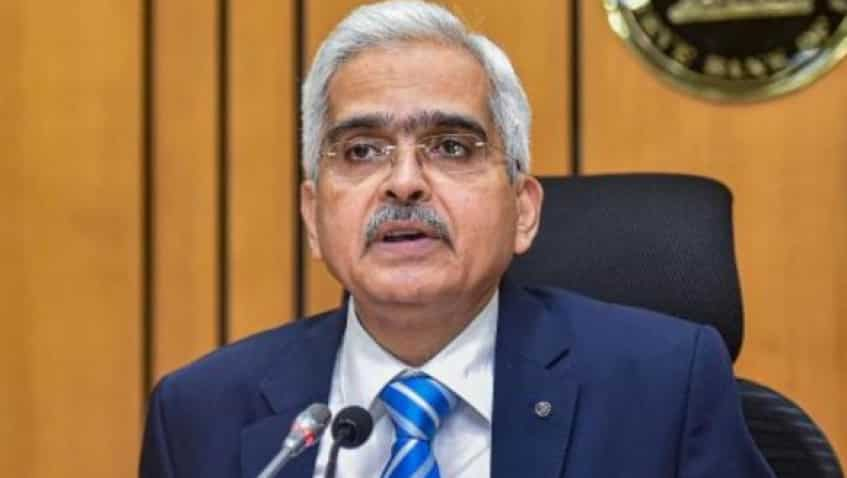

On Lakshmi Vilas Bank and Yes Bank, Shaktikanta Das says action taken in depositor interest

Governor Shaktikanta Das on Friday defended RBI's decisions to write-off bonds and shares of lenders during rescues of Lakshmi Vilas Bank and Yes Bank as legal ones taken in depositors' interest.

Governor Shaktikanta Das on Friday defended RBI's decisions to write-off bonds and shares of lenders during rescues of Lakshmi Vilas Bank and Yes Bank as legal ones taken in depositors' interest. Das said there cannot be a fixed template while dealing with cases of stress experienced by banks and working out solutions.

It can be noted that during the Yes Bank's rescue in March this year, over Rs 7,000 crore of additional tier-I bonds were written-off, while in LVB's case, tier-II bonds of nearly Rs 320 crore along with the entire outstanding shares, were written-off. Many of these instances were unprecedented and aggrieved parties have approached courts.

"The actions we take are in the best interest of the depositors and taken in compliance with legal provisions and regulatory guidelines," Das told reporters in a virtual press conference after the announcement of the bi-monthly policy review by the RBI.

He added that the RBI is "not indifferent to any segment of the economy or financial markets? and reiterated that decisions are taken in the best interest of depositors, safeguarding which is the paramount responsibility of the RBI.

"All our actions are within the legal framework, as per law and as per regulatory guidelines," he said, declining to elaborate further.

Yes Bank had to be bailed-out in an act led by SBI, where the country's largest lender and other financial institutions poured-in over Rs 10,000 crore of capital to get the troubled lender out.

In the case of LVB, the RBI decided to merge the old-age private sector lender faced with a situation of capital constraints, with Singaporean lender DBS.

When asked if something is lacking on the supervisory front, given the fact that the RBI has been forced to mount two rescue acts in a single year, Das said the supervision system has been strengthened in the last two years and the depth achieved is like never before.

Both the Yes Bank and LVB incidents did not happen overnight and the RBI was aware of the happenings. The central bank's first effort was to work with the management to resolve a problem by nudging, goading and requesting, he said, adding regulatory intervention was the last step in interest of depositor interest.

Deputy Governor M K Jain said unprecedented steps have been taken to improve supervision like unification of supervisory departments, strengthening the offsite monitoring and surveillance and usage of information technology and analytics tools.

See Zee Business Live TV Streaming Below:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:56 PM IST

Lakshmi Vilas Bank (LVB) logo, website tweaked post DBS merger; customers asked to use existing accounts

Lakshmi Vilas Bank (LVB) logo, website tweaked post DBS merger; customers asked to use existing accounts How much interest rate will Lakshmi Vilas Bank bank account holders get on their savings accounts and fixed deposits after merger with DBS

How much interest rate will Lakshmi Vilas Bank bank account holders get on their savings accounts and fixed deposits after merger with DBS  Lakshmi Vilas Bank merger with DBS Bank India: Keep aside amount equivalent to LVB's share capital, says Madras HC

Lakshmi Vilas Bank merger with DBS Bank India: Keep aside amount equivalent to LVB's share capital, says Madras HC