Do I have to pay tax if I suffer losses on my mutual fund investments? Exemptions, capital gains, and other key details

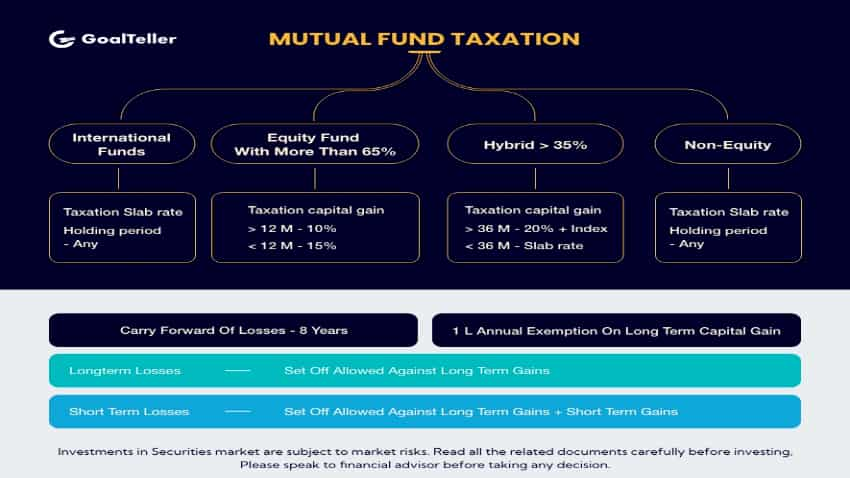

Mutual Fund Tax Treatment: As per Indian tax laws, any equity fund with more than 65 per cent exposure in Indian equities are defined as an “equity funds” for tax purposes. Gains from equity funds are taxed at 15 per cent if sold within 12 months (short-term capital gains), and at 10 per cent, if sold after 12 months (long-term capital gains).

)

Mutual Fund Tax Treatment: Investors who don't want direct exposure to equity take the mutual fund route. Mutual funds invest their money in equities, debt options, government securities, and corporate bonds, among others. The returns that the investors get are known as capital gains. Investors get short-term capital gains on selling their mutual fund holdings in less than 12 months. If they sell them after holding more than a year, their gains are called long-term capital gains. When you get returns on an investment, the first question that strikes your mind is whether you will be taxed on those gains? Whether the tax will be at a predefined fixed rate or as per your tax slab?

Likewise, when you earn gains on your mutual fund investments, the first thing you want to know is what will be the tax implications on these returns.

Vivek Banka, co-founder, Goalteller, clears a lot of your doubts.

What are tax rates on mutual fund capital gains?

Banka says that as per Indian tax laws, any equity fund with more than 65 per cent exposure in Indian equities are defined as an “equity funds” for tax purposes.

Gains from equity funds are taxed at 15 per cent if sold within 12 months (short-term capital gains), and at 10 per cent, if sold after 12 months (long-term capital gains).

However, relevant cess and surcharges would also apply along with these taxes.

Chart Courtesy: Goal Teller

Tax exemption on long-term capital

Tax rules allow for a Rs 1 lakh tax exemption for long-term capital gains, which means that the first Rs 1 lakh of gains wouldn’t be subject to tax.

E.g., if an individual has a long-term capital gains of Rs 2.5 lakh from equity funds, they would be subject to pay a tax of 10 per cent on their gains of Rs 1.5 lakh only (due to the Rs 1 lakh annual exemption), which will amount to Rs. 15,000 (Further cess and surcharge to apply).

Tax rules for balanced funds and equity savings funds

Certain section of funds like balanced funds and equity savings funds despite having lesser equities are also taxed as 'equity' as they take the help of arbitrage positions to technically classify as an equity fund.

What are the tax rules for debt funds?

In terms of debt funds, earlier these had a beneficial tax rate.

However, from the 2023 budget onwards, all such funds are taxed at your marginal tax rate, which makes them fairly inefficient for individuals in higher tax brackets.

Will I be taxed if I suffer losses?

In case in years, an investor suffers any losses from equity funds, those can be carried forward to future years and offset against gains.

As a thumb rule, long-term capital gains can be set off against long-term losses, while short-term capital gains can be set off against both long- and short-term gains.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:19 PM IST

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best? Small SIP, Big Impact: Rs 2,100 monthly SIP for 40 years or Rs 5,100 for 20 years, which do you think works better?

Small SIP, Big Impact: Rs 2,100 monthly SIP for 40 years or Rs 5,100 for 20 years, which do you think works better? From Rs 20,000 Monthly SIP to Rs 14 Crore Corpus: How many years it can take to reach that goal; by what age one can attain that stage

From Rs 20,000 Monthly SIP to Rs 14 Crore Corpus: How many years it can take to reach that goal; by what age one can attain that stage Top 4 SBI mutual funds that have converted Rs 13,100 monthly SIP investment into at least Rs 50 lakh in 10 years

Top 4 SBI mutual funds that have converted Rs 13,100 monthly SIP investment into at least Rs 50 lakh in 10 years Power of Compounding: With Rs 25,000/month salary, possible to create Rs 2.6 crore corpus? These calculations may surprise you

Power of Compounding: With Rs 25,000/month salary, possible to create Rs 2.6 crore corpus? These calculations may surprise you