PNB Tatkaal scheme for businesses to provide hassle free credit - Know details here

State lender Punjab National Bank (PNB) has come forward with PNB Tatkaal scheme to address urgent credit requirements of its customers.

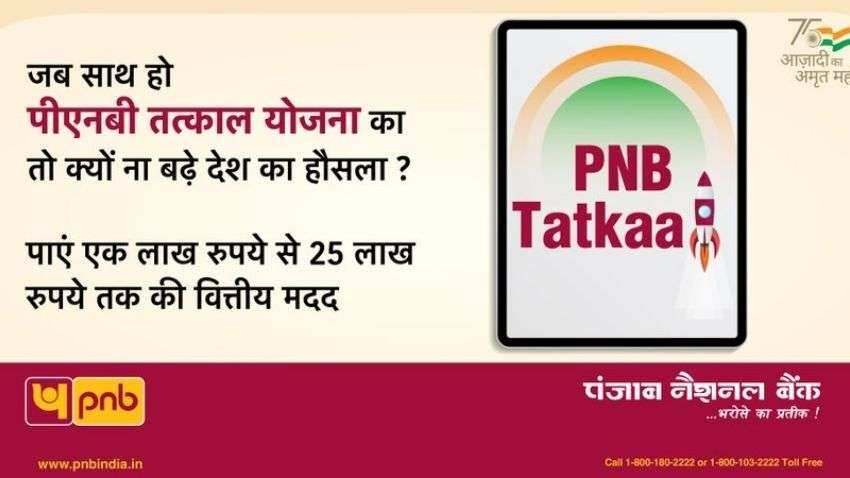

PNB Tatkaal Loan Scheme: State lender Punjab National Bank (PNB) has come forward with PNB Tatkaal scheme to address urgent credit requirements of its customers. The scheme has been designed by the bank to provide quick and hassle-free credit to businesses, it claims. The interested individuals can know more about the scheme by logging in to the official website of PNB at pnbindia.in.

See Zee Business Live TV Streaming Below:

PNB has recently tweeted from its official Twitter handle about this scheme. The tweet said, "Get financial help in the form of cash credit and term loan under PNB Tatkal scheme. Click for more information: tinyurl.com/6r92wkcw."

पीएनबी तत्काल योजना के तहत कैश क्रेडिट और टर्म लोन के रूप में पाएं वित्तीय मदद।

अधिक जानकारी के लिए क्लिक करें: https://t.co/CiTb5ggLJK#PNBTatkaal pic.twitter.com/4fJb6TIHwE

— Punjab National Bank (@pnbindia) November 14, 2021

The interested customers must know that this scheme is to meet the financial requirements related to business activity or expansion, however, the facility is not available for the purchase and construction of immovable property.

The business entities like individuals, firms, companies, limited liability partnership, co-operative societies and trusts engaged in business activities which are not prohibited by law are eligible for this loan. Furthermore, it must also be noted that the GST registered units which have filed GST returns for at least one year are also eligible for this loan.

The type of facility available under this scheme is cash credit for working capital and term loan for the purchase of fixed assets.

The loan limit under PNB Tatkaal scheme starts from Rs 1 lakh and ranges till Rs 25 lakh.

Regarding the tenure of the loan, it must be noted that the cash credit limit is one year and subjected to annual renewal. The term credit loan is up to seven years.

The interested customers must note that the rate of interest will be as per the bank's policy guidelines.

In case of further details, the interested individuals can login to the official website of PNB at pnbindia.in.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

11:52 AM IST

PNB Housing Finance jumps 11% on strong Q2 performance; broader market shows mixed trends

PNB Housing Finance jumps 11% on strong Q2 performance; broader market shows mixed trends  PNB account holders alert! Do this before August 12 to avoid account closure

PNB account holders alert! Do this before August 12 to avoid account closure PNB introduces Safety Ring mechanism to enhance security for internet, mobile banking users

PNB introduces Safety Ring mechanism to enhance security for internet, mobile banking users Nestle India board approves hike in royalty payment to parent company

Nestle India board approves hike in royalty payment to parent company PNB stock off to a poor start despite PSU bank revealing impressive numbers in Q3 updates

PNB stock off to a poor start despite PSU bank revealing impressive numbers in Q3 updates