Planning to invest? Here's a look at top mutual fund performers between May 15-May 19

The contribution of the country's smaller towns-- beyond-15 cities (B15) in industry parlance -- to mutual funds' (MFs) asset base surged 41% to Rs 3.09 lakh crore by March-end.

Amid the markets being bullish, investors have pumped in nearly Rs 1.51 lakh crore into mutual fund schemes in the month of April, with liquid, income and equity funds attracting most of the inflows, as per the data showed by Association of Mutual Funds in India (Amfi).

Mutual Funds are getting most of the attraction from small towns. According to a report by PTI, the contribution of the country's smaller towns-- beyond-15 cities (B15) in industry parlance -- to mutual funds' (MFs) asset base surged 41% to Rs 3.09 lakh crore by March-end due to investor-friendly initiatives by Sebi.

GET LIVE UPDATE OF MUTUAL FUND SCHEMES HERE

This week, markets witnessed another all-time high. With NSE Nifty touching historic high at 9,500 and BSE Sensex maintaining above 30,000-mark.

Here's a look at top mutual fund performers of the week from May 15-May 19:

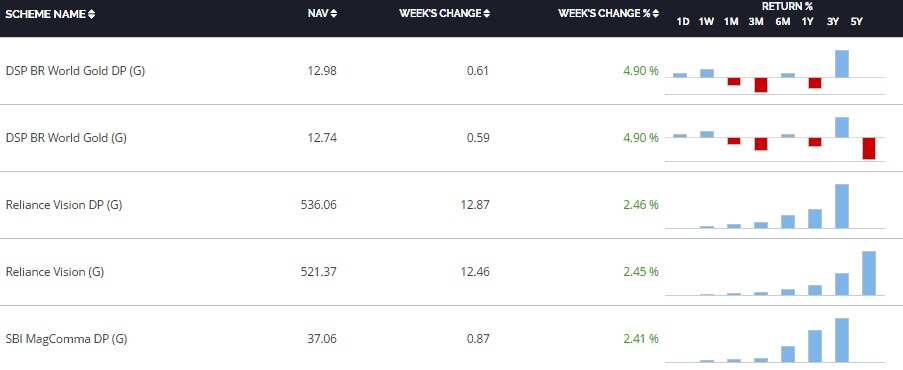

Equity Funds: Top performer this week was DSP BR World Gold DP (G), with net asset value (NAV) of 12.98 giving returns of 4.90% in one week and on similar line was DSP BR World Gold (G) with NAV of 12.74 giving returns of 4.90% during the week.

Then, third in the list was Reliance Vision DP (G), with NAV of 536.06 giving returns of 2.46% and on similar side line was Reliance Vision (G) with NAV of 521.37 giving returns of 2.45% in one week. Fifth in the list was SBI MagComma DP (G) with NAV of 37.06 giving returns of 2.41%.

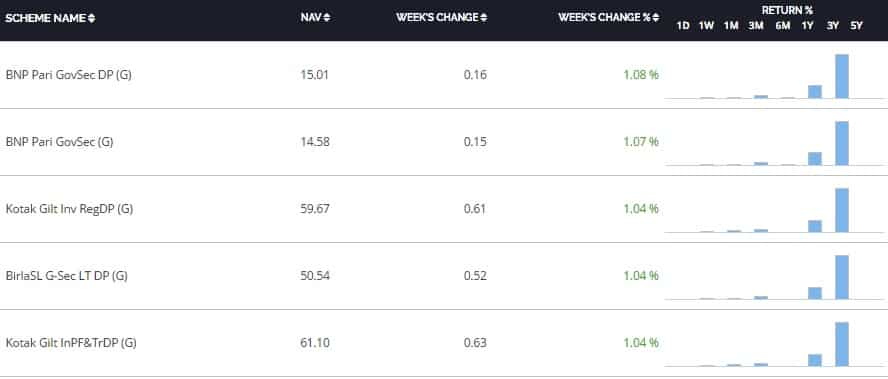

Debt Fund: These funds are considered as the safest option in the mutual funds.

