Public Provident Fund vs Mutual Fund SIP: What Rs 200 a day may become in 15, 20, 25, 30 years - Surprising numbers here

Public Provident Fund vs Mutual Fund SIP: Rs 200 a day can help you save in crores for retirement.

Public Provident Fund vs Mutual Fund SIP: Rs 200 a day can help you save in crores for retirement. Rs 200 may seem a small amount. But if you save this amount, say at the age of 25, for investment in popular financial instruments like Public Provident Fund (PPF) and Mutual Fund SIP for a longer period of time, you may be able to get richer by over a crore of rupees. Both instruments come with different terms and conditions.

While PPF is backed by the government and curently offers 8% interest along with guaranteed income tax exemption on the deposit as well as the withdrawal amount. Mutual fund SIPs are affected by market trends but one can expect a return of 12% per annum at a conservative estimate in the long run. Take a look at how saving Rs 200 a day for a monthly investment of Rs 6000 or an annual investment of Rs 72,000 in the PPF will give you:

The following chart explains what investing Rs 72,000 a year in PPF can give you. Remember, PPF account comes with a lock-in period of 15 years, which can be extended further in blocks of 5-years each. Calculating at the current interest rate of 8%, which is compounded annually, your investment of Rs 72,000 will turn into Rs 2,111,338 in 15 years. The amount will grow to Rs 3558433, Rs 5684690, Rs 8808861, Rs 13399328 in 20, 25, 30 and 35 years respectively.

ALSO READ | Bank strike on 26th December 2018 (Wednesday)

PPF calculation chart

| Yr | Opening Balance | Yearly Amt | Interest | Closing Bal | |

| 1 | 0 | 72,000 | 5,760 | 77,760 | |

| 2 | 77,760 | 72,000 | 11,980 | 161,740 | |

| 3 | 161,740 | 72,000 | 18,700 | 252,439 | |

| 4 | 252,439 | 72,000 | 25,955 | 350,394 | |

| 5 | 350,394 | 72,000 | 33,791 | 456,185 | |

| 6 | 456,185 | 72,000 | 42,254 | 570,439 | |

| 7 | 570,439 | 72,000 | 51,395 | 693,834 | |

| 8 | 693,834 | 72,000 | 61,266 | 827,100 | |

| 9 | 827,100 | 72,000 | 71,928 | 971,028 | |

| 10 | 971,028 | 72,000 | 83,442 | 1,126,470 | |

| 11 | 1,126,470 | 72,000 | 95,877 | 1,294,347 | |

| 12 | 1,294,347 | 72,000 | 109,307 | 1,475,654 | |

| 13 | 1,475,654 | 72,000 | 123,812 | 1,671,466 | |

| 14 | 1,671,466 | 72,000 | 139,477 | 1,882,943 | |

| 15 | 1,882,943 | 72,000 | 156,395 | 2,111,338 | |

| 16 | 2111338 | 72000 | 174667 | 2358005 | |

| 17 | 2358005 | 72000 | 194400 | 2624405 | |

| 18 | 2624405 | 72000 | 215712 | 2912117 | |

| 19 | 2912117 | 72000 | 238729 | 3222846 | |

| 20 | 3222846 | 72000 | 263587 | 3558433 | |

| 21 | 3558433 | 72000 | 290434 | 3920867 | |

| 22 | 3920867 | 72000 | 319429 | 4312296 | |

| 23 | 4312296 | 72000 | 350743 | 4735039 | |

| 24 | 4735039 | 72000 | 384563 | 5191602 | |

| 25 | 5191602 | 72000 | 421088 | 5684690 | |

| 26 | 5684690 | 72000 | 460535 | 6217225 | |

| 27 | 6217225 | 72000 | 503130 | 6792363 | |

| 28 | 6792363 | 72000 | 549149 | 7413513 | |

| 29 | 7413513 | 72000 | 598840 | 8084353 | |

| 30 | 8084353 | 72000 | 652508 | 8808861 | |

| 31 | 8808861 | 72000 | 719468 | 9591329 | |

| 32 | 9591329 | 72000 | 773066 | 10436425 | |

| 33 | 10436425 | 72000 | 840674 | 11349099 | |

| 34 | 11349099 | 72000 | 913687 | 12334786 | |

| 35 | 12334786 | 72000 | 992542 | 13399328 |

Mutual Fund SIP investment returns:

