How to apply for SBI car loan this festive season: Check guide, interest rate, features, benefits, tenure, exclusive YONO offers and more

It may not be possible for everyone to make a payout for car buying in one go. And, that's where car loan comes into picture.

SBI car loan apply online: Owning a car is a dream of many, and it goes without saying that it is one of the biggest investments an individual makes in his life time. Many people choose festive season of Navratra, Dussehra, Dhanteras and Diwali for car buying. It may not be possible for everyone to make a payout for car buying in one go. And, that's where car loan comes into picture.

India's largest lender, State Bank of India (SBI), says that the process of availing a car loan has been simplified for the benefit of millions of customers. Here we have incorporated all the details on the SBI car loan detailed process, documents required to avail this loan and the offers by the bank with multiple auto companies, for the convenience of readers looking for information on the same this festive season:-

SBI says it provides the best deal for financing a new car by offering lowest interest rates, lowest EMI, minimal paperwork and quick disbursement. The bank says it offers customized car loans for customers such as Regular Car Loan, Certified Pre-owned Car Loan, SBI Loyalty Car Loan for existing home loan borrowers, Assured Car Loan Scheme for existing term deposit customers, and Green Car Loan for Electric Cars.

-Lowest interest rates and EMI

-Longest repayment tenure (7 years)

-Zero processing charges

-Financing on ‘On-Road price'

-On-Road price includes registration and insurance

-Financing up to 90% of 'On-road Price'

-Interest calculated on daily reducing balance

-Allows purchase of new passenger cars, multi utility vehicles (MUVs) and SUVs.

-No advance EMI

Interest Rate:

-SBI offers car loan at an effective rate of 7.75% p.a.

-Get a special interest concession of 25 bps on applying for the loan through YONO i.e. 7.50% p.a.

Car Loan tenure: 3 - 7 years

SBI Auto Loan Market Share: 31.11%

Eligibility

- Age: 21 to 67 years

-Regular employees of Central Public Sector Enterprises, Defense Salary package, Para Military salary package/Indian Coastal Guard Package/Customers and Short Commissioned Officers of various Defense establishments

-Net annual income of applicant and/or co-applicant if any, together should be a minimum of Rs. 3,00,000

-Maximum loan amount can be 48 times of the net monthly income

-Professionals/Self-employed/Businessmen/Proprietary firms/Partnership firms/ Others income tax assesses

-Net profit/gross taxable income of self and/or co-applicant of Rs. 3, 00,000 p.a.

-Maximum loan amount can be 4 times net profit or gross taxable income as per ITR after adding back depreciation and repayment of all existing loans

-Persons engaged in agriculture and allied activities (Income Tax return is not required in case of agriculturists)

-Net annual income of applicant and/or co applicant together should be a minimum of Rs. 4, 00,000

-Maximum loan amount can be 3 times of net annual income

Apply Online: Customers can click on the link below to apply online for the car loan. Fill in the required details, check eligibility and get the loan quotation:

Link:https://onlineapply.sbi.co.in/personal-banking/auto-loan?se=Product&cp=S...

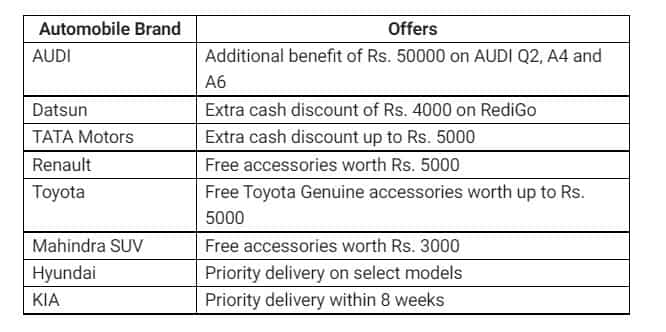

Exclusive Automobile offers for customers on applying for a car loan through YONO:

Avail car loan using YONO SBI at the comfort of your homes:

-Login to your YONO account

-On the home page, click on the menu (three lines) on the top extreme left

-Click on loans

-Click on Car Loan

-Do a quick eligibility check

-Request for the loan by providing a few details

-Find the eligible amount

-Fill up an application form & upload the necessary documents

-Click on Submit

Documents required

Salaried*

-Bank account statement for last 6 months

-2 passport size photographs

-Proof of Identity

-Any one - Passport/ PAN Card/ Voters ID card/ Driving License

-Address Proof

-Any one - Ration card/Driving License/Voters ID card/Passport /Telephone Bill/ Electricity bill/Life Insurance policy

-Income Proof: Latest salary slip

- I.T. Returns or Form 16 for the last 2 years

*Form 16/ITR is waived for SBI’s Salary Package customers who are maintaining their salary account with the Bank for minimum 12 months

*Bank account statement is waived for SBI’s Salary Package customers who are maintaining Salary account with the Bank

-Non-Salaried/ Professional/Businessmen

-Bank account statement for last 6 months

-2 passport size photographs

-Proof of Identity

-Any one - Passport/ PAN Card/ Voters ID card/ Driving License

-Address Proof

-Any one - Ration card/Driving License/Voters ID card/Passport /Telephone Bill/ Electricity bill/Life Insurance policy

- Income Proof: ITR for last 2 years

-I.T. Returns or Form 16 for the last 2 years.

-Audited Balance sheet, P&L statement for 2 years, Shop & establishment act certificate / sales tax certificate / SSI registered certificate / copy of partnership.

-Person engaged in agricultural and allied activities

-Bank account statement for last 6 months.

-2 passport size photographs

-Proof of Identity

- Any one - Passport/ PAN Card/ Voters ID card/ Driving License

-Address Proof

-Any one - Ration card/Driving License/Voters ID card/Passport /Telephone Bill/ Electricity bill/Life Insurance policy

-Direct agricultural activity (crop cultivation)

- Khasra/Chitta Adangal (showing cropping pattern)

-Patta/Khatoni (showing land holding) with photograph

-All land should be on free hold basis and ownership proof to be in the name of borrower

-Documentary proof of running of the activities to be provided for allied agricultural activity like dairy, poultry, plantation/horticulture

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Dearness Allowance (DA) Calculations: Is your basic monthly salary Rs 25,500, Rs 35,400, or Rs 53,100? Know how much DA will you get at different rates

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Monthly Pension Calculations: Is your basic pension Rs 25,000, Rs 35,000, or Rs 50,000? Know what can be your total pension as per latest DR rates

11:18 AM IST

Rs 30 crore assets restituted to SBI in Telangana loan 'fraud' case: Enforcement Directorate

Rs 30 crore assets restituted to SBI in Telangana loan 'fraud' case: Enforcement Directorate SBI Q3FY25 Results: Net profit soars 84% YoY to Rs 16,891 crore, NII grows 4%

SBI Q3FY25 Results: Net profit soars 84% YoY to Rs 16,891 crore, NII grows 4% Budget 2025 reaffirms India's position as innovation, knowledge-centric economy: SBI Chairman

Budget 2025 reaffirms India's position as innovation, knowledge-centric economy: SBI Chairman  Budget 2025: Top PSU stocks to watch for investment opportunities

Budget 2025: Top PSU stocks to watch for investment opportunities Integration of AI, Gen AI with financial sector to foster innovation: SBI Chief

Integration of AI, Gen AI with financial sector to foster innovation: SBI Chief