SBI term deposit rates: Good news, lender makes this big move, announces 15 bps to 75 bps hike

The revisions made for deposits between Rs 1 crore and Rs 10 crore, bear the similar changes on deposits made above Rs 10 crores with immediate effect.

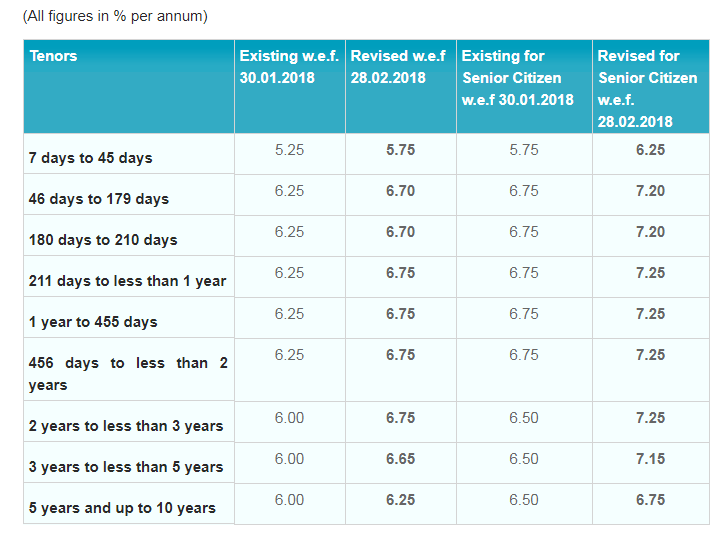

Good news has arrived for your deposits as the largest-lender State Bank of India (SBI) today increased interest rates on various term deposits with immediate effect. For retail domestic deposits below Rs 1 crore, an individual will now earn 6.40% interest rate on one-year deposits, which is higher by 15 basis points from previous 6.25% interest rate.

Interest rates of 6.40% have also been levied on deposits made for 211 days to less than 1 year tenure, above 1 year to 455 days tenure, and 456 days to less than 2 years’ tenure. These three tenures also had 6.25% interest rate on deposit previously.

As for senior citizen in above mentioned tenure - the interest rates on the deposits would 6.90% - above 15 basis points from previous 6.75% interest rates.

For higher maturity period, interest rates on deposits below Rs 1 crore was reduced by 50 basis points.

Individuals deposits would earn 6.50% interest rates each for 2 years to less than 3 years tenure, 3 years to less than 5 years tenure and 5 years and up to 10 years tenure. Earlier, they had deposit interest rate of 6%.

Meanwhile, senior citizens will enjoy 7% interest rates from previous 6.50% interest rates on their deposits for the above tenure.

Lesser tenure like 7 days to 45 days, 46 days to 179 days and 180 days to 210 days also saw increase in deposit interest rates by 50 basis points. Individual will earn 5.75% interest rate at SBI now from previous 5.25%, while senior citizen will receive 6.25% from 5.75% interest rates.

Here's a list of terms and condition for term deposits made below Rs 1 crore at SBI.

- Proposed rates of interest shall be made applicable to fresh deposits and renewals of maturing deposits

- Interest rates on “SBI Tax Savings Scheme 2006(SBITSS)” Retail Deposits and NRO deposits shall be aligned as per the proposed rates for domestic retail term deposits

- However, NRO deposits of Staff are not eligible for additional 1% interest otherwise applicable to staff domestic retail deposits, these rates of interest shall also be made applicable to domestic term deposits from Cooperative Banks

- Interest rate payable to SBI Staff and SBI pensioners will be 1.00% above the applicable rate

- Rate applicable to all senior citizens and SBI pensioners of age 60 years and above will be 0.50% above the rate payable for all tenors to resident Indian senior citizens i.e. SBI resident Indian senior citizen pensioners will get both the benefits of Staff (1%) and resident Indian Senior Citizens (0.50%)

