Government employees? SBI makes your EMIs on home loan cheap; Know from low interest rate to zero processing fee, all details here

SBI on its official twitter account says, "Central and state government employees can enjoy special benefits with the SBI Privilege Home Loan."

The State Bank of India (SBI) has been introducing various benefits to its customers in regards to their loans especially home loans. In almost every individuals checklist of dreams, one most likely includes a house of their own. But this time, it would be government employees, where the largest lender has brought in a bundle of good news. In fact, SBI is offering a host of services under its Privilege Home Loan scheme to government employees making their EMIs cheap. Both state and central government employees can avail home loans at an affordable price at SBI.

SBI on its official twitter account says, "Central and state government employees can enjoy special benefits with the SBI Privilege Home Loan."

Central and state government employees can enjoy special benefits with the SBI Privilege Home Loan. Apply Now: https://t.co/nZOwgD5iwv#SBI #StateBankofIndia #HomeLoans #SBIHomeLoans #SBIFlexipayHomeLoan #SMSHomeFacility #OnlineSBI #SBIPrivilegeHomeLoan pic.twitter.com/IvjInzAhT7

— State Bank of India (@TheOfficialSBI) January 18, 2019

SBI has launched SBI Privilege Home Loan exclusively for government employees. Individuals who are employees of Central or State Government which includes PSBs, PSUs of Central Government and other individuals with pensionable service are eligible to apply for this home loan.

The loan amount will be determined by taking into consideration factors such as applicant income and repaying capacity, age, assets and liabilities, cost of proposed house/flat etc.

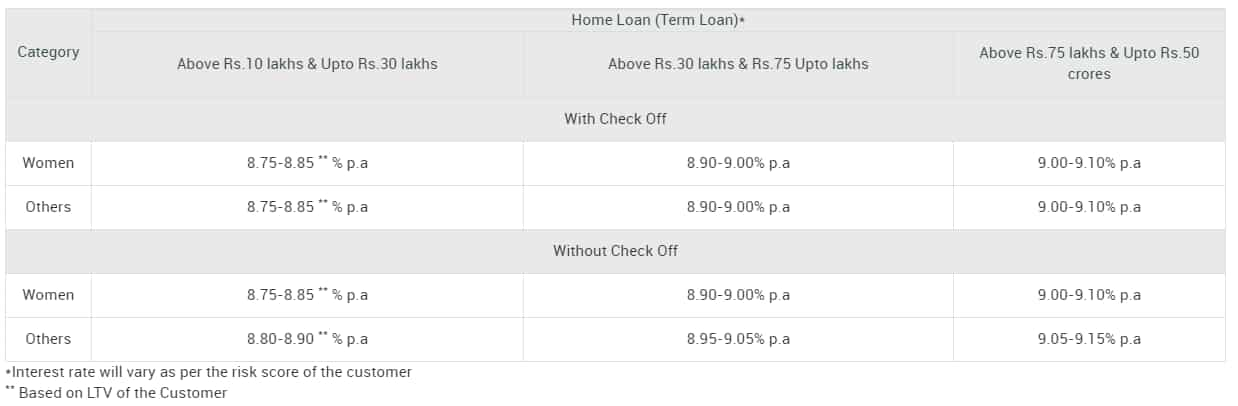

Interest rates offered by SBI to government employees are mentioned below:

Features of SBI Privilege Home loans are:

- Low Interest Rates

- Zero Processing Fee

- No Hidden Charges

- No Pre Payment Penalty

- Interest charges on Daily Reducing Balance

- Repayment up to 30 years

- Interest Concession for Women Borrowers

- Interest Concession in case Check Off is provided

Eligibility:

- Resident Type: Resident Indian

- Minimum Age: 18 years

- Maximum Age: 75 years

- Loan Tenure: up to 30 years.

Having a home loan is better because it comes with long tenures exceeding even 10 years. This allows you to make a proper plan for your repayment of debt in an appropriate manner. A borrower can always choose to close their loan before the tenure ends, however, this varies bank to bank. Some banks have a lock-in period, which means you cannot end your loan even if you have the lump sum amount to fulfill it.

Home loans are given depending upon your age, your salary status, your capability of repayment and background checks of previous loans. If your credit score is very good then getting an home loan is very easy as your bank is assured that you are trustworthy and capable enough to repay your debt.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:08 AM IST

Rama Mohan Rao Amara becomes SBI managing director

Rama Mohan Rao Amara becomes SBI managing director India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI

India's GDP expected to fall below 6.5% in FY25 amid slowdown in GDP growth in second quarter: SBI SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer

SBI Funds Management Limited appoints Nand Kishore as Managing Director and Chief Executive Officer SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate