Tata Group turmoil: Is it time to rejig your mutual funds portfolio?

With the ongoing saga at the Bombay House, Tata Group companies have lost nearly Rs 55,000 crore of investors' money in the past week. Several mutual funds have exposure to Tata Group stocks, which means a rejig such as this at the top level of one of India's largest conglomerates, and a boardroom drama gone public, is likely to have an impact on your portfolio if it consists a Tata stock. Should you still hold or is it right time restructure your portfolio?

The Tata Group ousted its chairman, Cyrus Mistry, in the summary proceedings of a board meeting on Monday.

In a scathing five-page e-mail which has since leaked, Mistry levelled allegations at the Group and his mentor, Ratan Tata, relating the tale of how he was reduced to a "lame duck" chairman. His e-mail also brought out several Tata Group companies' dirty linen into the public, which is now being scrutinised by the stock exchange and may draw attention from the markets' regulator Securities Exchange of India (Sebi).

In the ongoing battle, a recent news report quoted Mistry saying that the Tata companies faced nearly $18 billion in write-downs over time because of at least five unprofitable businesses that he'd inherited -- a claim that the Tatas have refuted but investors are still not sure.

Amid calls for more communication with the stakeholders and the likely initiation of a mediation between Mistry and Tata, investors remain concerned.

Apart from the huge equity holdings, stocks of Tata Group companies are owned by the mutual fund industry. In the light of the current turmoil, is it advisable to hold or sell? Let's take a look.

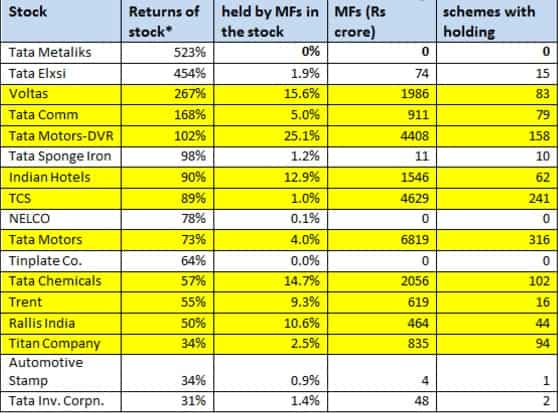

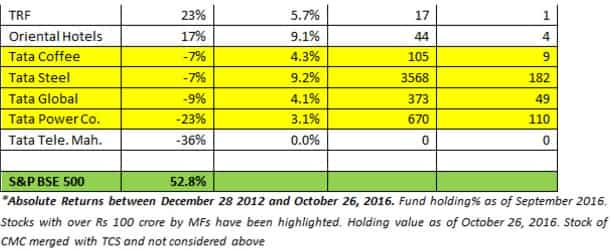

According to the chart, under Mistry's near-four-year regime, barring a few Tata stocks like Tata Power and Tata Steel that lost wealth for its investors, most of the companies yielded good returns for their investors, a Funds India report said.

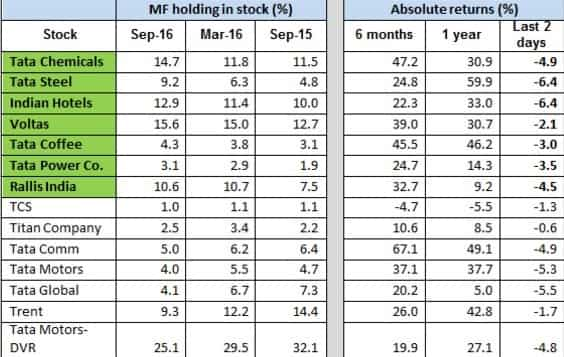

In a report titled 'Will the Tata Group shake up impact your funds', Vidya Bala, Head, Mutual Fund Research at the firm, said that the stocks of Tata Coffee or Tata Steel saw a commodity upturn, which the mutual funds were quick to spot, and increase stake at lower levels. The returns from these stocks, over the last one year, were also healthy.

Stocks like Tata Chemicals, Tata Power, or Indian Hotels and Tata Steel, were rewarded by the markets for streamlining their businesses or selling their non-core businesses. "The markets rewarded them for cleaning up and getting leaner," she said in the report.

Then there are other stocks like Voltas, which are turnaround stories. "Much of these returns were driven by better fundamentals or perception of improving fundamentals", the report said.

Mutual fund holding in the Group companies is not high except for in a couple of stocks. This means that dispersion of

the exposure may have limited the impact of the fall on the stock markets. Tata companies' stocks remained in the red from Tuesday till late trading session on Thursday before executives stepped in to allay investors' fears.

The report said, "the exposure in the Tata Stocks is so widely dispersed across many schemes that the impact of the recent fall has not been significant in individual schemes thus far."

According to the table about 316 schemes hold Tata Motors while 182 schemes hold Tata Steel. The holding by the fund industry in fundamentally weak companies such as Tata Steel is only 9.2%.

Going by the individual exposure, Reliance Tax Saver, that held 5.8% in Tata Steel as well as a 1.6% holding in Trent fell by 1.6% in the last 2 days (October 24-26); Franklin India High Growth companies, with a 5.2% stake in Tata Motors DVR fell by only 0.8%. UTI Transportation and Logistics with a 9.3% stake in Tata Motors fell by just 0.5% in these 2 days.

Bala said there's no need to panic as a mutual fund manager would gauge the impact of the fallout in Bombay House and "take a call whether to buy into dips in certain stocks, based on the fall as well as analysing the impact of the allegations" made in Mistry's letter.

All the individual Tata companies have their own boards and and full-time directors, so the exit of the chairman wouldn't serve to impact the day-to-day proceedings of a company, she said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Gold ETFs With Best Returns in 3 Years: No.1 ETF has converted Rs 7 lakh investment into Rs 10.80 lakh; know how others have fared

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

Top 7 Flexi Cap Mutual Funds With up to 52% SIP Return in 1 Year: Rs 20,000 monthly SIP investment in No. 1 fund has generated Rs 3.02 lakh; know about others too

02:48 PM IST

Air India orders 100 additional Airbus aircraft

Air India orders 100 additional Airbus aircraft  Tata Power, Asian Development Bank ink pact for $4.3-billion finance

Tata Power, Asian Development Bank ink pact for $4.3-billion finance  Indian Hotels shares hit fresh 52-week high as company plans expansion

Indian Hotels shares hit fresh 52-week high as company plans expansion  Tata group firm Indian Hotels Company picks majority stake in Rajscape Hotels

Tata group firm Indian Hotels Company picks majority stake in Rajscape Hotels  Air India to cancel around 60 flights on India-US routes in Nov-Dec due to non-availability of aircraft

Air India to cancel around 60 flights on India-US routes in Nov-Dec due to non-availability of aircraft