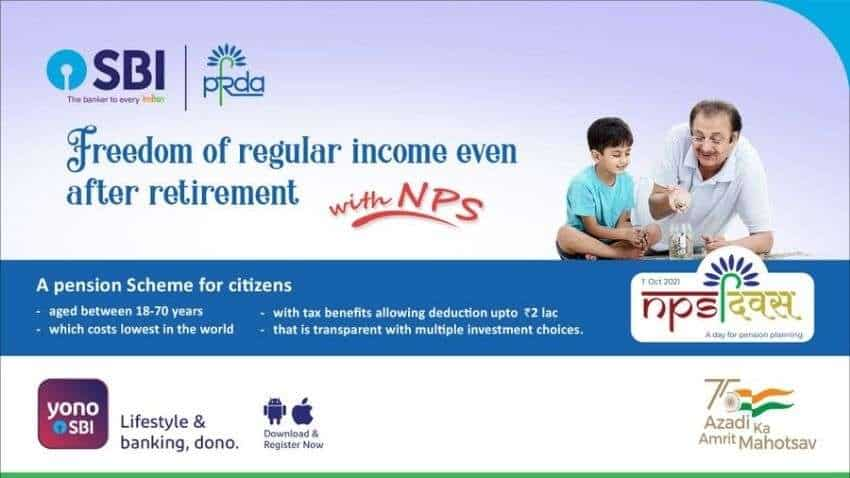

SBI offers these benefits under National Pension Scheme (NPS); see how to register, benefits, features and more here

The State Bank of India (SBI) is offering certain benefits under the National Pension Scheme (NPS).

SBI National Pension Scheme (NPS) Benefits: The State Bank of India (SBI) is offering certain benefits under the National Pension Scheme (NPS). The interested individuals can login to the official website of SBI at sbi.co.in for further details.

See Zee Business Live TV Streaming Below:

The largest public sector bank in the country has recently tweeted from its official Twitter handle about the benefits under its NPS scheme. The tweet said, "Give your future the financial freedom it deserves with National Pension System (NPS) scheme by SBI. Know more: sbi.co.in/web/personal-banking/investments-deposits/govt-schemes/nps."

Give your future the financial freedom it deserves with National Pension System (NPS) scheme by SBI.

Know more: https://t.co/BnflxsGh3V

#SBI #StateBankOfIndia #NPS #NPSDiwas pic.twitter.com/UkhUSbrVTt— State Bank of India (@TheOfficialSBI) September 29, 2021

The interested individual must note that the NPS is a defined contribution pension system introduced by the Government of India as a part of Pension Sector reforms, with an objective to provide social security to all citizens of India. It is administered and regulated by PFRDA.

Some of the key features of the NPS scheme are as follows:

1) The types of accounts include - Tier I – Pension account (Mandatory A/C - Tax benefit available) and Tier II – Investment account (Optional A/C – No tax benefit but corpus is withdrawable anytime) Rs. 50,000/- in a Financial Year.

2) The minimum contribution during account opening is Rs.500 for Tier I and the minimum contribution will have to be Rs 1000 for Tier II account opening.

3) This scheme is available for the citizens aged between 18 to 70 years

4) The scheme comes with tax benefits and allows deduction up to Rs 2 lakh

5) One-time shift to NPS - The existing corpus under superannuation can one-time be transferred to NPS without any Tax Incidence.

6) Continuation in NPS scheme post retirement – The provision to contribute till 70 years or to defer withdrawal up to the age of 70 years.

7) Complete withdrawal for corpus less than Rs.2 lakh - In case total accumulated corpus is less than Rs.2 lakh on attaining the age of 60 or later, subscriber may withdraw entire corpus.

The SBI has also tweeted the process of registering for the NPS scheme. The tweet said, "Get a future that's not only secured but also financially stable with National Pension System (NPS) scheme by SBI. To register visit: YONO App > Investments > NPS Account Opening or onlinesbi.co.in >e-Services > NPS Registration or Nearest SBI Branch."

Get a future that's not only secured but also financially stable with National Pension System (NPS) scheme by SBI.

To register visit: YONO App > Investments > NPS Account Opening or https://t.co/15Pn1hMUVI >e-Services > NPS Registration or Nearest SBI Branch#NPS #NPSDiwas pic.twitter.com/oAMDST4K2l— State Bank of India (@TheOfficialSBI) September 30, 2021

The interested users can register themselves for the NPS scheme by using the YONO app. After logging in to the YONO app, they will have to select the 'Investment' option and finally the NPS Account Opening option.

Apart from the YONO app, the customers can login to onlinsbi.co.in and under the e-Services section they can register for the NPS scheme. The customers can also register themselves for the scheme by visiting the nearest branch.

In case of further details and any query, the users can login to the official SBI website at sbi.co.in.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

03:24 PM IST

India likely to enter top 3 globally in terms of voter participation in elections: SBI Report

India likely to enter top 3 globally in terms of voter participation in elections: SBI Report SBI writes to RBI to consider non-financial transactions as well for tagging an account as operative

SBI writes to RBI to consider non-financial transactions as well for tagging an account as operative SBI fundraise touches Rs 50,000 crore in FY25

SBI fundraise touches Rs 50,000 crore in FY25 SBI raises Rs 10,000 crore through infra bond issuance

SBI raises Rs 10,000 crore through infra bond issuance SBI hikes lending rates under MCLR by 0.05%

SBI hikes lending rates under MCLR by 0.05%