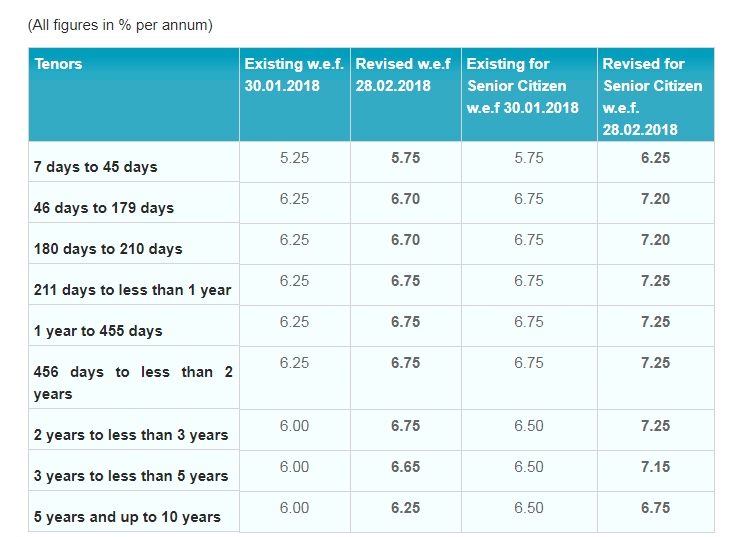

Going ahead, SBI also increased interest rates in the range of 25 basis points to 75 basis points for Domestic Bulk Term Deposits made between Rs 1 crore to Rs 10 crore.

Under this, an individual will earn interest rate of 6.75% on deposits made for 211 days to less than 1 year tenure - a hike of 50 basis points from previous 6.25% rate.

6.75% interest is also for 1 year to 455 days tenure and 456 days to less than 2 years tenure - from their previous 6.25% rate.

Senior citizens who have made deposits between Rs 1 crore and Rs 10 crore will earn interest rate of 7.25% in the above mentioned tenures from their previous rate of 6.75%.

A 75 basis points hike was made for tenure of 2 years to less than 3 years - where an individual will earn up to 6.75% interest rate from previous 6%. Having similar increase, a senior citizen will get 7.25% interest rate from their previous 6.50%.

Tenure of 3 years to less than 5 years and 5 years and up to 10 years have seen 65 basis points and 25 basis points hike from Wednesday onwards.

Individual will earn 6.65% interest rate on 3 years to less than 5 years tenure from their previous 6%, while they will receive 6.25% rate on 5 years and up to 10 years tenure from earlier 6%.

On the other hand, senior citizen will get 7.15% rate for 3 years to less than 5 years tenure from their previous 6.50%, and 6.75% for 5 years and up to 10 years tenure versus earlier 6.50%.

For lesser tenure, an individual will get 6.70% rate up by 45 basis points from previous 6.25%, on deposits made for tenure like 46 days to 179 days and 180 days to 210 days. While they will receive 5.75% interest rate higher by 50 basis points from previous 5.25% on deposits made for 7 days to 45 days tenure.

In lesser term, seniors will get 7.20% from 6.75% on deposits for 46 days to 179 days and 180 days to 210 days tenure. While they are liable to get 6.25% interest rate now from their earlier rate of 5.75% on deposits made 7 days to 45 days tenure.

The revisions made for deposits between Rs 1 crore and Rs 10 crore, bears the similar changes on deposits made above Rs 10 crores with immediate effect.

Earlier on January 30, 2018, the bank had increased its domestic bulk deposit rates ranging between 50 basis points to 140 basis points on various tenure.

Here are the terms and condition for deposits between Rs 1 crore and Rs 10 crore and above:

- Premature penalty for Bulk Term Deposits for all tenors will be 1%. It will be applicable for all new deposits including renewals. There is no discretion for reduction/waiver of penalty for premature withdrawal of term deposit

- Revised rates of interest shall be made applicable to fresh deposits and renewals of maturing deposits

- Interest rates on NRO term deposits shall be aligned as per the rates for domestic term deposits

- These rates of interest shall also be made applicable to domestic term deposits from Cooperative Banks

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

04:14 PM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate