Income Tax Calculator: Calculate your tax liability for assessment year 2019-20 here

Income Tax Calculator for Assessment Year 2019-20: The Constitution of India has given power to the Central and state governments to levy taxes in areas falling under their jurisdiction.

Income Tax Calculator for Assessment Year 2019-20: The Constitution of India has given power to the Central and state governments to levy taxes in areas falling under their jurisdiction. While the governments in states levy house tax, toll tax, entertainment tax, stamp duty, etc, the Union government has the power to levy taxes like income tax, wealth tax, gift tax, excise duty, custom, service tax, etc. As income Tax is a direct tax that comes directly from the pockets of the taxpayer, it is important to know about one's liability. You can do this by using this income tax calculator. The following illustration will also help:

First, take a look at some facts.

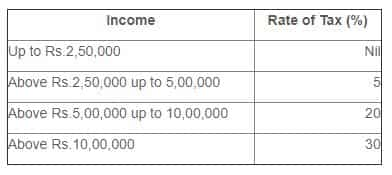

Tax rates prescribed for AY 2018-19: For Individuals/Hindu Undivided Family (HUF)/Association of Persons(AOP)/Body of individuals(BOI) the rates are:

Apart from the Income Tax, individuals also have to pay 4% towards ‘Health and Education Cess’.

Rebate U/s 87A is available for a resident individual if her/his total income does not exceed Rs 3,50,000. The amount of rebate is 100% of income-tax or Rs. 2500, whichever is less. This rebate is applied to the total tax before the 4% Education Cess is added. It is available to all individuals but not super senior citizens as they are fully exempted up to Rs 5 lakh.

Now, consider Mr X, aged 45, earned a total income of Rs 12,00,000 in FY 2018-19. If the tax slab mentioned above continues for the Assessment Year 2019-20 also, Mr X's tax liability will be calculated as:

| Payable Tax Calculation | Value in Rupees |

| Up to Rs 2,50,000 | Nil |

| From Rs.2,50,001 to Rs.5,00,000 @ 5% | 12,500 |

| From Rs.5,00,001 to Rs.10,00,000 @ 20% | 1,00,000 |

| On balance Rs.2,00,000 @ 30% | 60,000 |

| Total | 1,72,500 |

| Adding health and education cess @ 4% | 6900 |

| Total tax payable by You | 1,79,300 |

In order to decrease the high tax liability of Rs 177,800, Mr X can do tax planning and use several government schemes like PPF, 5-year tax saving deposits, ELSS, National Saving Certificates etc. to save income tax.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

01:26 PM IST

Zomato gets Rs 803.4 crore tax demand from GST authorities

Zomato gets Rs 803.4 crore tax demand from GST authorities  Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November

Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November No proposal on income tax relief for senior citizens under consideration: Centre

No proposal on income tax relief for senior citizens under consideration: Centre  Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  This is India's only tax-free state, residents earn crores without paying Income Tax

This is India's only tax-free state, residents earn crores without paying Income Tax