Investors see more value in mutual funds than investing in markets directly

Total AUM industry increased by 1.1% (by Rs 16,899 crore) to Rs 15.80 lakh crore in September 2016 on sequential basis.

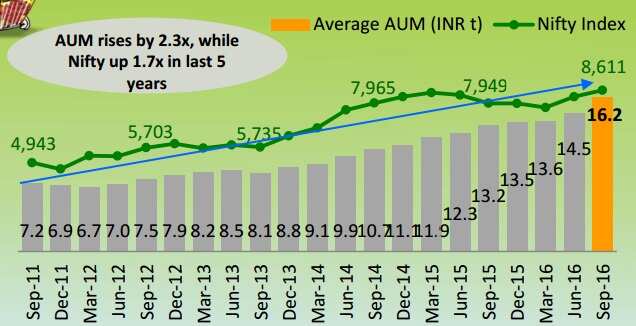

The average Asset Under Management (AUM) in mutual funds sector witnessed a 22.3% year-on-year rise in September 2016, which was higher than compared to markets as the benchmark index Nifty rose by 8.3% y-o-y in the same month.

Motilal Oswal, in a report said that the average AUM rose primarily on account of inflows in equities and increased participation of domestic investors in equity schemes.

As per the report, the mutual fund industry rose by 12th consecutive quarter by 11.7% quarter-on-quarter basis in the second quarter of the financial year which ended on September 30, touching an all time high of Rs 16.2 trillion.

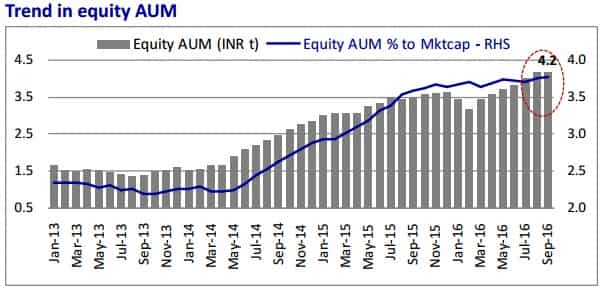

The total equity corpus of top 20 AMCs grew 0.8% month-on-month and 27.8% year-on-year in September, as against the Nifty's fall of 2% month-on-month and rise of 8.3% y-o-y.

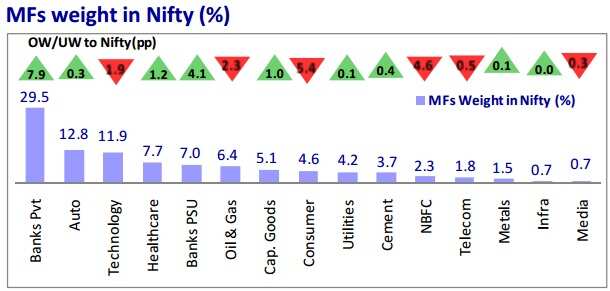

Sector-wise, mutual funds showed interest in Autos, NBFCs, PSU Banks, Cement and Chemicals—these sectors saw a m-o-m increase in weight.

Capital Goods, Private Banks, Utilities, Technology, Telecom and Media saw an MoM decrease in weight. The Private Banks (16.5%) remained the top sector holding during the month, followed by Autos (10.9%), Cap Goods (8.6%) and Healthcare (8.2%).

However, in a report by IDBI Capital, the domestic mutual funds turned out to be net buyers in equity in August 2016. Mutual Funds were net buyers in equities worth Rs 2,714 crore, as against net buying of Rs 2,717 crore in August 2016. In September mutual funds were net buyers in equity in 13 trading sessions and net sellers in six sessions. Net buying in equity was recorded highest at Rs 1,009.7 crore on 20 September 2016 while net selling recorded high at Rs 319.6 crore on 6 September 2016.

Total AUM industry increased by 1.1% (by Rs 16,899 crore) to Rs 15.80 lakh crore in September 2016 on sequential basis.

It witnessed 3% rise (by Rs45,080 crore) to Rs 15.63 lakh crore in August 2016. The m-o-m basis AUM of all categories witnessed rise except Income, GILT and Fund of Funds Investing Overseas which witnessed fall. Liquid funds saw highest rise in AUM, while Income Fund saw highest fall in AUM, the IDBI Capital report said.

Among the 18 newly launched schemes in September, the funds mobilized stood at Rs 4,300 crore, which included 16 close ended Income Funds and 1 close and 1 Open ended Equity Fund.

Other Exchange Traded Funds (ETFs) has witnessed net inflow of Rs 1,533 crore in September as against net inflow of Rs 892 crore in August. The total AUM of Other ETFs increased by Rs 1,042 crore or by 4.8% to Rs 22,740 crore on sequential basis, the report added.

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

10:58 AM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence