Looking for student loan to study at IIT, NIT, IIM, AIIMS? No processing fee, quick sanction, 100% financing - Here's how SBI helps

Surprisingly, one of the most attractive student loan schemes is offered by the largest lender State Bank of India (SBI) for candidates who are looking to study in these top education institutions.

Many young hearts desire to obtain higher and premium level education to secure a better future. Every year, there is a massive number of candidates applying for admission at IIT, NIT, IIM and AIIMS. One of the major advantages these institutions offer is that large companies look favourably at candidates with higher level of education, especially from these institutions. However, generally not many can afford to study at IIT, NIT, IIM and AIIMS. Some get lucky by way of scholarships, some have to save every penny for it. However, if funds are not available, do not worry, you can still study at prestigious institutions if you opt for student loans. Surprisingly, one such attractive education loan is offered by the largest lender, State Bank of India (SBI). Notably, up to Rs 40 lakh loan is offered with no processing fees!

Benefits of SBI's this student loan:

- 100% Financing

- NO Processing Fee

- Quick sanction at Designated Campus Branch or more than 5000 Selected Branches all over the country

- Repayment period of upto 15 years after Course Period + 12 months of repayment holiday

To become eligible for such loan, you must be an Indian citizen. Also, you should have secured admission to Professional/Technical courses in select Premier Institutions through entrance test/selection process.

Expenses Covered:

Fees payable to College/School/Hostel

Examination/ Library/ Laboratory fees

Purchase of Books/Equipments/Instruments

Caution deposit / building fund/ refundable deposit supported by Institution bills/ receipts [not to exceed 10% of the tuition fees for the entire course]

Travel expenses/expenses on exchange programme

Purchase of computer/laptop

Any other expenses related to education

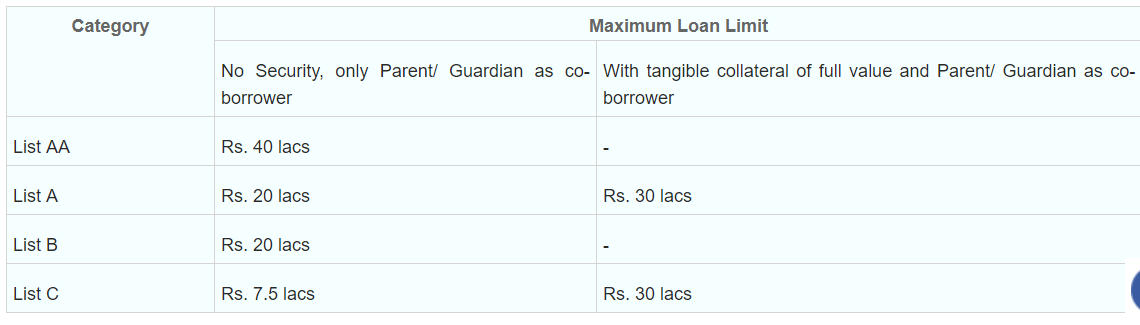

Here's how SBI gives this student loan:

In case of married person, co-obligator can either be spouse or parent/ parent-in-law. Parental co-obligation can also be substituted by a suitable third party guarantee.

Interest rate:

If you are taking loan upto Rs 40 lakh for these premium instution, then your interest rate is set at 10.70%. Reset period in your student loan is 1 year. Also, there is 0.50% concession for girl students. Also, there is 0.50% concession for students availing of SBI Rinn Raksha or any other existing policy assigned in favour of the Bank.

The accrued interest during the moratorium period and course period is added to the principle and repayment is fixed in Equated Monthly Installments (EMI). If full interest is serviced before the commencement of repayment; EMI is fixed based on principle amount only.

Repayment:

According to SBI, repay in 15 years, after the course completion + 12 months. In case second loan is availed for higher studies later, to repay the combined loan amount in 15 years after completion of second course.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

08:44 PM IST

SBI student loan offers - Don't let cash crunch stop you from getting the education you want - check list here

SBI student loan offers - Don't let cash crunch stop you from getting the education you want - check list here Student loans top tips: How education loan applicants can boost their chances of securing funds

Student loans top tips: How education loan applicants can boost their chances of securing funds What the common people expect from Union Budget 2018

What the common people expect from Union Budget 2018 "Narrow personal goals rarely brings anything but brief pleasure," Rajan's golden words to students

"Narrow personal goals rarely brings anything but brief pleasure," Rajan's golden words to students