SBI Monthly Income Scheme 2023: Earn monthly returns on single deposit | SBI monthly income scheme calculator, interest rate 2023

SBI Monthly Income Scheme 2023: Most of the people are aware of the post office monthly income scheme which recently revised the interest rates for the scheme from January 2023. The investors are now getting 7.1 per cent per annum payable monthly.

SBI Monthly Income Scheme 2023: The reports of mass layoffs by several firms in various multi-national and Indian companies have created an atmosphere of uncertainty among people.

The situation is even more worrying for those who have only a single source of income. Hence, amid these times of volatility, people are in search of lucrative investment plans that can guarantee them a regular and a fixed monthly income.

Most of the people are aware of the post office monthly income scheme which recently revised the interest rates for the scheme from January 2023. The investors are now getting 7.1 per cent per annum payable monthly.

However, today we will discuss another monthly income scheme provided by the largest public sector bank, State Bank of India (SBI).

One such investment plan offered by SBI is the SBI Annuity Deposit Scheme which offers guaranteed returns, providing investors with assurance and the peace of mind they deserve.

Understanding SBI Annuity Deposit Scheme

In the SBI Annuity Deposit Scheme, investors have to deposit one-time lump sum amount. After investment, investors receive re-payment of the same in monthly annuity installment comprising part of the principal amount plus interest on the reducing principal amount, compounded at quarterly rests and discounted to the monthly value.

In simpler terms, SBI Annuity Deposit Scheme allows investors to receive a predetermined monthly amount in return for their initial deposit in Equated Monthly Instalments (EMIs). So, it works on the concept of a loan. Bank provides you the loan where you repay it along with the interest on the loan in EMIs. Similarly, in an annuity deposit scheme you give a certain amount to the bank and it repays you with interest on the invested amount.

SBI Annuity Deposit Scheme: Duration of the investment scheme

Customers of SBI can take advantage of the SBI Annuity Deposit scheme for a deposit period of 3, 5, 7 and 10 years. The scheme is available at all branches of the SBI.

SBI Annuity Deposit Scheme Eligibility

All resident individuals, including minors can invest in the SBI Annuity Deposit Scheme while the mode of holding can be done singly or jointly.

SBI Annuity Deposit scheme: Rules for Premature closure

The bank allows the premature closure for the SBI Annuity scheme depositors in case of death of the subscriber. Premature payment is also allowed for deposits up to Rs 15 lakh, however, penalty is chargeable as applicable to Term Deposits.

SBI Annuity Deposit scheme: Facility for Loan

The scheme allows an overdraft or loan up to 75% of the annuity balance in certain circumstances.

SBI Annuity Deposit scheme: Tax

Interest on SBI Annuity Deposits scheme is subject to TDS.

SBI Annuity Deposit scheme: Maturity amount

In the SBI Annuity Deposit Scheme, investors receive re-payment of their invested amount in monthly annuity installment comprising part of the principal amount plus interest on the reducing principal amount. So, the maturity amount is zero.

EPFO passbook balance check online, SMS number: Here's your step-by-step guide

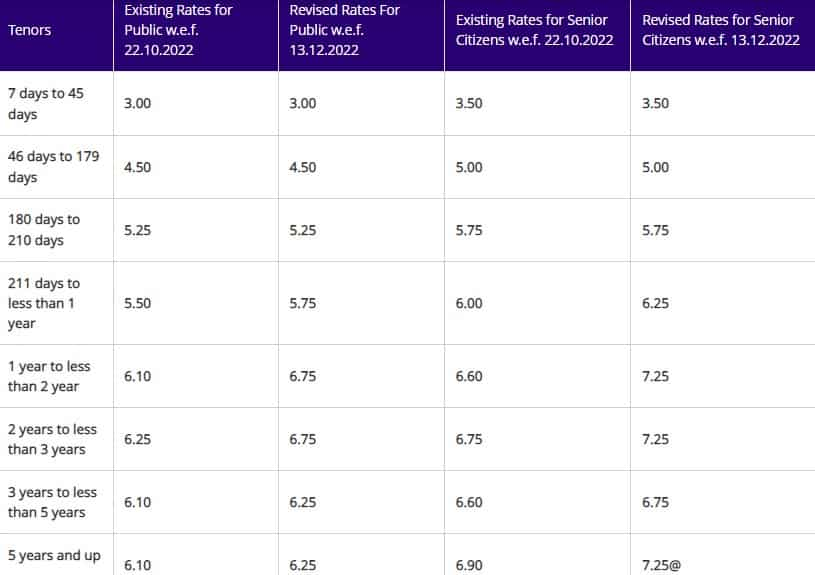

SBI Annuity Deposit scheme: Interest rates

The interest rates provided on the SBI Annuity Deposit Scheme are as applicable to term deposits chosen by the account holder.

SBI interest rates on Annuity Deposit scheme

SBI Annuity Deposit scheme: Payment date to customers by bank

Investors will start receiving the returns starting the first month's anniversary, if the date (29th, 30th, or 31st) is non-existent, the lender will make the repayment on the first day of the following month.

Annuity deposit scheme vs Fixed Deposit

In Fixed Deposit account, customers make one time Deposit and receive the maturity amount at maturity date which comprises principal and interest. Annuity Deposit accepts one time Deposit and amount is repaid to the customer over the pre-decided tenure selected by the investor, along with interest, in equated monthly installments. In FD, the investor's principal amount remains intact which is repaid after maturity, however, in SBI Annuity Deposit Scheme the invested amount is paid in full along with the interest by the bank during the pre-decided duration.

Annuity deposit scheme vs Post office MIS

The only difference between the two is that in the post office monthly income scheme, the investor gets the full invested amount after maturity, which is not the case in SBI Annuity Deposit scheme.

Egg prices touch record high: Here's what causing the surge

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:31 PM IST

SBI writes to RBI to consider non-financial transactions as well for tagging an account as operative

SBI writes to RBI to consider non-financial transactions as well for tagging an account as operative SBI fundraise touches Rs 50,000 crore in FY25

SBI fundraise touches Rs 50,000 crore in FY25 SBI raises Rs 10,000 crore through infra bond issuance

SBI raises Rs 10,000 crore through infra bond issuance SBI hikes lending rates under MCLR by 0.05%

SBI hikes lending rates under MCLR by 0.05%  SBI says its business as usual in Canada

SBI says its business as usual in Canada