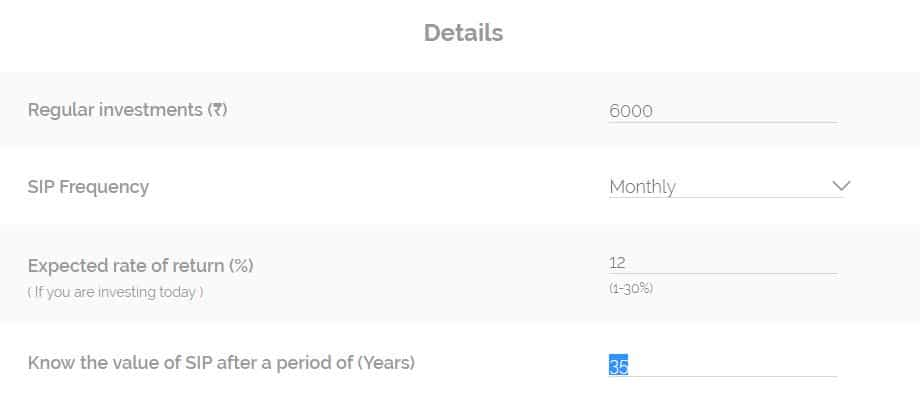

At a conservative return of 12%, investing Rs 6000/month (which is Rs 200 a day), you may get Rs 30,27,456 in 15 years. The returns in 20, 25, 30 and 35 years may likely be around Rs 59,94,888, Rs 1,13,85,811, Rs 2,11,79,483 and Rs 3,89,71,615 respectively. (Calulation done via online SIP calculator of HDFC Mutual Fund.)

*Source: HDFC Mutual Fund

So you see, with Rs 200 a day, you may be able to accumulate up to Rs 3 crore in 35 years. However, remember that SIPs are subject to market risks. So you need to monitor you investment. It is advised to not be greedy with the mutual funds. Invest your money to meet specific goals. Once, your goal is over, you should ideally pull out, or start a new SIP, to avoid risks. And, in any case, you should be always vigilant about how your fund is performing.

#Outlook2019 | लिस्टेट और अनलिस्टेट कंपनीयों में निवेश पर जानिए एबेकस एएमसी के फाउंडर सुनील सिंघानिया की राय।@SunilBSinghania @AbakkusInvest @AnilSinghviZEE pic.twitter.com/1vBdFCArsV

— Zee Business (@ZeeBusiness) December 25, 2018

(*The above article is for illustration purpose only. It is not meant to suggest you should invest in PPF or SIP. The investor should read all details of a financial instrument carefully before making any investment.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

09:40 PM IST

SSY, KVP, PPF, NSC and others: Centre keeps interest rates for small saving schemes unchanged in October-December quarter

SSY, KVP, PPF, NSC and others: Centre keeps interest rates for small saving schemes unchanged in October-December quarter SIP vs PPF: Risk or Guarantee? This investment option may help you reach Rs 1 crore milestone first

SIP vs PPF: Risk or Guarantee? This investment option may help you reach Rs 1 crore milestone first Post Office Scheme: Invest Rs 250 a day in this scheme to accumulate over Rs 24 lakh at 40

Post Office Scheme: Invest Rs 250 a day in this scheme to accumulate over Rs 24 lakh at 40 How to earn Rs 65.58 lakh, Rs 1.10 cr, and Rs 1.74 cr from interest in this Post Office scheme

How to earn Rs 65.58 lakh, Rs 1.10 cr, and Rs 1.74 cr from interest in this Post Office scheme Public Provident Fund: 3 options to extend PPF account after maturity

Public Provident Fund: 3 options to extend PPF account after maturity