Now, invest in mutual funds directly from WhatsApp: Motilal Oswal becomes first AMC in India to tie up with Facebook owned platform

WhatsApp has become a one stop platform for users. It is used to exchange text, audio, images, videos, GIFs, make calls and now, it can also be used to invest in mutual funds. Yes, you read it right! You can now add WhatsApp to the long list of platforms that allow you to invest in mutual funds.

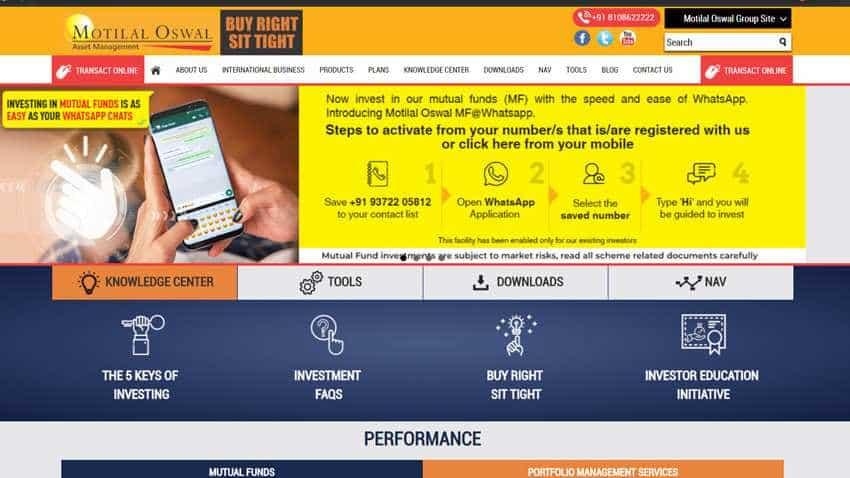

WhatsApp has become a one stop platform for users. It is used to exchange text, audio, images, videos, GIFs, make calls and now, it can also be used to invest in mutual funds. Yes, you read it right! You can now add WhatsApp to the long list of platforms that allow you to invest in mutual funds. Motilal Oswal Asset Management Company (Motilal Oswal AMC) has become the first AMC in India to introduce mutual funds (MFs) to WhatsApp. According to a banner on the AMC's website, the investors can now park their money in Motilal Oswal funds from the instant messaging platform.

Speaking on the launch, Aashish Somaiyaa, MD & CEO, Motilal Oswal AMC said, “Offering transactions on WhatsApp is our effort to try and be present wherever our investors might find it easier and convenient to be able to deal with us."

How to invest in Motilal Oswal mutual funds through WhatsApp?

1. You need to add Motilal Oswal AMC number to your contact list. As per the website, the number is +91 9372205812.

2. Go to WhatsApp and open the chat window for this number.

3. Type 'Hi' and send.

4. From here, you will be guided on how to invest in the mutual funds.

5. The investors might be asked to provide some details like Name, Date of Birth and their PAN card details.

6. Once the process is complete, you will get a payment link where the customer goes to bank account and authorises payment for the transaction.

Besides WhatsApp, the customers can continue to invest through fund house's website and mobile app. They can also invest through third party investment apps like Paisa Baazar and Patym Money. among others. The AMC is expected to introduce more features that will help customers access their account statements along with addressing their service requirements needs.

Why you should invest in mutual funds?

The biggest advantage of mutual funds is the liquidity they offer as well as the unmatcheable returns generated for you over the long-term. You can sell your units at any point (when the market is high), unlike some other investment schemes that come with a lock-in period. Also, mutual funds allow investors to diversify their investment. The fund manager always invests in more than one asset class (equities, debts, money market instruments etc.) to spread the risks.

SIPs allow investors to put money in small denominations. This reduces the average transactional expenses - you benefit from the market lows and highs. There are different type of mutual funds available in India catering to investors from all walks of life. You can choose the scheme as per your requirements.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

03:51 PM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence