RBI Retail Direct Scheme: Know the process, eligibility to open RDG account to directly invest in government securities

The RBI Retail Direct Scheme is aimed at enhancing access to government securities (G-sec) market for retail investors. It offers them a new avenue for directly investing in securities issued by the Government of India and the State Governments.

Prime Minister Narendra Modi on Friday launched two innovative customer centric initiatives of the Reserve Bank of India (RBI) - RBI Retail Direct Scheme and the Reserve Bank Integrated Ombudsman Scheme.

The RBI Retail Direct Scheme is aimed at enhancing access to government securities (G-sec) market for retail investors. It offers them a new avenue for directly investing in securities issued by the Government of India and the State Governments.

See Zee Business Live TV Streaming Below:

Investors will be able to easily open and maintain their government securities account online with the RBI, free of cost.

If you want to open an account under RBI Retail Direct Scheme, then you can check the process here:

Retail Direct Gilt Account (RDG) opening process:

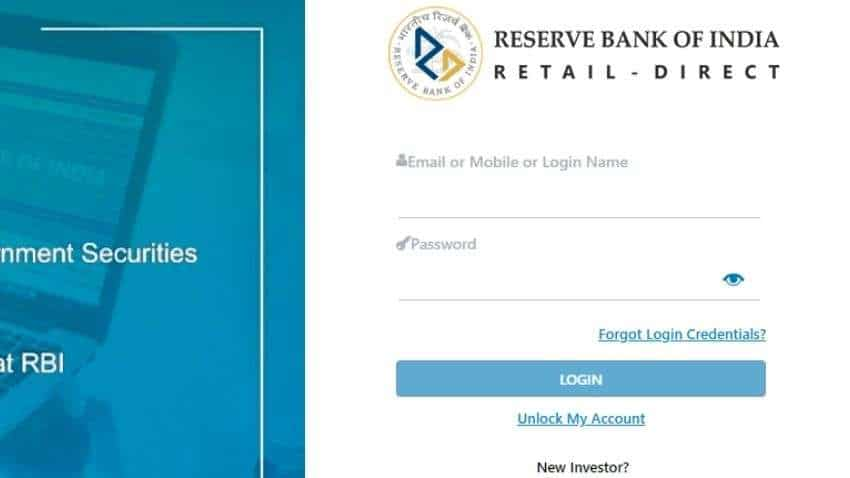

Step 1: Visit the official website of RBI Retail Direct that is ttps://rbiretaildirect.in/#/login/ and login.

Step 2: Open the account by linking OTP received on your registered mobile number and savings account.

Fees

RDG: RBI will not charge any fees or charges for opening and maintaining Retail Direct Gilt Account. Also, no charge or fee will be levied for bidding in the primary auction. The payment gateway charges will be borne by the registered investor.

Eligibility for retail investors

Retail investors should have the following to be eligible for opening the RDG account:

1. Savings account in India

2. Permanent Account Number that is PAN issued by the Income Tax Department

3. Any official document related to KYC

4. Valid email id

5. Registered mobile number

6. RDG account can be opened as single or joint account holder

7. NRI retail investors can invest in government securities only under Foreign Exchange Management Act (FEMA) norms.

8. There will be facility of two nominees, on the death of the account holder, the security score in the RDG account can be transferred to another RDG account.

9. The retail investor can also gift the security in the RDG account to another retail investor having security in the RDG account.

Investment process:

General procedure is followed for auction of government securities in the primary market.

1. Only one bid per security is allowed.

2. Facility of payment in UPI and linked bank account.

3. Refund will also be done in the linked bank account itself.

4. Allotted security will be credited in the investor's RDG account on the day of settlement.

5. Registered investors can easily buy or sell government securities on the online portal for secondary market transactions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Flexi Cap Mutual Funds With up to 52% SIP Return in 1 Year: Rs 20,000 monthly SIP investment in No. 1 fund has generated Rs 3.02 lakh; know about others too

Sukanya Samriddhi Yojana vs PPF: Rs 1 lakh/year investment for 15 years; which can create larger corpus on maturity?

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

01:36 PM IST

RBI raises collateral-free agricultural loan limit to Rs 2 lakh to aid farmers

RBI raises collateral-free agricultural loan limit to Rs 2 lakh to aid farmers 26th RBI Governor Takes Charge: Sanjay Malhotra sets sights on stability, growth, and trust

26th RBI Governor Takes Charge: Sanjay Malhotra sets sights on stability, growth, and trust How economists view RBI's CRR cut, status quo on rates & stance

How economists view RBI's CRR cut, status quo on rates & stance RBI adds 27 tonnes gold to country's reserve in October: WGC

RBI adds 27 tonnes gold to country's reserve in October: WGC  RBI to keep repo rate unchanged at meeting next week, chances of rate cut in February increased: Report

RBI to keep repo rate unchanged at meeting next week, chances of rate cut in February increased: Report