RBI Monetary Policy Preview: Repo rate cut? Home loan, car and bike loans likely to become even cheaper

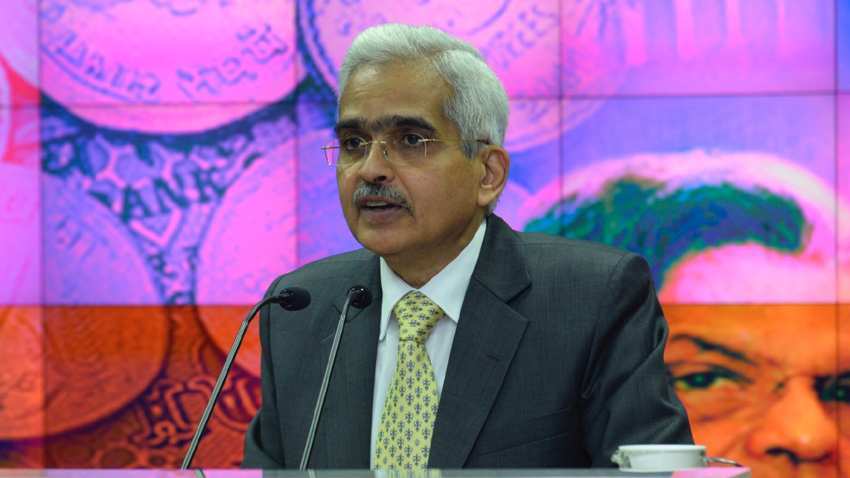

RBI Monetary Policy Preview: The Shaktikanta Das led panel will have a lot to work on when the Monetary Policy Committee (MPC) meets between December 3 and December 5.

RBI Monetary Policy Preview: The Shaktikanta Das led panel will have a lot to work on when the Monetary Policy Committee (MPC) meets between December 3 and December 5. With Q2FY20 GDP growth at a six-year low and economy going through a tough phase, the RBI is likely to cut the repo rate again while adjusting its GDP growth estimates. So, will home loan, car and bike loans, or even for that matter, personal loans become cheaper? Shanti Ekambaram, President – Consumer Banking, Kotak Mahindra Bank Ltd has some good news for loan takers, he believes a further rate cut of 25 bps can be expected in the coming MPC.

"Even as the October retail inflation at 4.62% breached the RBI’s medium-term target of 4%, I believe that the Q2FY20 GDP growth at a six-year low at 4.5% and the Sept IIP hitting an almost eight-year low with growth at (-) 4.3%, will nudge the RBI to cut the key policy rate by up to 25 basis points," she said.

A similar cut was announced by the Reserve Bank of India in its October meet. After this, the rate stands at 5.15 per cent. This was the fifth straight cut in rates by the RBI, reducing the rate by 135 points since February 2019. If expectations are met, the repo rate will come down to 4.9 per cent. One basis point is a hundredth of a percentage point.

Apart from this, the government can also increase its expenditure on infrastructure, ahead of the budget, to boost the economy.

WATCH Zee Business TV LIVE Streaming Online -

"The GDP numbers did throw up some positives in terms of a pick-up in government spending and private consumption. Against this backdrop, I do expect that the Government will step up spending in key areas such as infrastructure to give a boost to the economy. This is likely to pose a challenge to the budgeted fiscal deficit number of 3.3%. However, the need of the hour is for fiscal and monetary policies to work in tandem with each other to boost economic growth and consumption," Ekambaram added.

The latest GDP data for July-September quarter showed that India's economic growth fell to over six-year low of 4.5 percent. This is the first time in seven years that the country's GDP growth has fallen below the 5 percent mark.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:59 AM IST

Electricity distribution companies continue to remain a burden on state finances: RBI

Electricity distribution companies continue to remain a burden on state finances: RBI RBI imposes penalties on IndusInd Bank and Manappuram Finance for non-compliance of certain norms

RBI imposes penalties on IndusInd Bank and Manappuram Finance for non-compliance of certain norms Forex reserves drop $2 billion to $652.86 billion

Forex reserves drop $2 billion to $652.86 billion RBI flags rising subsidies by states as incipient stress

RBI flags rising subsidies by states as incipient stress Wholesale inflation eases to 1.89% in November from 2.36% in previous month

Wholesale inflation eases to 1.89% in November from 2.36% in previous month