How to make Rs 4,000 monthly investment in SIPs to Rs 4 crore for "secured" retirement life?

The simple formula of saving is out of your total monthly earning, keep one-third amount as savings. Supposedly, your salary is Rs 100, save atleast Rs 33 every month and spend Rs 99 on your expenses.

Generally, if you look at the pay structure of a salaried class person, during the initial point of career, it is often low, most of the time between Rs 25,000- Rs 35,000.

Once you start earning, expenses follow. From paying house rent to electricity charge, the bills keep on piling. And above all that, you need to think about short and long term goals. Short term goals could be buying a house or a car and at the same time, long term goal could be post retirement life.

Amid all the expenses, it is important to start saving early. The simple formula of saving is out of your total monthly earning, keep one-third amount as savings. Supposedly, your salary is Rs 100, save atleast Rs 33 every month and spend Rs 99 on your expenses. What is important here to save and build a habit of saving.

Enter Systematic Investment Plan (SIPs) through Mutual Funds. This is how it works.

Foremost thing which needs to be understand is, the investment amount should also increase yearly with the hike in salary.

Now, for instance you have just started earning say at the age of 27 years after completing your higher studies. You want to buy a house and at the same time want to have a secured post retirement life and your present salary is Rs 35,000. How much should you invest monthly?

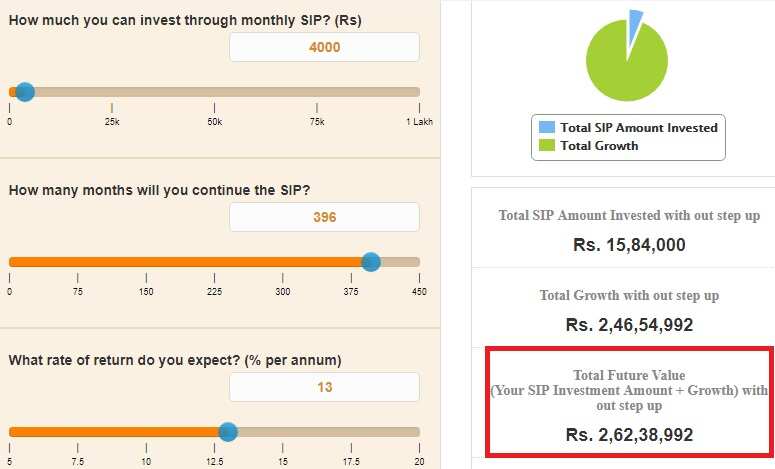

As you have still 33 years for retirement, you can right now start with Rs 4,000 monthly investment in SIPs. Which means your total investment amount over the years will Rs 15,84,000 (Rs 4000* 33 years).

Considering the rate of return at 13%, your total amount at the time of maturity will be Rs 2.62 crore. Clearly, your earnings on investment will be Rs 2.46 crore (Rs 2.62 crore- Rs 15,84,000).

However, with the rise in salary, and you decide to increase the monthly investment amount by 10% every year like Rs 4,000 every month for first year, then 10% increase will be Rs 4,400 every month from next year, so on for 33 years. Till the end of the maturity, your total investment amount will be Rs 41,18,400.

Taking the rate of return at same 13%, after 33 years you will get Rs 4.40 crore, which is an earning of Rs 3.98 crore. With this amount, you can easily buy a house and enjoy post retirement life.

Moreover, you can increase this amount even further by starting early.

So, do not delay and start investing in SIPs today to reap higher returns at the time of maturity.

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

11:33 AM IST

Top 5 SIP mistakes one must avoid while investing in 2025

Top 5 SIP mistakes one must avoid while investing in 2025 SIP Investments surge to record Rs 1.66 trillion in 2023, boosted by lower ticket sizes

SIP Investments surge to record Rs 1.66 trillion in 2023, boosted by lower ticket sizes Just Rs 2,000 a month invested via SIP could grow into Rs 1.62 Lakh in five years, check details here

Just Rs 2,000 a month invested via SIP could grow into Rs 1.62 Lakh in five years, check details here Wealth Guide: Mutual Funds - How to select the right MFs for long-term investments, SIPs

Wealth Guide: Mutual Funds - How to select the right MFs for long-term investments, SIPs With biggest AUM of Rs 6.1 lakh cr, SBI MF made these 7 additions, 3 exits in Sept 2021 - Full list of companies

With biggest AUM of Rs 6.1 lakh cr, SBI MF made these 7 additions, 3 exits in Sept 2021 - Full list of companies