Income Tax Return (ITR) filing: Here’s why you should know about Form 16

Last month, in a bid to rationalise some fields without making any change in the manner of filing the Income Tax Returns (ITR) as compared to last year. As the deadline for ITR filing nears, every taxpayer should remember about Form 16.

Income tax is a percentage that individuals or corporates pay to the government from their earnings. This income is categorized in different groups on the basis of the amount involved. Each group is categorised according to a specific tax slab. Income tax slab rates are revised during the Budget almost every year, with the government tinkering with it here and there. One of the major factor of Income Tax is also Income Tax Return (ITR) filing. Because we pay income tax on our various source of income, government also allows us to refund those taxes paid which in short means ITR filing. The Income Tax Department on it’s website has mentioned that all ITR forms are now available for e-filing. Last month, in a bid to rationalise some fields without making any change in the manner of filing the Income Tax Returns (ITR) as compared to last year. As the deadline for ITR filing nears, every taxpayer should remember about Form 16. It has various services that help you earn tax benefit. Let's know more about Form 16 under IT act.

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees.

These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to TaxPayers.

Now this form has all the information which a taxpayer needs to file ITR.

There are two components in Form 16 namely Part A and Part B.

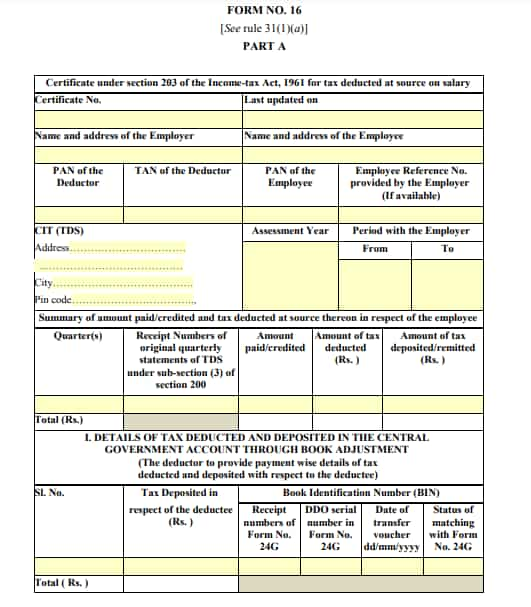

Part A

This section of Form 16 is generated and downloaded through TRACES portal. This is a certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source on salary.

It includes informations of both employer and employee.

- PAN of the Deductor

- PAN of the Employee

- TAN of the Deductor

- Employee Reference No. provided by the Employer (If available)

- Period with the Employer

- Assessment Year

- Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

- Receipt Numbers of original quarterly statements of TDS under sub-section (3) of section 200

- Tax Deposited in Book Identification Number (BIN) respect of the deductee (Rs.)

It needs to be noted that, if an assessee is employed under one employer only during the year, certificate in Form No. 16 issued for the quarter ending on 31st March of the financial year shall contain the details of tax deducted and deposited for all the quarters of the financial year.

Further, if assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No. 16 pertaining to the period for which such assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No.16 may be issued by each of the employers or the last employer at the option of the assessee.

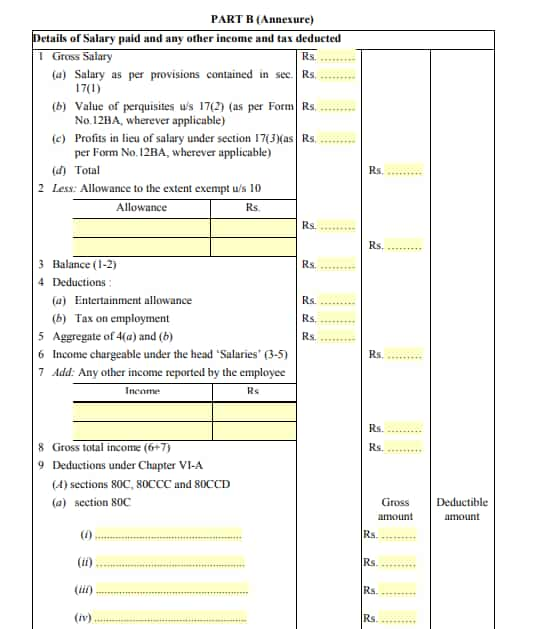

Part B

Now this form includes details of salary paid and any other income and tax deducted.

It involves informations like:

- Salary as per provisions contained in sec. 17(1)

- Value of perquisites u/s 17(2) (as per Form No.12BA, wherever applicable)

- Profits in lieu of salary under section 17(3)(as per Form No.12BA, wherever applicable)

- Entertainment allowance

- Tax on employment

- Deductions under sections 80C, 80CCC and 80CCD (a) section 80C

It needs to be noted that, the aggregate amount deductible under sections 80C, 80CCC and 80CCD(1) shall not exceed one lakh rupees.

Why Form 16 is needed

This form is a very important document because it serves as a proof for employer that the government has received the tax deducted by them.

Also it supports in the process of filing ITR at the IT department.

Here’s a list of details required for filing ITR from Form 16.

- Taxable Salary

- Breakup of Section 80C Deductions

- Aggregate of Section 80C Deductions(Gross & Deductible Amount)

- TDS (Tax Deducted at Source)

- Tax Payable or Refund Due

- TDS Deducted by Employer

- TAN of Employer

- PAN of Employer

- Name and Address of Employer

- Current Assessment Year

- Your (Taxpayer’s) Name and Address

- Your PAN

Not only this, even many banks and financial institutions demand Form 16 for verification of the person’s credentials while applying for loans.

According to ClearTax report, any person responsible for paying salaries is required to deduct TDS before making payment. The Income Tax Act lays down that every person who deducts TDS from a payment, must furnish a certificate with details of TDS deducted & deposited. An employer in specific is compulsorily required to furnish a certificate, in the format of Form 16.

If a Form 16 is not issued by employer, ClearTax adds, even when he fails to issue you a Form 16, you must file an income tax return and pay off the taxes that are due.

The report explains that while the onus of deducting tax on salaries and providing Form 16 is on the employer, the onus of paying income tax and filing income tax return is on you. If your income from all sources is above the minimum tax slab you are required to pay tax, whether or not your employer deducted TDS.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

04:02 PM IST

ITR Filing Last Date: 5 consequences you may face for missing income tax return filing deadline

ITR Filing Last Date: 5 consequences you may face for missing income tax return filing deadline About 6 crore ITRs filed for FY24, 70% under new tax regime: Revenue Secretary Sanjay Malhotra

About 6 crore ITRs filed for FY24, 70% under new tax regime: Revenue Secretary Sanjay Malhotra Old vs New Tax Regime: Salary above Rs 8 lakh and beyond? This regime will do wonders for you

Old vs New Tax Regime: Salary above Rs 8 lakh and beyond? This regime will do wonders for you EXCLUSIVE - Income Tax Return Filing: I-T Dept prepares 9 point action plan for refund, scrutiny, penalty, clamping down on TDS evasion, sharing info with CBI, ED — Check details

EXCLUSIVE - Income Tax Return Filing: I-T Dept prepares 9 point action plan for refund, scrutiny, penalty, clamping down on TDS evasion, sharing info with CBI, ED — Check details Income Tax Return filing: Know who should opt for new tax regime

Income Tax Return filing: Know who should opt for new tax regime