LIC Bima Ranta: Get 3-in-1 benefits - survival, guaranteed bonus and death benefit

LIC Bima Ratna Policy Details: LIC’s Bima Ratna is a non-linked, non-participating, individual, savings, life insurance plan which offers a combination of all three.

LIC Bima Ratna Policy Details: An insurance policy is significant for individuals, especially for those who are the breadwinners of the family, as it provides financial support to the family in case of any unfortunate event. But what if a policy has multiple benefits like survival, guaranteed bonus as well as a death benefit? LIC’s Bima Ratna is a non-linked, non-participating, individual, savings, life insurance plan which offers a combination of all three.

LIC Bima Ratna: 3 benefits

The one feature that distinguishes LIC's Bima Ratna from other policies is that it comes with triple benefits - survival benefit, guaranteed bonus and death benefits.

This plan provides financial support for the family in case of the unfortunate death of the policyholder during the policy term and also provides for periodical payments on the survival of the policyholder at specified durations to meet the various financial needs. This plan also takes care of liquidity needs through loan facilities.

LIC Bima Ratna: Survival benefit

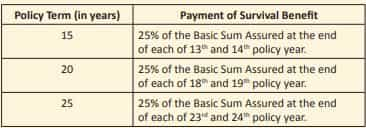

LIC Bima Ratna policy offers a fixed amount as survival benefit at a specified time for the policy term of 15 years, 20 years and 25 years. At the specified duration during the policy term, 25 per cent of the Basic Sum Assured is received. The survival benefits for various policy terms is as below:

LIC Bima Ratna: Guaranteed bonus

LIC’s Bima Ratna provides a policyholder with 50 per cent of the total sum assured along with a guaranteed bonus on maturity. Under this policy, a policyholder gets a Rs 50 bonus on every Rs 1000 basic sum assured for up to 5 years. From the 6th year to the 10th year, the individual gets a Rs 55 bonus and from the 11th year to the 25th year, they will get a Rs 60 bonus on every Rs 1000 basic sum assured.

LIC Bima Ratna: Death benefit

If the policyholder dies during the term, the sum assured and guaranteed bonus is given to the nominee. In such a situation, up to 125 per cent of the Basic Sum Assured or up to 7 times the annual premium, whichever is higher, is paid by LIC to the nominee.

Also Read: Income Tax: What are the 3 deductions under the new tax regime?

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

05:12 PM IST

6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit

6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit LIC gets GST demand notice of Rs 65 crore

LIC gets GST demand notice of Rs 65 crore Has your LIC policy lapsed due to non-payment of premiums? Here's what to do

Has your LIC policy lapsed due to non-payment of premiums? Here's what to do LIC's digital transformation; sells over 1 million policies through Ananda App

LIC's digital transformation; sells over 1 million policies through Ananda App SEBI grants LIC three more years to achieve 10% public shareholding

SEBI grants LIC three more years to achieve 10% public shareholding