What is Capital Gains Tax? Types and Exemptions - Explained

Capital Gains Tax: Movable personal assets such as cars, apparel and furniture are excluded from the Capital Gains tax bracket.

Capital Gains Tax: Capital gain means any profit that is earned from the sale of a capital asset. The profit generated from the sale is taxed and this is called Capital Gains Tax. Capital Gains Tax are classified under two categories -- Short Term Capital Gains and Long Term Capital Gains.

Short Term Capital Gains Tax

Any capital asset held by a taxpayer for not more than 36 months immediately preceding the date of its transfer is treated as short-term capital asset.

However, in respect of certain assets like shares (equity or preference) which are listed on stock exchanges, units of equity-oriented mutual funds, listed securities like debentures and government securities, Zero Coupon Bonds, the period of holding is 12 months. In case of unlisted shares of a company and immovable property, being land or building or both, the period of holding is 24 months.

Tax on Small Term Capital Gains

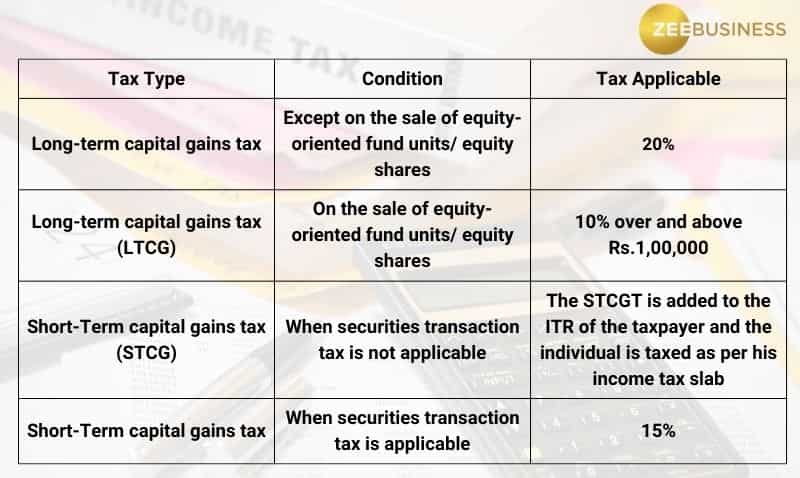

As per the rule, a 15 per cent tax is levied on profit on the sale of capital assets under the short term capital gains. The short term capital gains on debt mutual funds are added to the income of the taxpayer and are taxed according to the individual’s Income Tax slab rate.

Long Term Capital Gains Tax

Any capital asset held by a taxpayer for more than 36 months or 3 years immediately preceding the date of its transfer is treated as a long-term capital asset.

However, in respect of certain assets like shares (equity or preference), units of equity-oriented mutual funds, listed securities like debentures and government securities and Zero Coupon Bonds, the period of holding is 12 months. In case of unlisted shares of a company and immovable property, being land or building or both, the period of holding is 24 months.

Tax on Long Term Capital Gains

Currently, shares held for more than one year attract a 10 per cent tax. Gains arising from the sale of immovable property and unlisted shares held for more than 24 months and debt instruments and jewellery held for over 36 months attract 20 per cent long-term capital gains tax.

Long-Term Capital Gains on debt mutual funds are taxed at 20 per cent with indexation and 10 per cent without indexation, which is the adjustment of the purchase value for inflation.

Tax Rate on Long-Term Capital Gains and Short-Term Capital Gains:

EXEMPTIONS

Movable personal assets such as cars, apparel and furniture are excluded from the Capital Gains tax bracket.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

08:29 AM IST

Budget 2024: Long-term, short-term capital gains tax changes to fetch additional Rs 15,000 crore for government

Budget 2024: Long-term, short-term capital gains tax changes to fetch additional Rs 15,000 crore for government  SIP vs Lump Sum: How income tax on capital gains is calculated? Know expert calculations

SIP vs Lump Sum: How income tax on capital gains is calculated? Know expert calculations What is tax-loss harvesting? How does it help to reduce taxation burden on capital gains?

What is tax-loss harvesting? How does it help to reduce taxation burden on capital gains? Budget 2023: What is Long Term Capital Gains Tax?

Budget 2023: What is Long Term Capital Gains Tax? Budget 2023 Expectations: Capital gains tax regime to be tweaked? What we know so far on LTCG, STCG

Budget 2023 Expectations: Capital gains tax regime to be tweaked? What we know so far on LTCG, STCG