New LTC cash voucher scheme: Who is eligible and how employees can claim benefits from employer

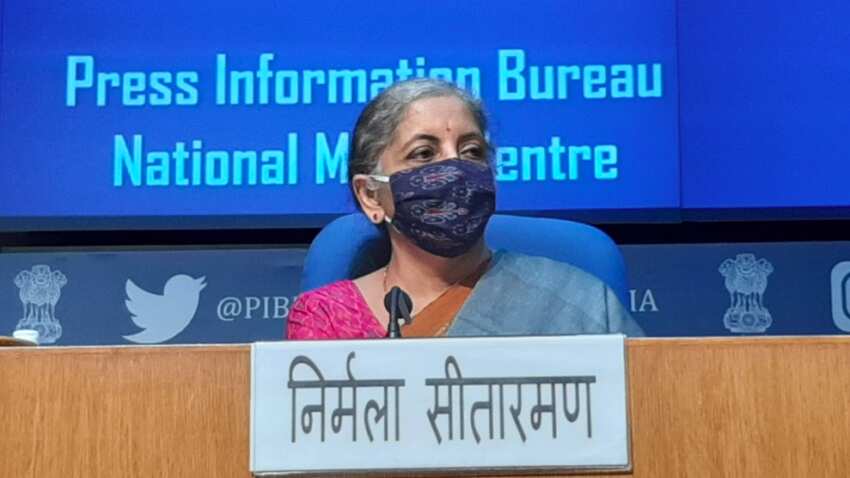

New LTC cash voucher scheme: The Finance Minister Nirmala Sitharaman on Monday made several announcements to boost the Indian economy. The government also announced giving out cash vouchers to central government employees this year in lieu of leave travel concession (LTC) fare which could be spent only on buying non-food GST-rated items.

New LTC cash voucher scheme: The Finance Minister Nirmala Sitharaman on Monday made several announcements to boost the Indian economy. The government also announced giving out cash vouchers to central government employees this year in lieu of leave travel concession (LTC) fare which could be spent only on buying non-food GST-rated items. Finance Minister Nirmala Sitharaman said the employees could buy items that attract 12 per cent or more goods and services tax (GST). These purchases will have to be made in digital mode from GST-registered outlets.

How to claim the LTC cash voucher benefit?

For those unaware, the central government employees get LTC to any destination to their choice plus one to their hometown. The current COVID-19 situation has made it difficult for anyone to travel. Instead, the government will pay the entitled fare as cash vouchers which have to be spent by March 31, 2021, she said.

Saraswathi Kasturirangan, Partner, Deloitte India explained that to avail the tax exemption employees are required to either purchase goods or services which are 3 times the amounts which would be claimed as a concession in respect of travel tickets within 31 March 2021.

She said that following conditions are to be met by the employees:

• The GST rate on such purchases/services should be 12% or more

• The expenses should be incurred through digital mode

• The GST invoices is required to be produced.

“Since this benefit is available to private sector employees as well, it is important for companies to look at their policies around Leave Travel concessions and amend them in line with the above to extend the tax benefits to its employees,” she added.

Centre to bear cost

Central government payout on cash-in-lieu-for-LTC will be Rs 5,675 crore, and another Rs 1,900 crore will be payout by central PSUs and public sector banks, Sitharaman said. The demand infusion because of this would be Rs 19,000 crore, and another Rs 9,000 crore if half of the states follow this guideline, she added.

Centre on Monday announced a slew of schemes to trigger economic revival via stimulus measures.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:10 PM IST

Budget 2022: Will Modi govt review introduction of LTC cash voucher for Central employees? What FHRAI urged

Budget 2022: Will Modi govt review introduction of LTC cash voucher for Central employees? What FHRAI urged Paying Income Tax? These new 6 rules in effect from 1st April 2021 will impact your pocket - Must know for taxpayers

Paying Income Tax? These new 6 rules in effect from 1st April 2021 will impact your pocket - Must know for taxpayers LTC benefits alert! Save more, enjoy tax benefits - Amazon.in makes big announcement

LTC benefits alert! Save more, enjoy tax benefits - Amazon.in makes big announcement Salary structure, DA, gratuity, EPF contribution, Income Tax, LTC scheme – These rules affecting your pocket set to change from April 1

Salary structure, DA, gratuity, EPF contribution, Income Tax, LTC scheme – These rules affecting your pocket set to change from April 1  7th Pay Commission Latest News: Central government employees' alert! one mistake could cost you your LTC claim—check report

7th Pay Commission Latest News: Central government employees' alert! one mistake could cost you your LTC claim—check report