How to open NPS account through OnlineSBI: Follow these easy steps

OnlineSBI.com: NPS is a contribution pension system introduced by the government as a part of Pension Sector reforms, to provide social security to all its citizens.

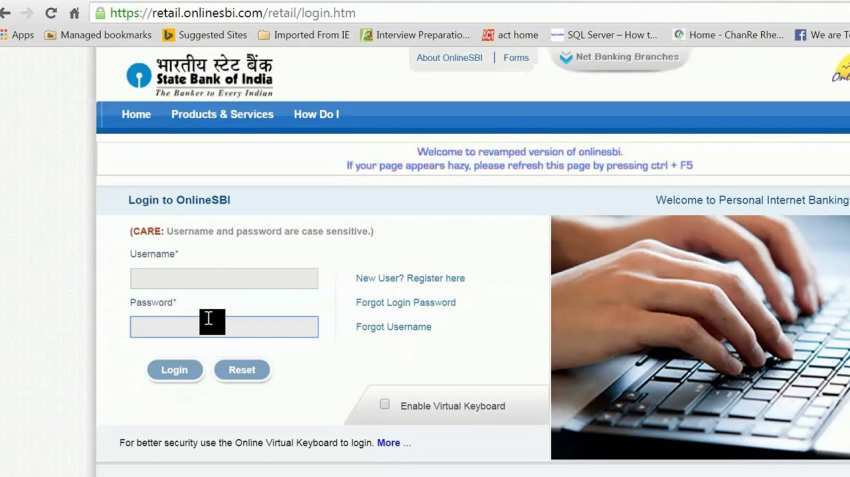

State Bank of India (SBI), which is the largest public sector bank in India, has over 15,000 branches and has a broad portfolio of products and services. With digitation of banking services, the SBI has evolved a highly secure internet banking portal -- OnlineSBI.com, which extends online services to both retail and corporate customers. SBI's online application also offers its corporate customers to open a NPS (National Pension System) account very easily. You just need to follow instructions given on the website and require to meet the requisite guideline to avail this facility on OnlineSBI portal.

Notably, NPS is a contribution pension system introduced by the government as a part of Pension Sector reforms, to provide social security to all its citizens. It is administered and regulated by PFRDA. If you are a corporate customers, you can easily open NPS account following the steps given below.

1. You can fill up an application online for registering with NPS.

2. Fill up and submit the required details online.

3. Print the Account Opening Form (AOF) on A4 size white papers.

4. Attach the required documents, such as photographs and proof of identity and address, as mentioned in the AOF.

5. A Temporary Pension Reference Number (TPRN) will be generated, which you should note down.

Subscribers can visit- https://retail.onlinesbi.com/npscorp/npsCorporateRegistration.htm for more details.

Notably, subscribers can also apply for NPS through Offline Mode at SBI, but they need to visit the nearest registered SBI branch and submit Registration Form & NPS Contribution Instruction Slip (NCIS) along with self-attested KYC documents.

Watch this Zee Business Video

The SBI's online application facilitates Corporate Internet Banking services, providing convenience banking. The services include: you can transact using the portal 24x7, saves your time and cost, you can pay your bills & taxes, transfer money to SBI accounts as well as other banks accounts, make payments to registered suppliers, collect and remit fees, besides allowing you to apply for IPOs online.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

02:06 PM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate