SBI home loan interest rate cut by 10 basis points; here's how your EMIs will get cheaper

When RBI policy repo rate cutshappen, borrowing from central bank becomes cheaper for lenders giving them room to reduce their lending rates.

The largest lender State Bank of India (SBI) has once again taken a lead when it comes to providing cheaper home loan interest rates, stirring the competition to next level among lenders. While many lenders like ICICI Bank, HDFC Bank, Bank of Maharashtra and Indian Overseas Banks have trimmed the lending benchmark MCLR rate earlier, SBI too has joined the bandwagon. But what is more interesting is that SBI has also cut its home loan interest rates for up to Rs 30 lakh mark. This is good news for SBI bank account holders, as now their EMIs on home loan will become much less than what they were paying earlier. This cut in MCLR rate is an outcome of RBI's policy repo rate reduction by 25 basis points to 6% just days ago. When RBI policy repo rate cutshappen, borrowing from central bank becomes cheaper for lenders giving them room to reduce their lending rates.

Now, find out how your home loan EMIs will become cheaper at SBI:

SBI has made its housing loan up to Rs 30 lakh more affordable by making a 10-bps cut. Now, a borrower will have to pay between 8.60% to 8.90% interest rates, compared to previous 8.70% to 9% rates on home loan.

Let's calculate!

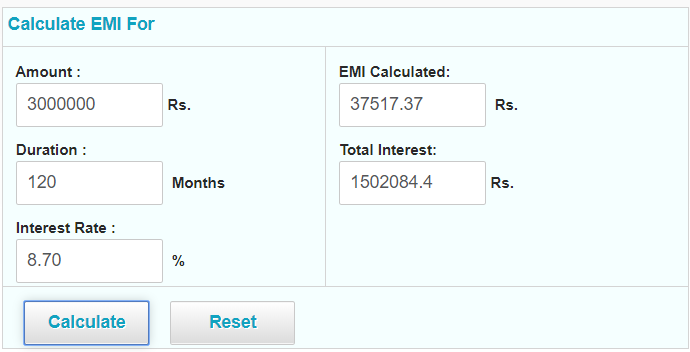

For instance, if you have taken a home loan up to Rs 30 lakh at SBI, at an interest rate of 8.70% for a tenure of 10 years, then your interest amount comes to over Rs 15.02 lakh. Hence, you will be paying EMI of Rs 37,517 every month.

(Image source: SBI)

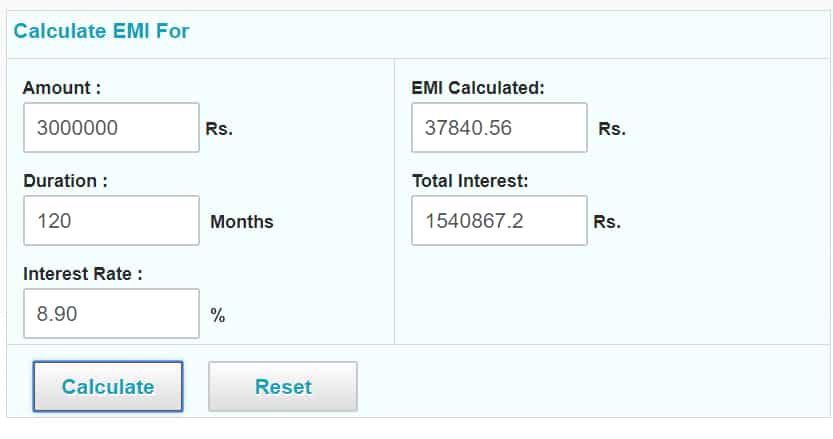

But with new rates, the above mentioned EMIs and interest rate will change. Taking the same example, however, now with 8.60% interest rates. The interest amount on home loan comes over Rs 14.82 lakh. So, every month, a SBI customer will have an EMI of Rs 37,356.

(Image source: sbi)

Hence, it is quite evident that home loan borrowers will enjoy lower interest rates at SBI.

But it is not just home loan borrowers who have seen good news, SBI has also reduced short term loan interest rates as well.

SBI said, “With SBI having linked its CC/OD rates above Rs. 1 lac to the repo rate for better transmission of RBI’s policy rates, the benefit of reduction in repo rate by 25 bps by RBI w.e.f. 4th April 2019 will get passed on in its entirety to such CC/OD customers banking with SBI w.e.f 1st May 2019.”

Earlier SBI kept all cash credit accounts and overdrafts with limits above Rs 1 lakh linked repo rate 6.25% with a spread of 2.25%. This meant, borrowers were seeing 8.50% interest rate. This will come down with new policy repo rate of 6%.

Apart from this, SBI has cut MCLR rate by 5 basis points across all tenures. Now 1 year MCLR has come down to 8.50% from previous 8.55%. With that, SBI says, interest rates on all loans linked to MCLR stand reduced by 5 bps. This will come into effect from April 10, 2019.

As far as you are concerned, now is the time to opt for loans at SBI, as they have become cheaper and much more attractive and less of a burden!

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

06:58 PM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate