Tax saving: Mutual Funds should be your next investment option

The tax saving mutual funds come with the added bonus that investments made in them are eligible for tax benefits under section 80C.

A lot has been said and wrote on how you can save tax on investments. As reported earlier, under section 80C of the Income Tax Act, a deduction of Rs 1,50,000 can be claimed from your total income.

In simple terms, you can reduce up to Rs 1,50,000 from your total taxable income through section 80C. This deduction is allowed to an Individual or a Hindu Undivided Family (HUF).

Whenever we talk about the tax savings options, the first investment options that pops-up is Mutual Funds. Thanks to all the advertising and awareness this medium has spread over the past one decade.

The tax saving mutual funds come with the added bonus that investments made in them are eligible for tax benefits under section 80C. Apart from giving tax benefits of up to Rs 1.5 lakh, the long term capital gains are not taxed.

Speaking to Zeebiz, Ajit Narasimhan, Category Head - Savings and Investments, BankBazaar.com, said, "Tax Saving Mutual Fund scheme, also known as Equity Linked Savings Schemes or ELSS, are offered by most Asset Management Companies in India. You can use ELSS to claim tax deduction of up to Rs 1.5 lakh under Section 80C.

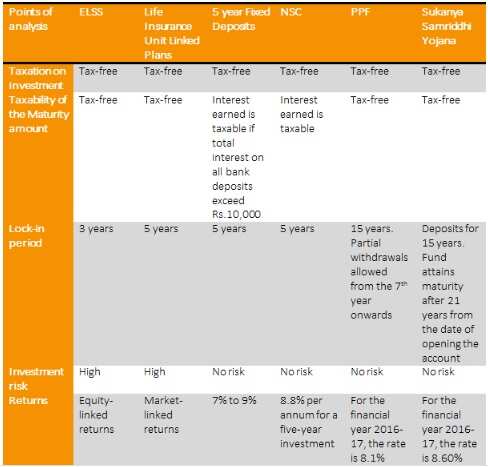

"Typically, most ELSS products are diversified equity schemes. The highest-ranked ELSS funds have provided a CAGR of around 20% in the last five years – far more than other investment options under 80C such as PPF and NSC, which provide returns in the range of 8-9%. Not just that, your ELSS returns are tax-free."

According to bankbazaar.com, while investments like PPF, FD and National Savings Certificates (NSC) may offer a safe environment to invest in, the returns from these investments are limited due to the fixed interest that it can earn in a year. With mutual funds, there may be a risk to the investment but they offer the shortest lock-in periods and the best returns because if the markets do well and the economy progresses, the returns also improve.

Moreover, sharing views on Mutual Fund as a high-return option, Archit Gupta, Founder & CEO ClearTax.com, said that ELSS are diversified mutual funds with lock in period of three years. They give you double benefit in the form of tax saving investment and are also exempt from long term capital gain tax. ELSS being equity oriented have the potential to earn higher returns.

This is how it works. For example, if the first investment was made on the January 1, 2015 and the second one on February 1, 2015 then on the January 1, 2018, ONLY the first instalments will get unlocked. The second instalment will remain locked till the 1st of February 2018.

So, don't let your money sit in FDs and RD, keep investing it in mutual funds to diversify your portfolio and get tax benefits. Because, Mutual Funds are subject to market risk, but they do give high returns too.

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:57 AM IST

This is India's only tax-free state, residents earn crores without paying Income Tax

This is India's only tax-free state, residents earn crores without paying Income Tax Don't have Form 16 and want to file income tax? This is how it is possible

Don't have Form 16 and want to file income tax? This is how it is possible Tax Saving Strategy: 8 ways you can save Rs 1.50 lakh tax under Section 80C

Tax Saving Strategy: 8 ways you can save Rs 1.50 lakh tax under Section 80C ITR Filing Tips: Should you invest in ELSS mutual funds this income tax season?

ITR Filing Tips: Should you invest in ELSS mutual funds this income tax season? Tax Saving FDs: Here’s how you can save tax by investing in fixed deposits

Tax Saving FDs: Here’s how you can save tax by investing in fixed deposits