Invested in mutual funds? This is how much tax you will have to pay on gains

The income tax deduction when it comes to capital gains through mutual funds depends on the time for which one stayed invested in the scheme.

Mutual funds are one the most popular investment schemes these days. These funds allow investors to put funds into a pool and grow their money. But, the capital gained from mutual funds is also taxable under the Income Tax Rules.The income tax deduction when it comes to capital gains through mutual funds depends on the time for which one stayed invested in the scheme. There are namely two kinds of holding periods when it comes to mutual funds, long term and short term. The term duration for equity mutual funds and balance mutual funds to be long term is 12 months and more. When it comes to debt funds, for it to be a long term holding, the tenure should exceed 36 months. Equity mutual funds and balance mutual funds become short term when the duration falls short of 12 months. Similarly, the debt funds are short term holdings when the term duration is shy of 36 months.

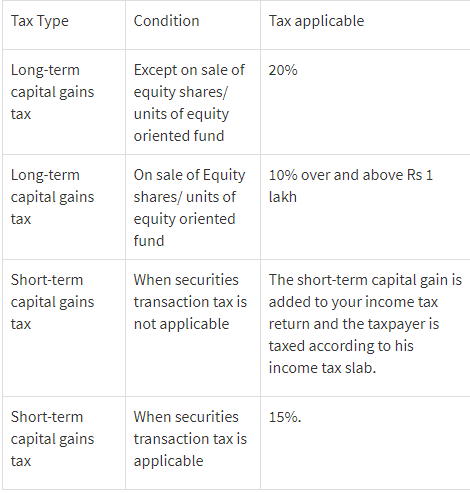

If your investment is in equity and balanced mutual funds having holding period of 12 months or more, then they are termed as long term gains. In case if it is debt mutual funds, then LTCG is specified if investment kept for 36 months or more. Hence, here LTCG taxes will be levied on your mutual fund gains. In case the holding period of your equity and balanced is lesser than 12 months, then they are termed as short term gains. Here the tax imposed on the gains are with regard to the short-term capital gains tax.

According to ClearTax report, the longer you hold onto your mutual fund units, the more tax-efficient they become. This is because the tax on long-term gains is much lesser than tax on short-term gains.

Under Section 80C with the Equity-Linked Saving Scheme, wherein there is a lock in period of 3 years. Here, the long term capital gains or LTCG is tax free if its falls below Rs 1 lakh. If the LTCG exceeds the said amount, it is taxed at the rate of 10%, devoid the benefit of indexation.

Similarly, on LTCG non-tax saving equity funds, there is no tax levied on returns up to Rs 1 lakh. Above the said amount, tax is imposed at the rate of 10% without the benefit of indexation. In the case of short term capital gains, a tax cut of 15% is put if the units are redeemed before 12 months.

Balanced funds are taxed the same way as non-tax saving equity funds.

When it comes to the debt funds, the LTCG is imposed a tax rate of 20% after indexation. The short term capital gains on debt funds are taxed according to the income tax slab the individual falls under. It can be observed clearly that the longer one stays invested in a mutual fund investment, the more tax-efficient it becomes, as the tax imposed on short term capital gains are higher than the ones charged on the long term capital gains.

Watch Zee Business Live here:

How to plan your investment?

Tax expert Sunil Garg told Zee Business Online, "When investors put money in mutual funds, they are either invested in long term or short term capital gains. The investor should plan according to the tax rate of 10% on long term gains and 15 % on short term gains."

Garg added that firstly, the investor should plan for a long term mutual fund. Moreover, in a financial year, long term capital gains up to Rs 1 lakh is exempted. "Hence any investor can plan that at the end of the financial year, that he earns up to Rs 1 lakh, so that he or she is exempted from the income tax. Ultimately, you can plan your mutual funds i) on the period of holding and make sure it isn long term ii) in a financial year if you earn up to Rs 1 lakh then it is exempted" he added.

(By Ruchika Goswamy)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

05:25 PM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence