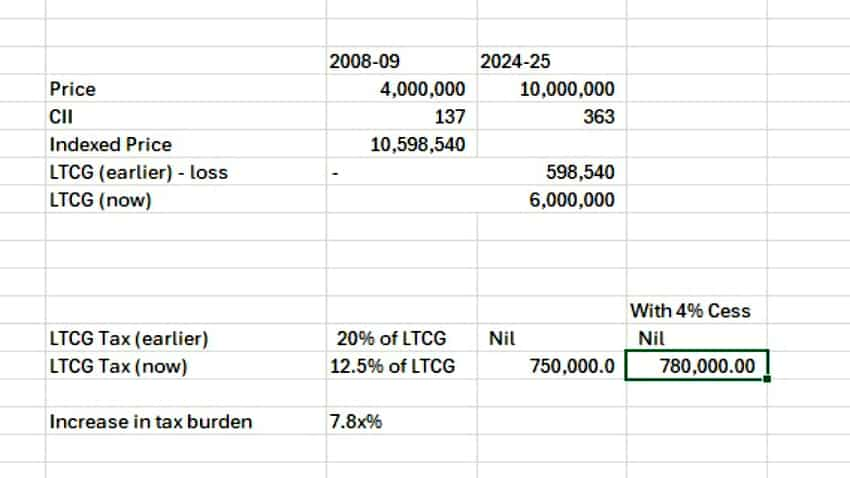

Why you may need to pay Rs 7.80 lakh extra in tax to sell the same property after indexation rule change; get calculations here

Before the Budget 2024 was announced, the tax code had the indexation provision for property sellers in India. According to that, they would adjust a property's purchase price to reflect inflation's effect on it. So, if inflation outpaced the rise in the property's value or if the property lost its value over years, the property holder would claim a capital loss in their ITR return.

)

In her Budget 2024 speech, finance minister Nirmala Sitharaman announced the end of indexation in property. Photo: Pixabay/Representational

LTCG tax kept below STT to encourage long-term investors: FM

LTCG tax kept below STT to encourage long-term investors: FM