over five years. 8 fund managers have been managing funds between two and five years, and 15 fund managers have a relatively lower experience of managing / co-managing funds below two years," as per the report.

(Disclaimer: Kindly note data provided above is for information purpose only and should not be construed as investment, taxation and/or legal advise.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

12:19 PM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence