PPF Calculator: Your Rs 200 can become Rs 49.47 lakh! Make money while you sleep

PPF Calculator: If earning individuals start investing in PPF account in early phase of career, they can definitely be able to invest in PPF account for 25-30 years.

PPF Calculator: Most people are so caught up in their daily jobs that they fail to realise that there are so many opportunities to make more money slipping by. Yes, people can get money from alternative options apart from their salaries. In fact, even as they sleep, people can make money! How? Well read on. So, at a time when stock markets are behaving abnormally and have shed around 30 per cent in the last one and a half months, investors should realise how important a diversified portfolio really is. That means, they should have invested in small savings schemes that are backed by the government. Among them is the Public Provident Fund (PPF) scheme.

Here an investor not only saves income tax on investment up to Rs 1.5 lakh in a financial year (if the taxpayer has chosen the old income tax slabs), the PPF interest rate still gives 7.1 per cent assured guaranteed return to account holders! Yes, even as they sleep, their wealth can increase. Importantly, PPF is a great alternative tool to create wealth that will ensure enough money in future for the subscribers of this scheme. The only thing required here is discipline to keep investing and patience. This is no get-rich-quick scheme.

See Zee Business Live TV streaming below:

Speaking on how investors should include PPF account in their portfolios, Manikaran Singhal, a SEBI registered tax and investment expert said, "PPF account should be used for long-term investment goals as it has a maturity period of 15 years. But, I would advise PPF account holders to continue investing in the PPF account till they are earning, may be for 25 years. If they do so, they will be able to get compounding benefits ion their investment as they will be able to get interest on the PPF interest accumulating in their PPF account." Yes, benefit upon benefit!

Please see Zee Business tweet below:

कोरोना वायरस से लड़ना है, सैनिटाइजर इस्तेमाल करना है#StayHomeSaveLifes #COVID19 #StayHome @AnilSinghvi_ pic.twitter.com/lyImUmwf5r

— Zee Business (@ZeeBusiness) April 15, 2020

On how to continue investing in the PPF account even after 15 years have passed and maturity of scheme has been reached, Balwant Jain, a Mumbai-based tax and investment expert, explained, "One can increase the PPF account maturity period for five years by submitting Form-H within one year of the maturity. This Form-H submission will enable the PPF account holder to continue investing in the PPF account and get PPF interest accumulated in their PPF account." Jain said there is no limit on extension of the PPF account maturity but every time investors will have to submit Form-H within one year of the PPF account maturity. Means, if a PPF account completes 15 years, it can still be extended for next five years by submitting Form-H and after completion of next five years, the same can be extended for a further five years.

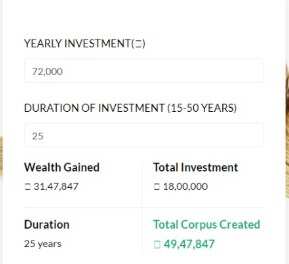

If earning individuals start investing in PPF account in early phase of career, they can definitely be able to invest in PPF account for 25-30 years. Since, there is a growing tendency to retire around 55 years, let's assume that a PPF account is opened at 30 years of age. Investment in this PPF account goes on for 25 years. If investment is Rs 6,000 per month, this money will grow to Rs 49,47,847 PPF account balance after 25 years - here we are assuming PPF interest rate at 7.1 per cent per annum . So, your Public Provident Fund can help you get Rs 49,47,847 through Rs 6,000 per month or Rs 200 per day (pd) investment.

Hence, it's advisable for the investors to have a diversified portfolio and when it comes to retirement fund, there should be some investment tools that have assured returns and PPF can be that tool, as the above-mentioned PPF calculation suggests.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

01:55 PM IST

SSY, KVP, PPF, NSC and others: Centre keeps interest rates for small saving schemes unchanged in October-December quarter

SSY, KVP, PPF, NSC and others: Centre keeps interest rates for small saving schemes unchanged in October-December quarter SIP vs PPF: Risk or Guarantee? This investment option may help you reach Rs 1 crore milestone first

SIP vs PPF: Risk or Guarantee? This investment option may help you reach Rs 1 crore milestone first Post Office Scheme: Invest Rs 250 a day in this scheme to accumulate over Rs 24 lakh at 40

Post Office Scheme: Invest Rs 250 a day in this scheme to accumulate over Rs 24 lakh at 40 How to earn Rs 65.58 lakh, Rs 1.10 cr, and Rs 1.74 cr from interest in this Post Office scheme

How to earn Rs 65.58 lakh, Rs 1.10 cr, and Rs 1.74 cr from interest in this Post Office scheme Public Provident Fund: 3 options to extend PPF account after maturity

Public Provident Fund: 3 options to extend PPF account after maturity