Sovereign Gold Bond Premature Redemption: RBI releases calendar, details of tranches; know how to do it?

Premature redemption of the Sovereign Gold Bonds (SGBs) is permitted after five year from the date of issue of such bond, on the date on which the next interest is payable

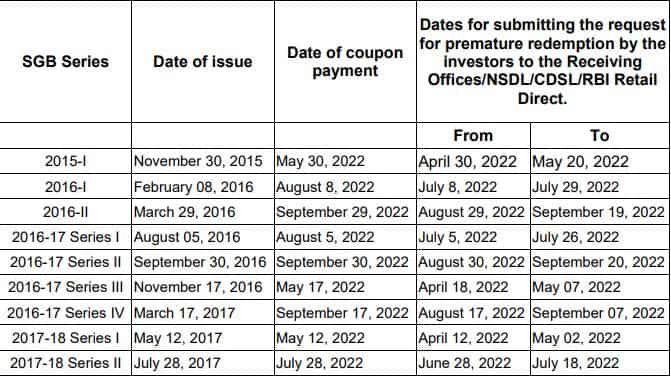

Sovereign Gold Bond Premature Redemption: The Reserve Bank of India (RBI) has released dates of premature redemption of Sovereign Gold Bonds (SGB). The Central Bank, through a release has listed the details of tranches falling due for premature redemption during H1 of 2022-23 i.e. from 1 April, 2022 up to 30 September, 2022 along with the window for submission of request for premature redemption.

Premature redemption of the Sovereign Gold Bonds (SGBs) is permitted after five year from the date of issue of such bond, on the date on which the next interest is payable.

SGP Premature Redemption: How to do it?

- The request for pre-mature redemption shall be submitted to the Receiving Offices (RO) or Depository through DP (in case of dematerialized securities) at least 10 days before the next interest payment date, according to RBI document.

- If the RO/Depository Participant/Depository can call for additional documents, KYC proof, declaration etc.

- The request shall be scrutinized to verify the correctness of the particulars and may be submitted to RBI through the E-Kuber Portal at least four days before the due date of interest.

- On maturity and in case of premature redemption, the bonds shall be redeemed in Indian Rupees and the redemption price shall be based on simple average of closing price of gold of 999 purity of previous week (Monday to Friday) for SGBs issued under tranche 1 to 9 and previous three working days for tranches issued thereafter at the rate published by the India Bullion and Jewellers Association Limited.

- The redemption proceeds shall be credited to the bank account of the customer.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

09:39 PM IST

Sovereign Gold Bond Update: Centre to issue SGBs when required, say sources

Sovereign Gold Bond Update: Centre to issue SGBs when required, say sources  Physical gold vs SGBs: Which generated more wealth for investors since launch of gold bonds?

Physical gold vs SGBs: Which generated more wealth for investors since launch of gold bonds? Should investors keep gold in their portfolio? Here's what market guru Anil Singhvi says

Should investors keep gold in their portfolio? Here's what market guru Anil Singhvi says Sovereign Gold Bonds 2024, SGB Series-IV: Today is last day to buy SGB Series IV bonds, know where you can purchase them

Sovereign Gold Bonds 2024, SGB Series-IV: Today is last day to buy SGB Series IV bonds, know where you can purchase them Sovereign Gold Bonds vs Gold ETFs: Which one offers better returns?

Sovereign Gold Bonds vs Gold ETFs: Which one offers better returns?