Income Tax slabs for AY 2019-2020 to change? Here's how your tax liability may sum up

Budget 2019: Several reports suggest that in the last budget of its current term, Prime Minister Narendra Modi-led Union government will raise the Income Tax slab, raising the exemption limit to Rs 5 lakh from the current Rs 2.5 lakh. This will come as a huge relief to the middle class.

Budget 2019: Several reports suggest that in the last budget of its current term, Prime Minister Narendra Modi-led Union government will raise the Income Tax slab, raising the exemption limit to Rs 5 lakh from the current Rs 2.5 lakh. This will come as a huge relief to the middle class. In Financial Year 2018, as many as 5.43 crore Income Tax Returns were e-filed up to 31st August 2018, as per the Ministry of Finance. There are around 2.7 crore taxpayers reporting income up to Rs 3.5 lakh and about 1.5 crore assessees filing returns on income over Rs 3.5 lakh.

In its pre-budget memorandum to the government, the Confederation of Indian Industry (CII) has recommended raising the income tax limit. The CII has also urged the government to raise the limit of deduction under section 80C from Rs. 150,000 to Rs. 250,000, to provide saving opportunities to the public at large.

You may be curious to know how the reported change in income tax slab will affect you. For this, it is important to know how the income tax is calculated. To understand this, take a look at the following illustration:

But first, suppose you earned a total income of Rs 12 lakh in FY 2018-19. Also, the government doesn't change tax prescribed for other income slabs.

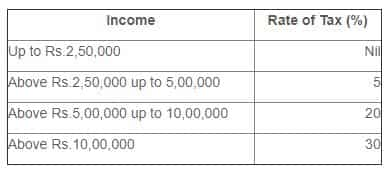

The tax rates prescribed for AY 2018-19 are:

If the minimum tax exemption limit is raised to Rs 5 lakh, your tax liability will be calculated as:

| Payable Tax Calculation | Value in Rupees |

| Up to Rs 5,00,000 | Nil |

| From Rs.5,00,001 to Rs.10,00,000 @ 20% | 100,000 |

| On remaining Rs 2,00,000 @ 30% | 60,000 |

| Total | 1,60,000 |

| Adding health and education cess @ 4% | 6400 |

| Total tax payable by You | 1,66,400 |

Thus your total tax liability will be Rs 1,66,400. Now, compare this with the current tax prescriptions:

| Payable Tax Calculation | Value in Rupees |

| Up to Rs 2,50,000 | Nil |

| From Rs.2,50,001 to Rs.5,00,000 @ 5% | 12,500 |

| From Rs.5,00,001 to Rs.10,00,000 @ 20% | 1,00,000 |

| On balance Rs.2,00,000 @ 30% | 60,000 |

| Total | 1,72,500 |

| Adding health and education cess @ 4% | 6900 |

| Total tax payable by You | 1,79,300 |

It is clear from the above that you will end up saving over Rs 13,000 in income tax if Modi government raises the income tax slab.

Apart from income tax, assessees have to pay 4% towards 'Health and Education Cess'.

A resident individual is also eligible for a rebate under Section 87A if her/his total income is not more than Rs 3.5 lakh. Such individuals are liable for a 100 per cent rebate or Rs 2500, whichever is less. This rebate applies to the total tax before the 4% Education Cess is added. This rebate is not applicable to super senior citizens as they are already fully exempted up to Rs 5 lakh.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

02:43 PM IST

Zomato gets Rs 803.4 crore tax demand from GST authorities

Zomato gets Rs 803.4 crore tax demand from GST authorities  Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November

Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November No proposal on income tax relief for senior citizens under consideration: Centre

No proposal on income tax relief for senior citizens under consideration: Centre  Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  This is India's only tax-free state, residents earn crores without paying Income Tax

This is India's only tax-free state, residents earn crores without paying Income Tax