SBI ONLINE: State Bank of India account holder? Fund transfer charges to know

The customers just have to know certain details like bank account number, bank IFSC code, and name for the online transaction to be done. Customers can transfer money to the account of any person with an account in the same bank or any other bank.

Country's largest lender, SBI or State Bank of India offers various services to the account holders right from National Electronic Funds Transfer (NEFT) to Real-Time Gross Settlement (RTGS). SBI customers can remit funds using one of these payments services. The bank customers can transfer money from anywhere using this mode of the online transaction. The customers just have to know certain details like bank account number, bank IFSC code, and name for the online transaction to be done. Customers can transfer money to the account of any person with an account in the same bank or any other bank.

Currently, every NEFT transaction carries a charge anywhere between Rs 2.50 to Rs 25 plus 18% GST, and RTGS transaction charge also varies between Rs 25 and Rs 50 along with 18% GST. Several banks have already waived off charges for NEFT transactions when made through internet banking.

RTGS/NEFT/ECS CHARGES

Real Time Gross Settlement (RTGS)

Just like NEFT, RTGS are also transactions which are carried online on a real-time basis. Via RTGS, a customer can make a minimum Rs 2 lakh transactions which can go up to maximum Rs 25 lakh. Among benefits of RTGS is that they are much faster possible way of transferring hefty amount, as real-time indicates transaction carried aren’t subject to any waiting period. This is a facility used for transferring high-value amounts.

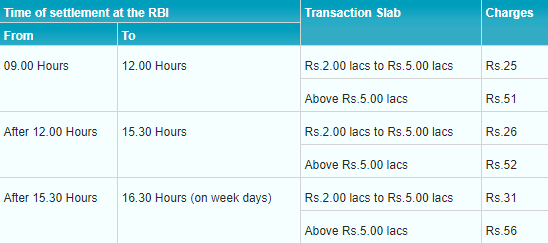

a) RTGS Customer Transactions (R-41)

b) RTGS Inter-Bank Transactions (R-42)

One should know that the charges are to be recovered from the account where the credit is afforded. However, no recovery shall be effected from the accounts of Vishesh Customers and holders of Savings Plus and Premium Savings Accounts.

Charges recovered are to be credited to the branch which puts through the transactions.

Non-home transactions will be allowed to be conducted without any service charges from all Staff/SBI Pensioners and Staff of Associates. Also, the charges are inclusive of Service Tax and no separate recovery is required to be made

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

04:54 PM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate