Income Tax Return filing: Follow deadline or you may face these consequences

Income Tax Return filing for AY 2019-20: The process to file income tax returns for the new financial year has started. The income tax return is a form where taxpayers declare their taxable income, deductions, and tax payments.

Income Tax Return filing for AY 2019-20: The process to file income tax returns for the new financial year has started. The income tax return is a form where taxpayers declare their taxable income, deductions, and tax payments. The deadline to file the income tax return for this year has been set as July 31. While most people find the process confusing, there is absolutely no need to worry. In case you end up paying an extra amount, the I-T department will refund it to your account. To file ITR, you need to fill forms ITR 1 to ITR 7, used for different types of income.

Suresh Surana, RSM astute consulting group told Zee Business TV that the last date to file the income tax returns is July 31. "The deadline for those whose accounts are audited is, however, September 31," he said. But, what happens if you fail to file the income tax returns on time? Well, in this case, you might invite a lot of trouble for yourself. This includes penalty as well as further prosecution.

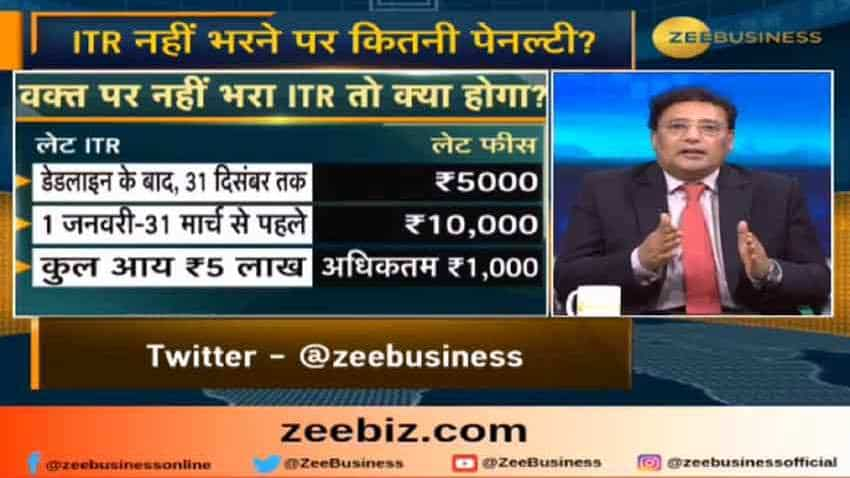

Late ITR filing

Surana explained that in case an individual fails to file the income tax return on time, first of all they have to pay a late penalty. Apart from this, they might even face prosecution. "The penalty for filing the income tax return after July 31 and till December 31 is Rs 5,000. If the return is filed between January 1 and March 31, the amount to be paid is Rs 10,000. The taxpayers can't get a waiver for this," he said.

Watch Zee Business TV video here -

#LIVE | #ITR भरने का काउंटडाउन शुरू, खुद कैसे भरें इनकम टैक्स रिटर्न? जानिए #MoneyGuru में @pallavi_nagpal के साथ। https://t.co/ORiU15eDg2

— Zee Business (@ZeeBusiness) June 4, 2019

The Income Tax department also charges 1 per cent interest per month on the unpaid tax amount. This will add an additional burden on you.

"The defaulters could also be jailed for two to seven years under Section 276CC. Even though this doesn't happen that frequently, there is always a risk," Surana said. The section says that the taxpayer shall be punishable "in a case where the amount of tax, which would have been evaded if the failure had not been discovered, exceeds one hundred thousand rupees, with rigorous imprisonment for a term which shall not be less than six months but which may extend to seven years and with fine."

In any other case, the defaulter should get imprisonment for a term which shall not be less than three months but which may extend to three years and with fine: provided that a person shall not be proceeded against under this section for failure to furnish in due time the return of income under subsection (1) of section 139.

Surana said the taxpayers should also know that if they are having a loss in capital gains or business and fail to pay tax on time, they won't be allowed to carry forward the loss. "Only the loss in house property is allowed to be forwarded," he said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

01:22 PM IST

Hidden charges on SBI ATM cards: Is your money disappearing quietly?

Hidden charges on SBI ATM cards: Is your money disappearing quietly? Latest personal loan interest rates for SBI, PNB, Bank of Baroda, HDFC bank and ICICI bank

Latest personal loan interest rates for SBI, PNB, Bank of Baroda, HDFC bank and ICICI bank 8 post office investment schemes that offer over 7% guaranteed return

8 post office investment schemes that offer over 7% guaranteed return Millennials turning towards new-age investment instrument fractional investing: Report

Millennials turning towards new-age investment instrument fractional investing: Report  Income Tax: How are e-filing and e-payment of taxes different? Know details here

Income Tax: How are e-filing and e-payment of taxes different? Know details here