Post office saving scheme: This India Post scheme offers 6.6% annual interest every month- Details here

Those who are looking forward to put money in a government-run scheme can consider a post office saving scheme. This scheme by the India Post offers 6.6 per cent interest payable per annum.

National Savings Monthly Income Account: Those who are looking forward to put money in a government-run scheme can consider a post office saving scheme. This scheme by the India Post offers 6.6 per cent interest payable per annum. The interested individuals can login to the official website of India Post at indiapost.gov.in for further details.

See Zee Business Live TV Streaming Below:

Recently, India Post has tweeted about this savings scheme from its official Twitter handle. The tweet said, "Invest in National Savings Monthly Income Account (MIS) and get up to 6.6% annual interest every month. To learn more, click:cutt.ly/MxLVlZA."

नेशनल सेविंग मंथली इनकम अकाउंट (MIS) में निवेश करें और हर महीने 6.6% तक का वार्षिक ब्याज प्राप्त करें। अधिक जानने के लिए, क्लिक करें: https://t.co/cLiIyZSIoB #AapkaDostIndiaPost pic.twitter.com/LvLk4BgJxe

— India Post (@IndiaPostOffice) December 13, 2021

Minimum and maximum investment

The interested individuals who are looking for investment under this scheme must note that the minimum amount for the opening of account under this scheme, the minimum amount is Rs 1000. The deposits will have to be made in the multiples of Rs 1000.

It has to be noted that the maximum investment limit is Rs 4.5 lakh in a single account and Rs 9 lakh in a joint account. An individual can invest maximum INR 4.5 lakh in MIS (including his share in joint accounts). Now, for the calculation of share of an individual in joint account, each joint holder have equal share in each joint account.

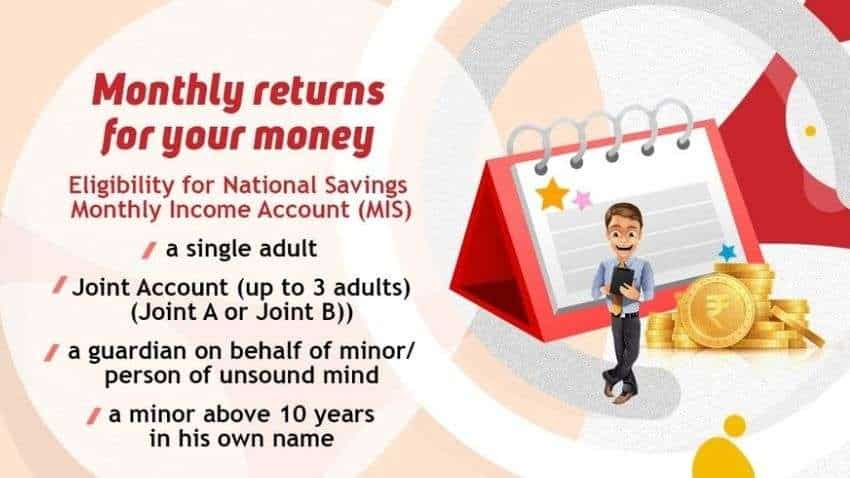

Who can open?

The interested investors must be aware of who can open an account under this scheme. It must be noted that the account can be opened by a single adult, a joint account can be held by up to 3 adults (Joint A or Joint B), a guardian on behalf of minor/ person of unsound mind and a minor above 10 years in his own name.

Interest details

The individuals must also be aware of the interest details about the scheme. They are as follows:

(i) Interest shall be payable on completion of a month from the date of opening and so on till maturity.

(ii) If the interest payable every month is not claimed by the account holder such interest shall not earn any additional interest.

(iii) In case any excess deposit made by the depositor, the excess deposit will be refunded back and only PO Savings Account interest will be applicable from the date of opening of account to the date of refund.

(iv) Interest can be drawn through auto credit into savings account standing at same post office, or ECS. In case of MIS account at CBS Post offices, monthly interest can be credited into savings account standing at any CBS Post Offices.

(v) Interest is taxable in the hand of depositor.

Maturity details

The account may be closed on expiry of 5 years from the date of opening by submitting prescribed application form with pass book at concerned Post Office. In case the account holder dies before the maturity, the account may be closed and amount will be refunded to nominee/legal heirs. Interest will be paid up to the preceding month, in which refund is made.

In case of any queries, the interested individuals can login to the official website of India Post at indiapost.gov.in.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

08:58 AM IST

PMVVY launch: Should you invest Rs 1.5 lakh to get Rs 1000 per month?

PMVVY launch: Should you invest Rs 1.5 lakh to get Rs 1000 per month?