No change in tax slab? Correct! Your income tax has still gone up

Finance Minister Arun Jaitley has smartly played the tax equations in Budget 2018. He did provide a sense of relief by re-introducing the standard deduction (SD) of Rs 40,000, but soon after squeezed it by hiking the education and health cess from 3 per cent to 4 per cent.

In lieu of the existing transport allowance (Rs 19,200 per annum) and medical reimbursement (up to Rs 15,000 per annum), Jaitley proposed to give a flat SD of Rs 40,000 to salaried employees.

This reduces the taxable income of salaried individuals by minimum Rs 5,800.

However, the increase in cess will cancel out most of these gains, and, in fact, go negative for higher tax brackets.

"In order to take care of the needs of education and health of BPL and rural families... I propose to increase the cess by one per cent. The existing three per cent education cess will be replaced by a four per cent 'Health and Education Cess' to be levied on the tax payable.

"This will enable us to collect an estimated additional amount of Rs 11,000 crore," Jaitley said, while presenting the Budget 2018-19 in Parliament today.

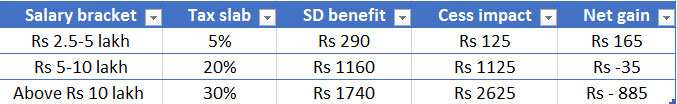

We did some calculations and below is how much you tend to gain or lose from the SD against a hike in cess:

Hence, while people in lowest tax bracket may tend to gain (albeit just Rs 165) from SD vs cess mechanics, people in 20 per cent and 30 per cent tax bracket will lose up to Rs 885.

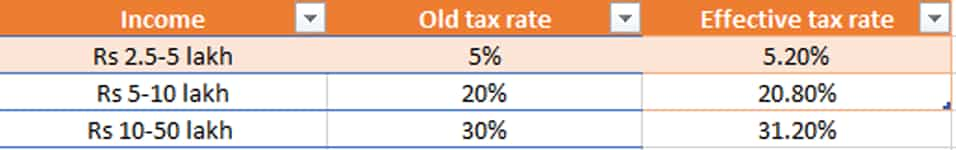

Going by this, your effective income tax slabs have gone a revision, albeit indirectly:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

11:40 AM IST

CBDT asks field officers to step up collections to meet Rs 10.05 lakh crore target

CBDT asks field officers to step up collections to meet Rs 10.05 lakh crore target Investing in new LTCG tax regime not that taxing

Investing in new LTCG tax regime not that taxing Govt favours income centric agriculture policies: Radha Mohan Singh

Govt favours income centric agriculture policies: Radha Mohan Singh 33,000% surge in 10 years and still counting! This stock deserves attention

33,000% surge in 10 years and still counting! This stock deserves attention Capital gains tax on Bitcoins! Pay 30% for 36 months, 20% beyond

Capital gains tax on Bitcoins! Pay 30% for 36 months, 20% beyond