SBI bank account holder? Amazing facility! Important ATM cash withdrawal update for you

It's an important update for State Bank of India (SBI) account holders!

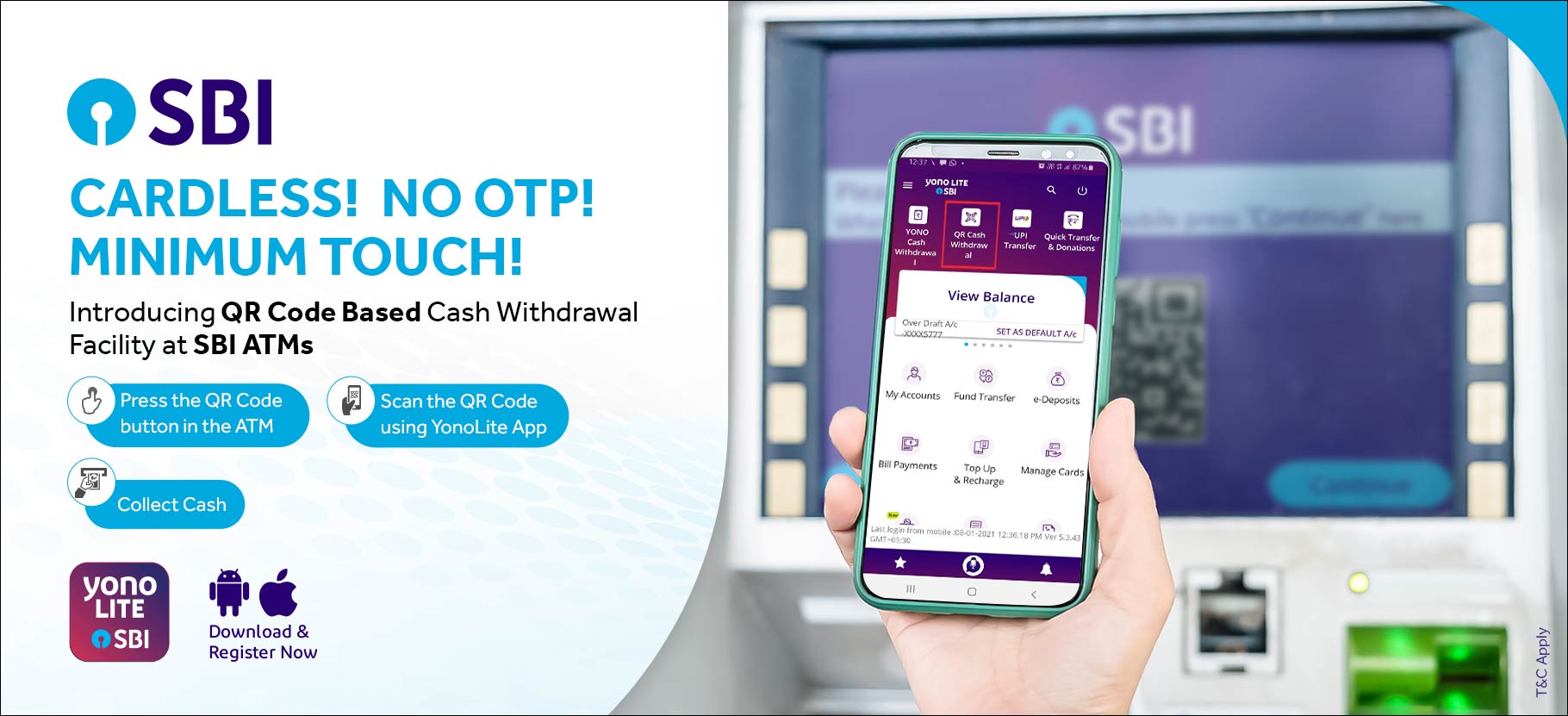

It's an important update for State Bank of India (SBI) account holders! SBI has introduced a new ATM cash withdrawal facility for its customers. SBI has introduced QR based cash withdrawal facility at its ATMs. SBI says its facility is cardless, requires no OTP and has minimum touch involved.

Here is the process for SBI QR based cash withdrawal facility:-

Step 1 - Press the QR code button in the SBI ATM

Step 2 - Scan the QR code using YonoLite app

Step 3 - Collect cash

Earlier on 14th Jan, SBI listed foreign currency bonds of $600 million under its $10 billion Global Medium Term Note Programme on India INX's Global Securities Market (GSM) GIFT IFSCs primary market platform for raising funds from global investors.

The bonds were issued through SBI's London branch and were priced at a record low coupon of 1.80 per annum. The low coupon reflects investor confidence in the country's largest bank and paves the way for a strong pipeline of foreign currency bond issuances in the year 2021.

State Bank of India has been one of the largest issuers of bonds who have listed their foreign currency bonds on India INX with a total of $2.6 billion listed on the Global Securities Market platform with this listing.

Since launch of Global Securities Market, it has been the leading listing platform for bonds at GIFT IFSC. The Global Securities Market platform of India INX offers fund raising guidelines at par with other international venues. MTNs established on India INX platform since launch in January, 2018 are of value $48.5 billion plus and listing of bonds aggregate to $24.5 billion.

On January 12, 2021, India INX derivatives turnover touched a new high of USD 16.86 billion. The exchange has made listing of Global Depository Receipts and REITs available and will soon permit listing of InvITs.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:45 PM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate