Paytm users alert! Now, you will be charged for adding money through credit cards

Paytm users will have to pay extra for adding money to the wallet through their credit cards, company's website states.

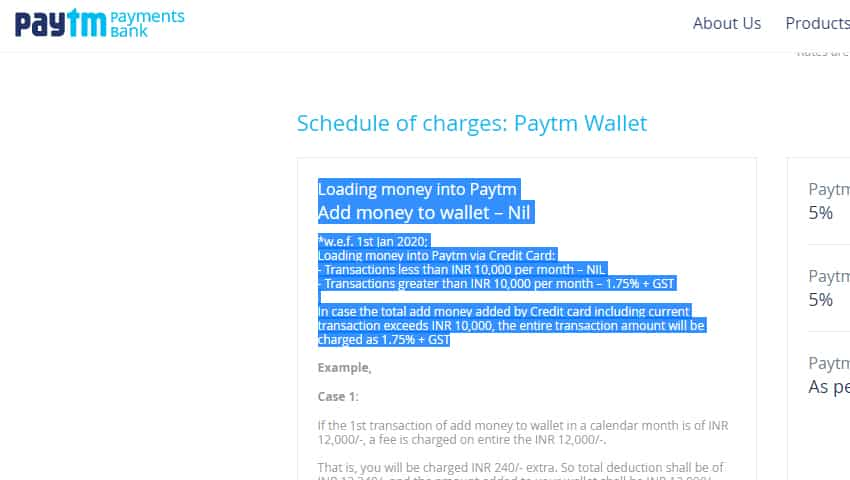

Paytm users will have to pay extra for adding money to the wallet through their credit cards, company's website states. According to the information available on the official website on Paytm, the customers will have to pay 1.75 per cent + GST for credit card transactions exceeding Rs 10,000 per month limit. Notably, the customers will not have to pay anything extra if the transaction value or amount is less than Rs 10,000.

The new charges have been updated on the Paytm website and are applicable on all transactions done on or after January 1, 2020. However, the company has not released any statement confirming the same. In case you wish not to pay this extra amount, you should add money to the Paytm Wallet through debit cards, UPI, netbanking and other wallets. Paytm confirmed this through a tweet to one of its customers.

“To add money to your wallet without any charge, we recommend you to use other payment options such as UPI or Debit Card," the tweet said. In July 2019, Paytm had claimed in a blog post that it will not charge ‘convenience fee’ or ‘transaction fee’ on Paytm app on any mode of payment including cards, UPI, netbanking and wallets.

Founded in 2010 by Vijay Shekhar Sharma, Paytm has close to 130 mn monthly active users.

The platform is facing tough competition as several foreign brands are trying to have a bigger share in the Indian market. These include Flipkart-owned PhonePe, Sequoia-backed BharatPe, and Google Pay. Facebook-owned WhatsApp is also trying to bring its own Payments solution to India. WhatsApp Payments should have arrived in India, had it not hit a roadblock with the local authorities.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

03:54 PM IST

Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29

Zomato, Paytm, Delhivery, Varun Beverages gain up to 4% on F&O addition from November 29 Paytm shares surge 12% after NPCI nod for onboarding new UPI users

Paytm shares surge 12% after NPCI nod for onboarding new UPI users Paytm Q2 FY25 Results: Digital payments firm turns profitable with one-time exceptional gain; PAT at Rs 928 crore

Paytm Q2 FY25 Results: Digital payments firm turns profitable with one-time exceptional gain; PAT at Rs 928 crore  Paytm CEO Vijay Shekhar Sharma says company focusing on consumer payments business

Paytm CEO Vijay Shekhar Sharma says company focusing on consumer payments business National Cinema Day: You can book Stree, Goat or any other movie ticket at Rs 99 on this day; know when and how to avail offer

National Cinema Day: You can book Stree, Goat or any other movie ticket at Rs 99 on this day; know when and how to avail offer