Planning to buy a house? We compare best home loans for you

ICICI Bank on Monday announced a reduction of 0.70% benchmarks across tenures.

State Bank of India (SBI) cut interest rates on loans by 90 basis points earlier this week. Other banks, including ICICI Bank and Punjab National Bank (PNB) followed soon after. Getting a home loan how is cheaper but the interest rates between banks still differ.

On Sunday, SBI had reduced its MCLR rates by 0.90% points across all tenure loans bringing down the effective home loan rates to 8.60% from 9.10% per annum.

ICICI Bank on Monday announced a reduction of 0.70% benchmarks across tenures effective from today while Bandhan Bank Ltd has cut its MCLR by 148 basis points to 10.52% per annum.

So, buying a home is now cheaper.

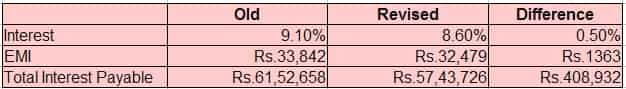

This is how much you will save:

Adhil Shetty, CEO & Co-founder, BankBazaar.com, said, for instance, considering SBI home loan rates, if you are taking loan of Rs 40 lakh for a period of 25 years, your monthly EMI will come at Rs 32,479, when the interest is at 8.6% as compared to monthly EMI of Rs 33,842, when the interest rate was 9.1%. Which means, you are saving Rs 1,363 monthly.

Similarly, in the total interest payable, with the old interest rate, your total amount comes at Rs 61,52,658, which will now come down to Rs 57,43,726 with revised interest rates. Clearly, this shows, buying a home has become cheaper by Rs 4,08,932.

But, which bank to consider for home loans:

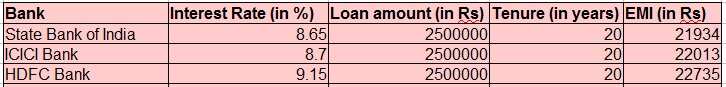

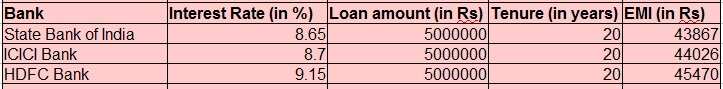

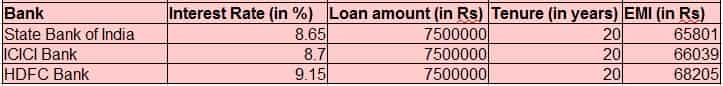

Here, we have selected three major banks, namely SBI Bank, ICICI Bank and HDFC Bank and three home loan amount for a tenure of 20 years.

In first case, when the loan amount is Rs 25 lakh for the tenure of 20 years, the EMI for SBI will be Rs 21,934 with interest rate at 8.65%, with ICICI Bank, EMI will be Rs 22,013 with interest rate at 8.75% and with HDFC Bank, EMI will be Rs 22,735 with interest rate at 9.15%.

In the second case, the loan amount is Rs 50 lakh for the same 20 year period. The EMI with SBI will be Rs 43,867 with interest rate at 8.65%, with ICICI Bank, EMI will be Rs 44,026 with interest rate at 8.75% and with HDFC Bank, the EMI will be Rs 45,470 with interest rate at 9.15%.

In the third case, the loan amount is Rs 75 lakh for 20 years. The EMI with SBI will be Rs 65,801 with interest rate at 8.65%, with ICICI Bank, the EMI will be Rs 66,039 with interest rate at 8.7% and with HDFC Bank, the EMI will be Rs 68,205 with interest rate at 9.15%.

In all the three cases, it clearly shows that the getting home loan from SBI will be a better option.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

11:03 AM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate