SBI home loan: Buying property? WAIT! Do this first, major money benefit for you

SBI home loan is one of the most popular such facilities for people looking to buy property. However, those looking to get SBI home loan must do this first!

Going for a State Bank of India or SBI home loan? Then you should hold your application till August 31st! Why? If you do this, your interest rate would be 0.2 per cent lower, leading to a smaller home loan EMI burden. India's largest commercial bank is going to cut its home loan interest rates from 8.25 per cent to 8.05 per cent from 1st September 2019. The three days delay in your SBI home loan application would not only help you save your hard-earned money in lower EMI but a hefty amount that you would be paying on interest during the loan tenure.

Recently, SBI has reduced MCLR by 15 bps due to which overall home loan interest rate is now reduced by 35 bps since April 2019. Currently, SBI offers the cheapest home loan with an interest rate of 8.05 per cent as repo rate linked home loan and this rate will be applicable to all existing and new loan from 1st September.

See Zee Business Live TV streaming below:

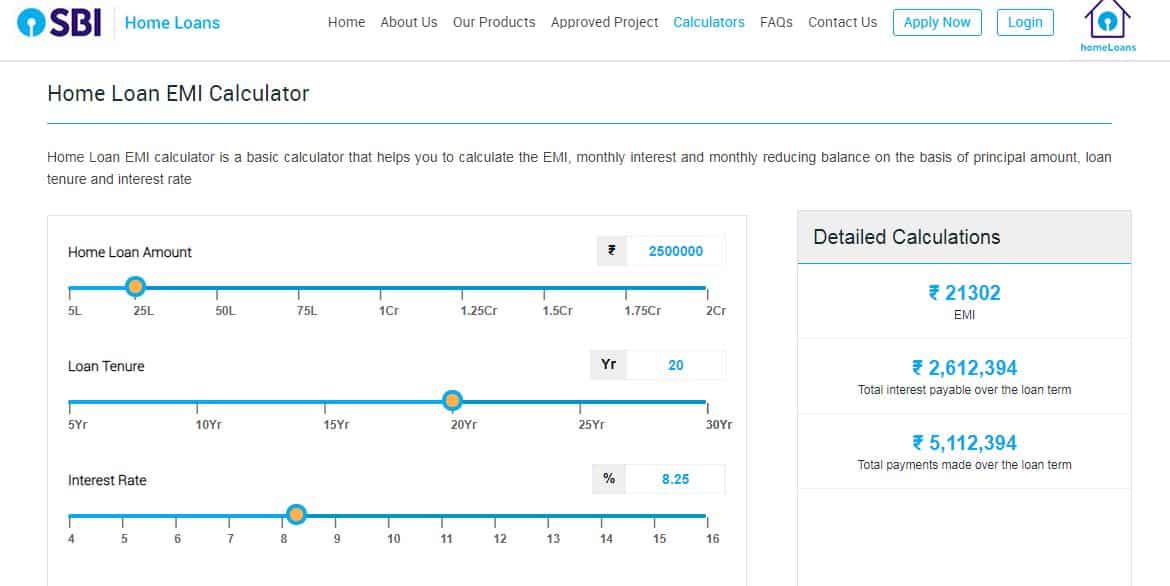

So, in current circumstances, if a person goes for SBI home loan of Rs 25 lakh for a tenure of 20 years, his or her monthly EMI would be Rs 21,302, while he will have to pay Rs 26,12,394 as interest during the loan period. However, if the loan applicant delays his or her SBI home loan application to September 1st, his or her monthly home loan EMI would be Rs 20,989 while he or she would pay Rs 25,37,327 as home loan interest during the home loan period. So, if the person delays her or his SBI home loan application to September 1, he or she would pay Rs 313 lesser in monthly home loan EMI. This will would lead to saving Rs 75,067 in home loan interest payments!

Hence, a home loan applicant is advised to hold his or her SBI home loan till September 1 and avail the benefits of SBI's RLLP (Repo Linked Lending Pattern) that is going to change the Indian banks loan lending pattern for sure.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SIP Calculation at 12% Annualised Return: Rs 10,000 monthly SIP for 20 years, Rs 15,000 for 15 or Rs 20,000 for 10, which do you think works best?

FD Rates for Rs 10 lakh investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 5-year fixed deposit returns

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

SBI Senior Citizen FD Rates: Know your maturity amount for investments ranging from Rs 5 lakh to Rs 15 lakh in 1 year, 3-year and 5-year, calculations inside

01:23 PM IST

SBI 1-year FD vs Central Bank of India 1-year FD: Which one gives higher return on fixed deposits; check maturity amount on Rs 1,00,000, 2,00,000 and 3,00,000 investments

SBI 1-year FD vs Central Bank of India 1-year FD: Which one gives higher return on fixed deposits; check maturity amount on Rs 1,00,000, 2,00,000 and 3,00,000 investments SBI JanNivesh SIP: From Rs 250 to Rs 7 lakh corpus; Find out how you can turn your pocket money into a huge amount

SBI JanNivesh SIP: From Rs 250 to Rs 7 lakh corpus; Find out how you can turn your pocket money into a huge amount Recapitalisation, reforms have worked well for public sector banks: SBI Chairman

Recapitalisation, reforms have worked well for public sector banks: SBI Chairman Impact of US tariff reciprocity on Indian exports likely to be limited: SBI

Impact of US tariff reciprocity on Indian exports likely to be limited: SBI ED restores SBI's assets worth Rs 79 crore in money laundering case

ED restores SBI's assets worth Rs 79 crore in money laundering case