Debt Funds are the funds that invest in debt instruments e.g. company debentures, government bonds and other fixed income assets. They are considered safe investments and provide fixed returns.

Top performer under this category was BNP Pari GovSec DP (G) with NAV of 15.01 giving return of 1.08% and on the similar line was BNP Pari GovSec (G) with NAV of 14.58 giving return of 1.07% in one week.

Third in the list was Kotak Gilt Inv RegDP (G) with NAV of 59.67 giving return of 1.04% and in line with it was BirlaSL G-Sec LT DP (G) with NAV of 50.54 giving return of 1.04%. Fifth in the list was Kotak Gilt InPF&TrDP (G) with NAV of 61.10 giving return of same 1.04% in one week.

Hybrid funds: According to BankBazaar, these are funds that invest in liquid instruments e.g. T-Bills, CPs etc. They are considered safe investments for those looking to park surplus funds for immediate but moderate returns.

This week, the schemes under this catergory gave returns in the range of 1.4%-1.2% in one week. Top performer in this week was ICICI PruBalanced DP (G) with NAV of 123.53 giving return of 1.42% and in line with it was ICICI PruBalanced (G) with NAV of 118 giving return of 1.39%.

Third in the list was Mirae AssetPruden DP (G) with NAV of 12.87 giving return of 1.24%. Then, in the list was SBI Dyn AssetAll DP (G) with NAV of 11.87 giving returns of 1.20%. Fifth in the list was Mirae AssetPruden (G) with NAV of 12.43 giving returns of 1.20% in one week.

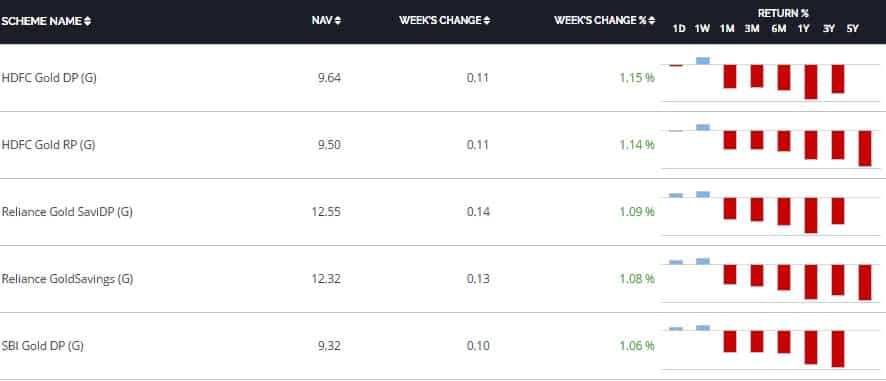

Commodity funds: According to Investopedia, Commodity mutual funds typically invest in both the stocks of companies involved in commodities, such as mining companies, and in commodities proper.

Compared to monthly returns, this category has picked up in giving weekly returns.

The top performer under this segment during the week was HDFC Gold DP (G) with NAV of 9.64 giving return of 1.15% and in line with it was HDFC Gold RP (G) with NAV of 9.50 giving return of 1.14%.

Further, third in the list was Reliance Gold SaviDP (G) with NAV of 12.55 giving return of 1.09% and in line with it was Reliance GoldSavings (G) with NAV of 12.32 giving return of 1.08%. Fifth in the list was SBI Gold DP (G) with NAV of 9.32 giving return of 1.06%.

Mutual funds helps in creating funds to meet your various life goals. So, augment your investment in Mutual Funds and invest at least a part of your monthly income in it.

Looking at the performance of the mutual funds category, you can pick up your favorite scheme and start investing.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 11,111 monthly investment for 15 years, Rs 22,222 for 10 years or Rs 33,333 for 7 years, which do you think works best?

Rules of 72, 114, 144 & 8:4:3: How long will it take for your Rs 50 lakh investment to become Rs 1 crore?

09:25 AM IST

Mutual Funds, AUM falls marginally in November after 21 months of rising trend

Mutual Funds, AUM falls marginally in November after 21 months of rising trend Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund