SBI Customers? Your bank offers 6.80% interest on deposits in this account, all you need is Rs 100; senior citizens benefit most

Recurring Deposit is a product to provide a person with an opportunity to build up saving through regular monthly deposits of fixed sum over a period of time.

One of the major factor of fixed deposits is that it requires a lumpsum amount of investment and offers you an interest rates on them depending upon the tenure.But not all can manage to chalk down a portion of thier wealth in making a hefty deposit, for these customers monthly investment comes as a best option. Guess what!If you are an SBI customer, then your bank just has an investment option, where you can make monthly investment to as low as Rs 100 and earn the similar interest rates levied on other term deposits. This surely comes as a good news to customers. All they have to do is open an recurring deposit account with SBI.

Recurring Deposit is a product to provide a person with an opportunity to build up saving through regular monthly deposits of fixed sum over a period of time.

Key features of SBI's recurring deposit accounts are:

Monthly deposits of Minimum Rs.100/- and in multiples of Rs 10/- No maximum.

The account can be kept opened for minimum period 12 months maximum 120 months.

SBI on its website says, rate of interest as applicable to Bank's TDR / STDR for the period of the RD.Simply put, by just Rs 100 investment on monthly basis in recurring deposit account, a customer can earn up to 6.80% interest. In fact senior citizens are most beneficiary.

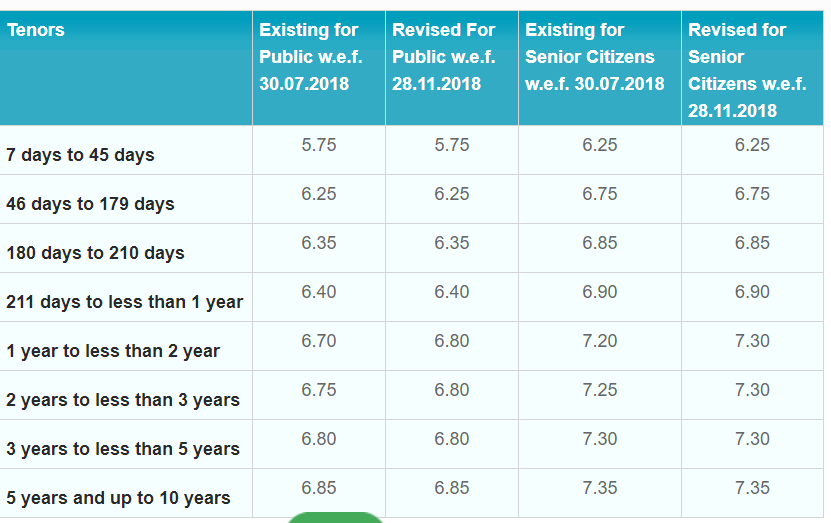

Under SBI's term deposit below Rs 1 crore, a customer can earn up to 6.80% interest rate each for tenures like 1 year to less than 2 year, 2 years to less than 3 years and 3 years to less than 5 years.

As for senior citizen, they enjoy interest rates of 7.30% each for tenures like 1 year to less than 2 year, 2 years to less than 3 years and 3 years to less than 5 years.

The interest rate is higher when it comes to investment for5 years and up to 10 years, as regularly a citizen will get 6.85%, whereas a senior citizen will earn 7.35%.

Going ahead, there is Loan / Overdraft up to 90% available against the balance in RD account. Apart from this there is also TDS

applicable.

Premature withdrawal allowed and for this, rules for TDR/STDR is applicable.

Nomination facility available and it is advised to avail of the facility.Passbooks are issued.

Terms and conditions!

Where the depositors fail to pay an instalment for a calendar month, no reminders will be sent by the Bank.

Penalty charges for non-Deposit of monthly instalments:

For a/c of period 5 years and less --Rs. 1.50 per Rs. 100/- per month

For a/c of period above 5 years- Rs. 2.00 per Rs. 100/- per month.

A service charge will be levied on Recurring Deposit accounts paid out on or after the date of maturity, wherein there is default in payment of three or more consecutive instalments and the account has not been regularized.

A service charge of Rs.10/- will be levied on such accounts at the time of payment at or after maturity.

In case six consecutive instalments are not received, the account should prematurely be closed and balance paid to the account holder.

Instructions for disposal of maturity proceeds are accepted at the time of opening of accounts.ng of accounts.

Hence,SBI's recurring deposit account is best for those customers who are not able to make a lumpsum deposits.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Highest FD rates: Here's what SBI, PNB, Canara Bank and other banks are giving on Rs 5 lakh investment in 1-year, 3-year and 5-year investments

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

08:44 AM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate