LIC Scheme ALERT! Get High Fixed Returns! Pradhan Mantri Vaya Vandana Yojana is here

For the first fiscal year, the scheme assures an interest income rate at 7.40 per cent per annum payable monthly. This assured rate of pension shall be payable for the full policy term of 10 years for all the policies purchased till 31 March 2022.

Most of the time senior citizens park their retirement savings in risk-free zones. They don't want to risk their savings in unknown territory. For a safe bet, they deposit their money in the post office, government-related schemes, or go for bank fixed deposits to get a regular income after their retirement. LIC Pradhan Mantri Vaya Vandana Yojana is one such policy that assures higher fixed interest to senior citizens.

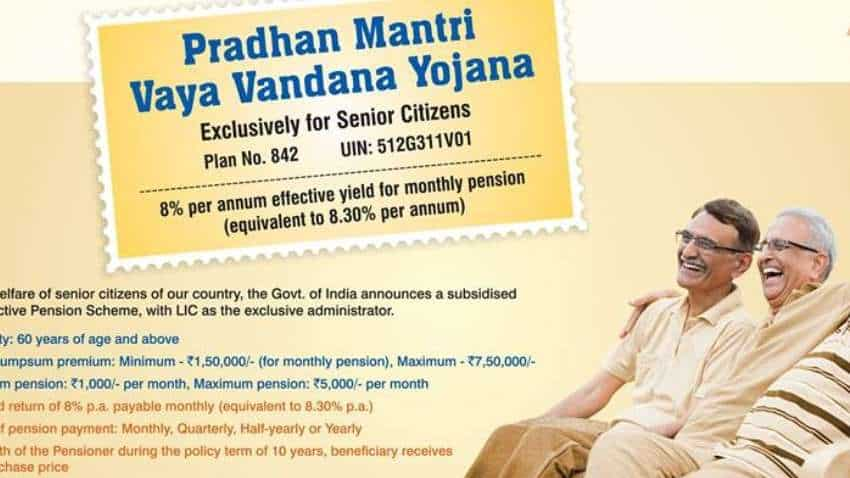

LIC Pradhan Mantri Vaya Vandana Yojana is a pension scheme for senior citizens, above 60 years of age that assures guaranteed pension for 10 years. The Centre launched LIC Pradhan Mantri Vaya Vandana Yojana last year in May. As per the terms and conditions under this plan, the guaranteed rates of pension for policies sold during a year will be reviewed and decided at the beginning of each year by the Ministry of Finance. For the first fiscal year, the scheme assures an interest income rate at 7.40 per cent per annum payable monthly. This assured rate of pension shall be payable for the full policy term of 10 years for all the policies purchased till 31 March 2022.

See Zee Business Live TV Streaming Below:

The scheme can be purchased online through the LIC website. The government has extended the policy for another three financial years till March 2023. However, age is the biggest criteria here. A person, who has attained a minimum age of 60 years, can only buy this policy. Similarly, on the death of the pensioner during the policy term of 10 years, the purchase price will be refunded to the beneficiary.

The minimum pension includes Rs 1,000/- per month; Rs 3,000/- per quarter; Rs 6,000/-per half-year; and Rs 12,000/- per year, whereas the maximum pension includes Rs 9,250/-per month; Rs 27,750/-per quarter; Rs 55,500/-per half-year; and Rs 1,11,000/-per year. However, the total amount of purchase price under the plan allowed to a senior citizen shall not exceed Rs 15 lakh.

Simultaneously, the loan facility is also available after the completion of 3 policy years. The maximum loan that can be granted up to 75 per cent of the purchase price. Also, in case of medical emergencies, the pensioner can withdraw 98 per cent of the purchase amount.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

IPL Auction 2025 Free Live Streaming: When and where to watch Indian Premier League 2025 mega auction live online, on TV, Mobile Apps, and Laptop?

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

08:33 PM IST

Only 21% feel millennials will have comfortable retirement

Only 21% feel millennials will have comfortable retirement