SIP flows top Rs 10,000 cr in September; Top 7 schemes to invest from Sharekhan

September mutual fund data has many things for the mutual fund industry and equity markets to cheer about. The overall asset under management (AUM) grew to a record near Rs 37 lakh cr in September supported by Rs 10,000 cr of flows seen from Systematic Investment Plans (SIP) for the first time.

Equities as an asset class have been able to outperform most traditional asset classes; hence, return-hungry investors are increasing allocation towards equities every month which is positive for Indian markets.

The S&P BSE Sensex rose by over 25 percent while the Nifty50 rallied nearly 28 percent so far in the year 2021. Equity markets have been resilient amid muted global cues, US rate hike fears as well as rising concerns around the energy crisis.

See Zee Business Live TV Streaming Below:

Experts are of the view that risks arising out of the energy crisis will be transitory, and the long-term story of Indian markets remains intact.

With lower yields in debt instruments incl Banks FDs and flat returns in Gold, equity is a preferred asset class, suggest experts. Dips, if any, should be used to buy into quality stocks or increase allocation towards equities.

“For long-term equity investors, risks pertaining to global factors pertaining to rising energy prices, continuing semiconductor shortages, and new supply-side disruptions may be transitory,” Aashwin Dugal, Co-Chief Business Officer, Nippon India Mutual Fund, said.

“Good news on the SIP front continues with monthly input value finally crossing Rs. 10,000 cr in September. This is heartening as this is a significant jump from Rs.8,000 the SIP book had shrunk to a year back. This clearly highlights improving appetite from retail as well as HNIs,” he said.

Top picks:

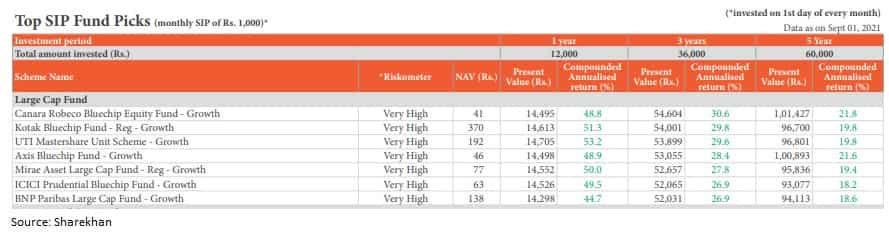

Sharekhan identified 7 schemes that have given a CAGR of 18-20 percent in the last 5 years. If investors would have invested a minimum of Rs 1000 every month for 5 years (total amount Rs 60,000) would have now grown to Rs 90,000-Rs 100,000.

The MF research team at Sharekhan follows a comprehensive approach of looking at the Quantitative and Qualitative parameters of funds to ensure you receive quality recommendations.

Top SIP fund schemes according to Sharekhan include Canara Robeco Bluechip Equity Fund, Kotak Bluechip Fund, UTI Mastershare, Axis Bluechip, Mirae Asset Large Cap Fund, ICICI Prudential Bluechip Fund, and BNP Paribas Large Cap Fund.

Disclaimer: The views/suggestions/advice expressed here in this article are solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

10:49 AM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Building a retirement corpus: How much should you invest at different life stages to build a corpus of Rs 4 crore; see examples

Building a retirement corpus: How much should you invest at different life stages to build a corpus of Rs 4 crore; see examples Unlocking the Power of SIP: From 15x15x15 to 15x5x3 Rule - 5 golden principles for long-term investment success

Unlocking the Power of SIP: From 15x15x15 to 15x5x3 Rule - 5 golden principles for long-term investment success Using 7-5-3-1 rule in mutual fund investment for enhanced wealth creation and improved resilience

Using 7-5-3-1 rule in mutual fund investment for enhanced wealth creation and improved resilience  Exclusive | Soon, SEBI to come up with a consultation paper on Rs 250 SIP

Exclusive | Soon, SEBI to come up with a consultation paper on Rs 250 SIP