MCLR Cut: Is it time to get a home loan or should you wait some more?

Ramaswamy Subramanian Co-founder and CEO at Finanzmart said, "It is a good time for genuine home buyer opting for home loans at this rate because these interest rates are at its lowest now. In fact in 2-3 years the rates have been progressively coming down.”

Urjit Patel-led Reserve Bank of India (RBI) cut interest rates by 25 basis points in September.

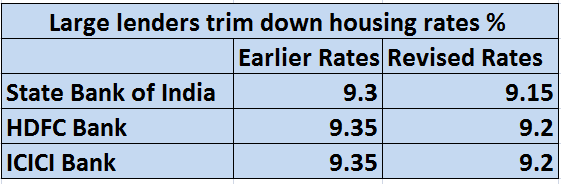

On November 03, the largest public sector bank State Bank of India (SBI) cut its home loan rate to its lowest in six years. ICICI Bank and HDFC Bank too cut their home loan interest rates. Many other banks have followed this by reducing their lending rates to 9.15% per year.

So, is this a good time to apply for that home loan or should you wait for rates to come down further?

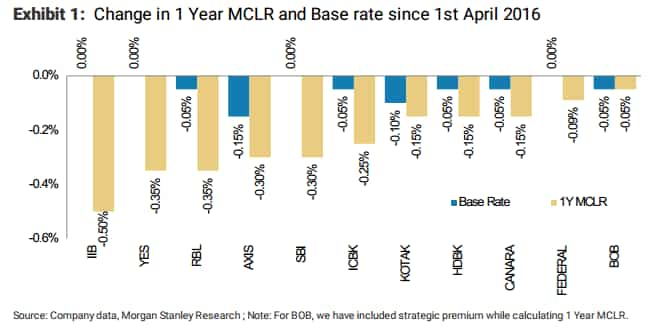

Sumeet Kariwala, Anil Agarwal, Subramanian Iyer and Rahul Gupta analyst at Morgan Stanley said, “As MCLR has been in effect for only seven months, the bulk of loans are still linked to base rates. This is supporting yields in the entire loan book -- despite the cuts in yields on the front book.”

The marginal cost of fund based lending rate was implemented by RBI on 1st April 2016 – a move to ensure better rate transmission among banking system.

Nilanjan Karfa and Avinash Singh of Jefferies said, “Some of the larger banks have reduced their MCLR in the last 1 week and we expect some more to follow. Thus, current rate cuts of nearly 15-20 basis points under home loans is perhaps just the beginning.”

Ramaswamy Subramanian Co-founder and CEO at Finanzmart said, "It is a good time for genuine home buyer opting for home loans at this rate because these interest rates are at its lowest now. In fact in 2-3 years the rates have been progressively coming down.”

He said, “Banks like SBI, HDFC Bank and ICICI Bank move over home loan rate cut, is expected to be followed by the other banks soon – which will open gates for many option in this regards.”

Also he added, “Presently the real estate market is going through lot of inventories lying unsold, which is why the supply side is pretty high."

When asked about the existing home loans which are stuck at old base rate, Subramaniam explained, “In fact it is a good time for people who have taken home loan for last two-three years. As brings in possibility for the existing borrowers to shift their balance loan to their respective bank or any other banks for enjoying the benefit of lower rates.This will give substantial savings in their EMIs.”

"Typically this season is where banks are more aggressive as the end of financial year nears, also festive season have started so by next two –three months there will be an uptick in the home loan business both on the balance transfer side and the fresh loan side," added Subramaniam.

Till September 2016, the outstanding housing finance portfolio of banks rose by 18% to Rs 8,05,800 crore compared to Rs 6,82,900 crore a year ago, as the Reserve Bank of India (RBI) data.

"For banks - the quality of portfolio will improve, which will automatically support in tackling their non-performing assets, as it would attract income," Subramaniam said.

Going ahead, private sector banks like HDFC Bank and ICICI Bank will be more aggressive in retail segment. As a result, outlook of home loan business for banks will be stable in coming quarters.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

12:25 PM IST

RBI MPC Meeting: What happens to your home, car loan rates after RBI keeps repo rate unchanged

RBI MPC Meeting: What happens to your home, car loan rates after RBI keeps repo rate unchanged Home Loan: Are rising interest rates affecting the affordable housing sector?

Home Loan: Are rising interest rates affecting the affordable housing sector? EPFO: Is prepaying a loan from EPF money a wise decision?

EPFO: Is prepaying a loan from EPF money a wise decision? Home Loan: What are the penalties if you miss your home loan EMI?

Home Loan: What are the penalties if you miss your home loan EMI? Financial Planning: How you can get the maximum tax benefits from leveraging different loans

Financial Planning: How you can get the maximum tax benefits from leveraging different loans