Money Guru: How to avail business loan online? Top 5 ways explained here

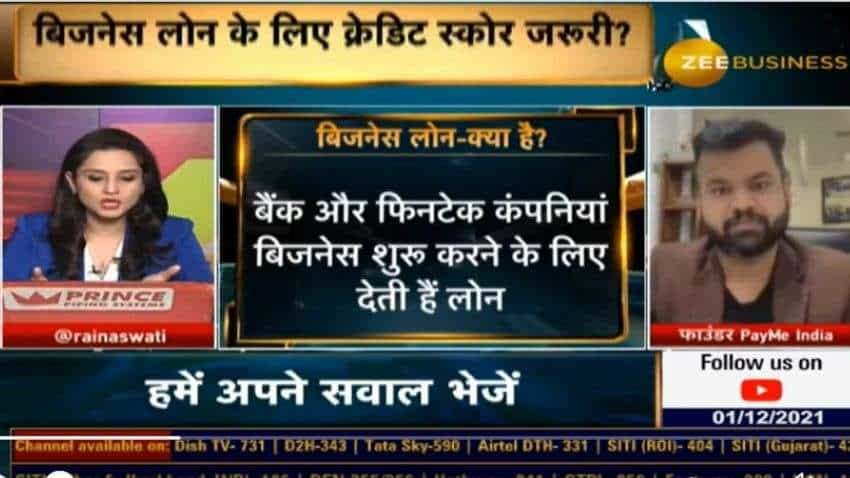

Zee Business news anchor, Swati Raina, in the show ‘Money Guru’ spoke to Mahesh Shukla, Founder of Pay Me India, to understand the key details of ‘5 ways to get a loan for your business’.

If you want to start your business or want to expand you trade, then you may have the concern that how will you get the funding? From where you will get the loan? To get the answers to all these questions, Zee Business news anchor, Swati Raina, in the show ‘Money Guru’ spoke to Mahesh Shukla, Founder of Pay Me India, to understand the key details of ‘5 ways to get a loan for your business’.

What is a business loan?

Responding to the question asked by Swati Raina, Mahesh Shukla said, “Business loan as the name indicates is a loan which is taken for the purpose to start a business or to expand the business."

What is the process of taking a business loan?

Shukla responded to this question by Raina as “The process and steps include:-

-Filling the application form

-Form submitted to bank or NBFC

-Bank will evaluate the form

-Maybe a bank representative will reach you physically and inspect your home and office. This is called -PD (Probability of default)

-Then, they will check your buro offline.

-And then they will send a confirmation that your business loan is approved.

-Then, you will have to agree with the terms and condition which includes ROI (Return of Investment)

-At last loan agreement will be signed and you will get the money.”

Who are the entities eligible for the loan?

Responding to this question, Mahesh said, “Corporates, Startups, and Established Firms are eligible for business loans.”

Online business loan

Responding to the question asked by Swati Raina, how easy it is to get a loan online, Shukla said, “Taking an online loan has now become easier because of digitalization. There are many online companies like Pay Me India where we give you money in a completely digital way. So, that you don’t have to come to our branch.” He then added, “Digital loans have low ticket sizes and for the big-ticket sizes physical meeting is important.”

Government schemes for the startup of small businesses

Swati asked, which government scheme has proved successful for starting a new business, to which Mahesh replied, “If you want to start your business on a small scale then Mudra loan is a good and successful scheme. Mudra loan’s sanction rate is also very high.”

Raina while talking to Shukla said, "In Mudra loan, you will get Rs 50,000 – Rs 10 lakh amount as loan and private/ public bank, commercial banks, Gramin banks, small finance banks and the corporate bank will sanction your loan in this scheme."

For more details: WATCH FULL VIDEO here: -

शुरु करना है अपना व्यापार?

कहां से मिलेगा बिजनेस लोन?

व्यापार के लिए कौन सी सरकारी स्कीम?

कैसे चुटकियों में मिलेगा ऑनलाइन लोन?#MoneyGuru में आज बताएंगे 'बिजनेस लोन पाने के 5 तरीके' ?@rainaswati | @PayMeIndia https://t.co/o4zeMtrsDH— Zee Business (@ZeeBusiness) December 1, 2021

Shukla added, “Stand-up India is also a very good scheme by the government for startup business.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

Fundamental picks by brokerage: These 3 largecap, 2 midcap stocks can give up to 28% return - Check targets

SBI Senior Citizen FD Rate: Here's what State Bank of India giving on 1-year, 3-year, 5-year fixed deposits currently

Retirement Planning: Investment Rs 20 lakh, retirement corpus goal Rs 3.40 crore; know how you can achieve it

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

07:35 PM IST

Money Guru: Experts give 9 mantras of investment this Navratri

Money Guru: Experts give 9 mantras of investment this Navratri Money Guru: Is your loan GOOD or BAD? Experts Decode

Money Guru: Is your loan GOOD or BAD? Experts Decode Money Guru: Top tips for investment tips from goal setting to asset allocation – details here!

Money Guru: Top tips for investment tips from goal setting to asset allocation – details here! Money Guru: Expensive education! How to effectively manage expenses – experts decode

Money Guru: Expensive education! How to effectively manage expenses – experts decode Your ITR return can get cancelled without verification – full details here

Your ITR return can get cancelled without verification – full details here