Will Rupee weakness make Gold dearer ahead of Dhanteras, Diwali? What you need to know?

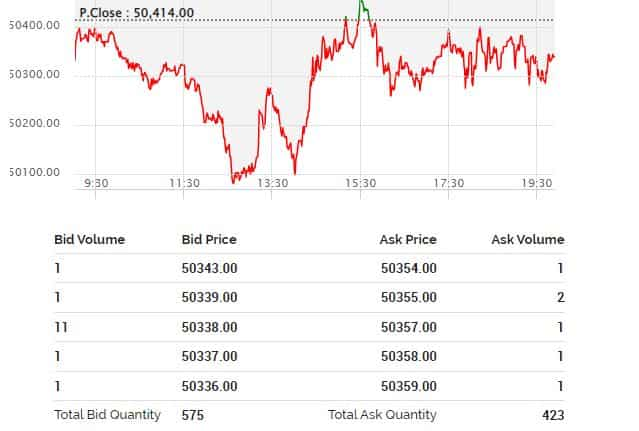

MCX December Gold futures were trading at Rs 50304 per 10 gram, down by Rs 110 or 0.22%. Expert Anuj Gupta recommends for today’s session is Sell at Rs 50600 with a stop loss at Rs 50950 and price target of Rs 50000

Will Rupee's fall against the US Dollar make gold dearer in near term and as we are only days away fro Dhanteras and Diwali? Commodity and currency expert Anuj Gupta feels otherwise. According to him, while the Rupee has been witnessing a fall, the price of Gold in international markets is also on a losing side. This will likely negate any disadvantage arising of the rupee fall, he opined.

Gupta, who is Vice President (VP), Commodity and Currency Research at IIFL Securities said that the price of Gold is expected to remain flat over the next few days. He further said that Gold and Silver prices over the past three weeks have been largely flat.

MCX December Gold futures were trading at RS 50304 per 10 gram, down by Rs 110 or 0.22 per cent. His recommendation for today’s session is Sell at Rs 50600 with a stop loss at Rs 50950 and price target of Rs 50000.

Meanwhile, December Silver futures were trading at Rs 55986 per kg and were down by Rs 368 or 0.65 per cent. Selling is recommended at Rs 56500 with a stop loss at Rs 57300 and price target is Rs 55300.

Also Read: Rupee Vs Dollar: Will rupee see further lows and where is it headed? Experts decode

A Motilal Oswal report sees support for MCX Gold at Rs 50250-50050 and resistance at Rs 50500-50650. Internationally, Spot Gold has support at USD 1625-1605 while resistance at USD 1660-1680. As for Silver futures support is see at Rs 56000-55750 and resistance at Rs 56550-56850. Spot Silver price has support at USD 18.40-18.20 and resistance at USD 1880-19.

Deveya Gaglani, Research Analyst, Axis Securities

Gold price is hovering around $1640 level from the past few days.The dollar index has mostly dictated the gold price movement in the recent past. China had delayed its key economic data, which created a cloud of uncertainty among global participants regarding its industrial health. On the other hand, Bloomberg Economics Forecast US Recession Within Year, which may boost Gold price in the near term. Aggresive rate hike is already priced in for Gold. The downside pace has gradually slowed down as denoted by the technical indicators. Prices are reluctant to break below $1640, so we could notice a short covering which could take prices till the level of $1670 in coming weeks.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Latest FD Rates: Know what SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on 1-year, 3-year and 5-year fixed deposits

Rs 4,000 Monthly SIP for 33 years vs Rs 40,000 Monthly SIP for 15 Years: Which can give you higher corpus in long term? See calculations

08:30 PM IST

Gold prices steady ahead of US Fed meet; key factors to watch for 2025 outlook

Gold prices steady ahead of US Fed meet; key factors to watch for 2025 outlook Gold may experience steady, albeit modest growth in 2025: WGC

Gold may experience steady, albeit modest growth in 2025: WGC Gold prices surge as US Inflation data sparks fed rate cut hopes

Gold prices surge as US Inflation data sparks fed rate cut hopes Gold price dips by Rs 190 to Rs 78,960/10 grams, silver rate climbs by Rs 350 to Rs 93,850/kg

Gold price dips by Rs 190 to Rs 78,960/10 grams, silver rate climbs by Rs 350 to Rs 93,850/kg Gold slips below Rs 79,000 per 10 gm on reduced demand, global cues

Gold slips below Rs 79,000 per 10 gm on reduced demand, global cues