Thinking where to invest? This is how you can diversify your portfolio

Investing money is not an easy task especially when you are a beginner. Business tycoon Warren Buffett had once said, "Wide diversification is only required when investors do not understand what they are doing."

Unlike earlier times, now a days the investors are flooded with various financial instruments where they can easily park their money. But, the question is "Where to invest?"

This totally depends on your financial goals and how much "risk" you are ready to take.

Here, we try to give you a glimpse of how you can allocate assets and where should you invest:

For instance, your age is in the range of 21-30 years and you are at early stage of your career. Considering that, you can presently, take "Medium" risk.

As investments should be for long-term and as you are a beginner, it would be advisable to take investment horizon for above 10 years.

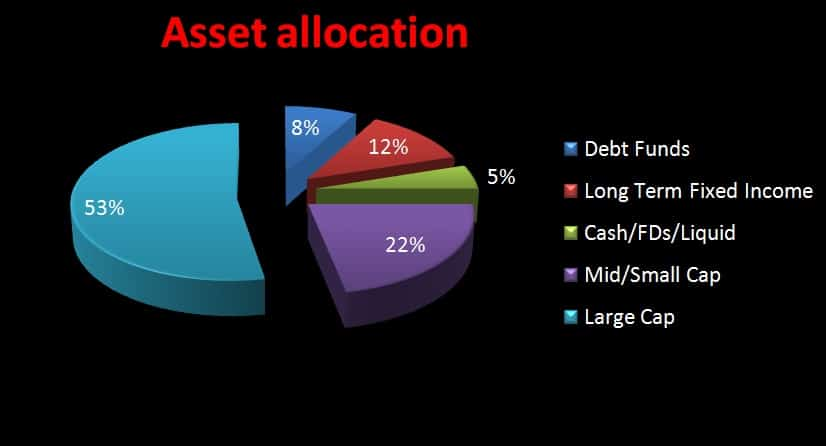

This what how you should allocate your assets:

Based on your above specifications, you should invest 25% into debt and 75% in equity.

Divinding it into further, in debt instuments: 12% into be your Long Term fixed income, 8% into debt funds and just 5% should be your liquid cash or bank fixed deposits.

Under equity investment, 22% should go into small and mid cap companies and rest 53% should be invested into Large cap companies.

So, think wisely before investing your money and diversify your portfolio to generate returns from each instruments and balancing the risk factor.

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Sukanya Samriddhi Yojana vs PPF: Rs 1 lakh/year investment for 15 years; which can create larger corpus on maturity?

Top 7 Flexi Cap Mutual Funds With up to 52% SIP Return in 1 Year: Rs 20,000 monthly SIP investment in No. 1 fund has generated Rs 3.02 lakh; know about others too

Latest FD Rates: Know what SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on 1-year, 3-year and 5-year fixed deposits

10:14 AM IST

10 Financial habits to avoid for a smoother and diligent financial life

10 Financial habits to avoid for a smoother and diligent financial life  The Rule of 72: How long will it take for your monthly investment to cross Rs 10 lakh with 12% returns?

The Rule of 72: How long will it take for your monthly investment to cross Rs 10 lakh with 12% returns? Why for achieving financial freedom investors need to have adequate insurance coverage?

Why for achieving financial freedom investors need to have adequate insurance coverage? HCLTech elevates Shiv Walia as Chief Financial Officer

HCLTech elevates Shiv Walia as Chief Financial Officer Why over diversification of portfolio can jeopardise your financial planning? Know expert view

Why over diversification of portfolio can jeopardise your financial planning? Know expert view