Here's all you need to know about "Gift Tax"

Talking to Zeebiz, Archit Gupta, Founder & CEO ClearTax.com, said that the Section 56 says that incomes which do not form part of other income heads are included in ‘income from other sources’.

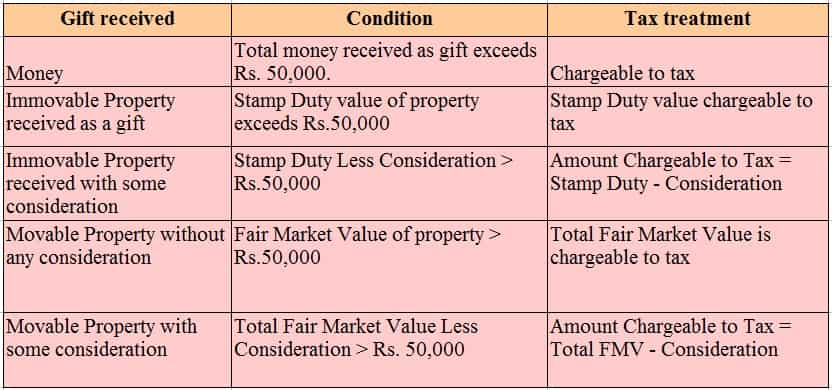

You are exempt from gift tax under the following situations:· monetary value of all gifts received don't add up to Rs.50,000.

· Received from a relative (relative as defined in the Act)

· Received on occasion of marriage

· Received by way of a will or inheritance

· Received in contemplation of death of the payer

· Received from Local Authority

· Received from a fund, foundation, university, or other educational institution, hospitals, or any trust of institution defined in Section 10(23C)

· Money Received from a charitable Institution registered under section 12AA

From the next fiscal, the money received as "gift" valuing more than Rs 50,000 will be chargeable to tax under the new amendment to Section 56 of the Income Tax Act.

According to The Hindu report, Revenue Secretary Hasmukh Adhia has said that Company employees receiving large largesse, whether from the company itself or from somebody else, will now have to pay tax if the gift is valued at more than Rs 50,000.

What is Section 56?

Talking to Zeebiz, Archit Gupta, Founder & CEO ClearTax.com, said that the Section 56 says that incomes which do not form part of other income heads are included in ‘income from other sources’.

So basically this is a residual income head. It goes on further to explain some specific’ incomes which are taxed under this head of income from other sources and situations when they may be exempt from tax.

"The new amendments, have made the section on taxability (including exemptions which have been provided) of transfer of sums of money or property applicable to ‘any person’, so these will now apply to all businesses, individuals, HUF, companies, firms, LLP, effectively for every person taxable under the law," Gupta said.

However, the Section do provides some exemptions where receipts of money/property (both movable and immovable) are not taxable, such exemption has been extended to transactions not considered as a transfer in the first place (such as those where capital gains does not apply - section 47).

How can you save tax on gifts received

Gifts to parents are free from tax, these are not taxable for giver – the parents have to start including any income that these gifts have earned in their total income. So if you gift, money, assets to your parents, they (or you) don’t have to pay tax on the value of the gift, however if any income is earned from such a gift that is included in the receiver’s tax return. For example, if you gift a property to your parents, any rental income shall be directly taxable in their hands, Gupta said.

Similar rules apply for gifts to adult children (over the age of 18 years). For example, if adult children are gifted fixed deposits by parents – the interest income is included in the adult child’s return.

What necessary documents require file filing them

"Its good to maintain a proper trail and documentation of a gift of high value. It is also recommended to disclose exempt gifts in the tax return, if they are of high value. Valuation where required to be estimated is done according to rule 11U and 11UA. Relevant details and documents used in valuation must be carefully maintained as well," Gupta added.

Here's a list of the situations you are exempt from list tax:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

05:09 PM IST

KL Rahul-Athiya Shetty wedding: How much tax will the newly-married couple pay for expensive wedding gifts?

KL Rahul-Athiya Shetty wedding: How much tax will the newly-married couple pay for expensive wedding gifts? Budget 2023: What is Gift Tax and why govt should abolish this?

Budget 2023: What is Gift Tax and why govt should abolish this? Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING

Gifts Tax: Know which gifts are taxable this festive season | TAX SAVING Diwali 2019: No escape! You have to pay tax on gifts; check full list here

Diwali 2019: No escape! You have to pay tax on gifts; check full list here Giving Diwali gifts? Do you know the tax implications these moves could have? Find out now

Giving Diwali gifts? Do you know the tax implications these moves could have? Find out now