Budget 2024: How increase in standard deduction can give relief to crores of taxpayers? What expert says

In the old tax regime, there is nil tax up to the limit of Rs 2.50 lakh. From Rs 2.50 lakh to Rs 5 lakh income, there is five per cent income tax on income above Rs 2.50 lakh. Taxpayers under the new tax regime have to pay nil income tax up to the earnings of Rs 2.50 lakh. The tax slab for Rs 2.50-Rs 5 lakh income is five per cent tax on income above Rs 2.50 lakh.

)

Income Tax Slabs: As Finance Minister Nirmala Sitharaman is set to deliver her Interim Budget 2024 (Union Budget 2024) speech in less than an hour from now, crores of salaried class people in India will fix their gaze to know if she makes any changes in the current income tax slabs.

Taxpayers who have opted the new tax regime and the old tax regime will eagerly wait for the tax slab limit to rise. The most basic of which can be the standard deduction, which stands at Rs 50,000. Before we move further, here's what we need to know about the current tax slabs.

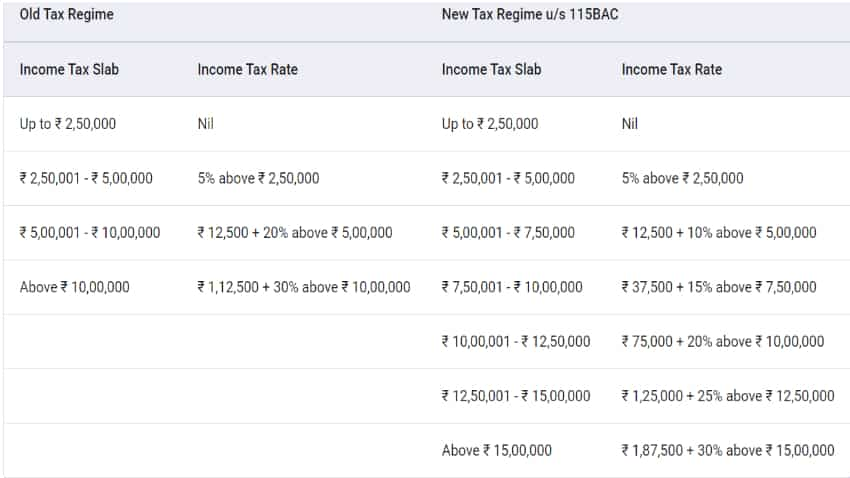

Old Tax Regime Income Tax Slab

In the old tax regime, there is nil tax up to the earnings of Rs 2.50 lakh. From Rs 2.50 lakh to Rs 5 lakh income, there is five per cent income tax above Rs 2.50 lakh earnings.

In the Rs 5 lakh-Rs 10 lakh bracket, one has to pay Rs 12500 plus 20 per cent income tax on income above Rs 5 lakh.

For income above Rs 10 lakh, a taxpayer has to pay Rs 112500 plus 30 per cent tax on income above Rs 10 lakh.

New Tax regime Income Tax Slab

For the new taxpayers, the new tax regime is the default choice.

However, the taxpayers who have been filing income tax for many years, can pick between the old and the new tax regimes.

Taxpayers under the new tax regime don't have to pay nil income tax up to the earnings of Rs 2.50 lakh.

The slab for Rs 2.50-Rs 5 lakh income is five per cent tax above the income of Rs 2.50 lakh.

Data Courtesy: The Income Tax Department Website

From Rs 5 lakh-7.50 lakh, taxpayers have to pay Rs 12,500 plus 10 per cent tax on income above Rs 7.50 lakh.

From Rs 7.50 lakh to Rs 10 lakh, the tax rate is Rs 37500, plus 15 per cent above the income of Rs 7.50 lakh.

In the bracket of Rs 10 lakh to Rs 12.50 lakh, the total tax is Rs 75,000 plus 20 per cent above the income of Rs 10 lakh.

In the Rs 12.50 lakh-Rs 15 lakh bracket, the tax is Rs 125,000 plus 25 per cent tax on income above Rs 12.50 lakh.

For income above Rs 15 lakh, the taxpayers have to pay Rs 187,500 plus 30 per cent tax above the income Rs 15 lakh.

These slabs give a standard dedcution of Rs 50,000, plus Rs 12500 in tax rebate.

As a result, they can save their tax in their income up to Rs 7.50 lakh.

What Taxpayers Expect

As the finance minister dleivers her Interim Budget speech on Thursday, taxpayers will expect her to increase the standard deduction to at least Rs 50,000.

Even a 50,000 increase in tax slabs, their income up to Rs 8 lakh can become tax free. It will further increase their purchasing power which can boost the Indian economy further.

What Expert Says

While talking to Zee Business, tax expert Balwant Jain also said that it should be increased to Rs 1 lakh.

This is because salaried people have very few ways to save tax. Business owners find many ways to save tax, but salaried people have less options.

When did standard deduction come into existence?

Standard deduction was introduced in the year 2018-19.

However, at that time, it used to be 40,000 unlike Rs 50,000 today.

In 2019, it was increased to Rs 50,000.

For this, the taxpayer has to provide no investment proof or receipt.

There has been no change in it for the last 5 years, while inflation has increased significantly.

In such a situation, it is expected that the government will provide some big relief to the people this time.

How does the standard deduction work?

Currently you get tax exemption on Rs 50,000 under standard deduction.

You can reduce Rs 50,000 from your taxable salary without thinking anything.

Due to this, the taxable income of some people can be so low that no tax is levied on them with the rebate of 87A.

Understand it with an example

Suppose your taxable income is Rs 5.50 lakh.

In such a situation, after standard deduction of Rs 50,000, your taxable income will be Rs 5 lakh and effectively no tax will be levied on you.

Whereas if you are in the new tax regime, then you will not have to pay any tax on up to Rs 7.50 lakh.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

11:00 AM IST

Budget 2024: Middle class to get relief in upcoming budget, tax concessions likely for incomes up to Rs 12 lakh

Budget 2024: Middle class to get relief in upcoming budget, tax concessions likely for incomes up to Rs 12 lakh How to save tax if annual income is Rs 7 lakh - Income tax slab 2022-23

How to save tax if annual income is Rs 7 lakh - Income tax slab 2022-23 From income tax slab to saving schemes - what has Budget 2023 done to Personal Finance? Here are the top 10 pointers

From income tax slab to saving schemes - what has Budget 2023 done to Personal Finance? Here are the top 10 pointers Old Income Tax Regime Vs New: How are both different?

Old Income Tax Regime Vs New: How are both different? Budget 2023: What salaried class, taxpayers want from Modi government?

Budget 2023: What salaried class, taxpayers want from Modi government?